RETIRE RICH I always recommend to my clients to reinvest their dividends on every equity position held. Forget about a 529 Plan. When my daughter was born, I established a custodial account for her and put $10K into a DRIP. That was over 13 years ago. By the time she starts college, she won't have to worry about graduating with debt. One of the smartest things I ever did. |

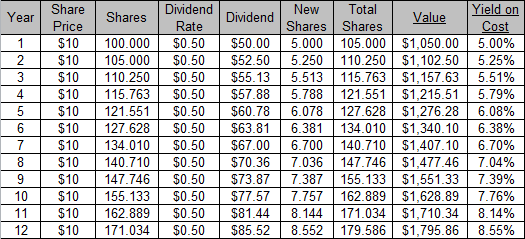

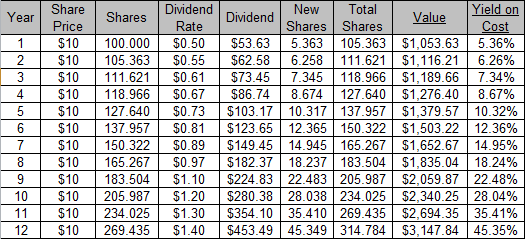

| By Dr. David Eifrig Jr., MD, MBA Most people don’t know this... But a corporate “loophole” lets you collect $5,000... $10,000...even $30,000 or more in extra income starting with very little cash. You don’t have to go through a Wall Street stock exchange and you’ll never have to pay huge fees and commissions to brokers. As you’ll see, some U.S. companies will pay you dividends that grow to five – or even 10 times –bigger than normal over a period of time. And you can save the fees and commissions that come with using your regular broker. All you have to do is fill out a simple one-page application. You write down your name, address and sign the bottom. Mail it in with a check for $25 to $50... and you’re signed up for this little-known “loophole.” Over time, these dividends can grow to be hundreds of percent higher than regular dividends you get through the stock market. So how does this one-page form boost your income to such incredible levels? When you sign up, you take part in a program that allows you to compound your wealth at a high rate of return over many years by getting shares directly from the company. This means you cut out brokers, stock exchanges and all the other expensive red tape of Wall Street. You’ve probably never heard about this program before because the government discouraged companies from advertising it. Otherwise, too many people would get involved, putting Wall Street brokers out of business altogether. The technical name for these programs is Dividend Reinvestment Plans (DRIPs). I like to call them the “33-cents-a-day Retirement Plan.” Some of my colleagues call it the “Dividend Boost.” But the idea is the same... You can start using this with just $10 and earn safe, steady income for your retirement. The programs turbo-charge your dividend payments. Why You Should Buy Stocks Outside the Market In essence, DRIP programs let companies sell stock directly to the investing public. It’s like buying a pair of sneakers from a “factory direct” outlet instead of going to Foot Locker at the mall. Using DRIPs offers many benefits – notably the absence of broker fees. Because you buy stock directly from the company, you avoid the commissions (the fees brokers and money managers charge). Each company sets the specific terms of its DRIP program. Some DRIPs offer shares at a discount to the market price of the stock. Discounts can range from as little as 1% to as much as 10%. This gives investors an immediate return on their investment. Most plans allow you to make automatic monthly payments and invest as little as $10 at a time, even if the amount buys only a fraction of a share. This is an ideal way to start out small and continue to invest monthly, or as often as you like. Some programs allow investors to make optional cash purchases of additional shares directly from the company, usually at a 1%-10% discount and with no fees attached. And most DRIPs offer automatic dividend reinvestment... again, often at discounted prices. There’s no catch here. DRIPs are highly efficient ways of making long-term investments in the world’s most dominant companies. Many of these stocks pay larger dividends every year... and after awhile you’re making real money from a small initial investment. How DRIPs Got Started DRIPs plans began in the 1960s, during America’s economic and population boom. Back then, our country was experiencing a period of rapid economic growth. To keep up with this growth, America’s basic infrastructure – things like bridges, highways, oil refineries, water and sewage systems, the power grid, and commercial and residential real estate – needed to be built or improved. Naturally, only a few companies could handle such large projects. And more importantly, these companies needed a constant supply of new capital to ensure the projects were done right. The government came up with an ingenious solution based on employee stock purchase plans. These plans originated at many of America’s richest blue-chip firms during the early 20th century. They enabled employees to purchase shares directly from their company at a discount, collect the company’s dividends, and automatically reinvest the profits. In the ’60s, the government decided to make this format available to the general public. It allowed companies to sell equity shares directly to the public, rather than through the traditional financial markets. Americans no longer needed brokers to become investors. They could send a check in the mail and begin investing in a company right away. And the companies could use this“public investment” for their projects. Under this plan, there are no brokers... no Wall Street... and no stock exchanges to deal with. Many of these companies even gave huge discounts (up to 10%) for buying shares directly through the company. If too many people got involved, Wall Street cronies would go out of business altogether. To encourage direct investment, these companies paid out unusually high dividends and designed programs that automatically reinvested the profits. Thus, ordinary Americans could start out small – with as little as $25, or one share at a time – and accumulate thousands of dollars in savings without ever investing another penny. Companies that offer these DRIPs detail them in a prospectus, which the participating company will send you. Dividends Are A Sign of A Good Business And Shareholder Friendliness One thing you’ll hear me say over and over: Dividends Don’t Lie…It’s a cornerstone of our investing strategy. Here’s what I’m talking about: A good accountant can fudge 99% of the figures on a balance sheet or a profit statement. But he can’t fake a cash payment. If a company is paying cash, it’s hard to fake the numbers. For example, take Wall Street’s favorite number – earnings. Earnings are subject to all sorts of bookkeeping adjustments like depreciation, reserve accounting, and different inventory valuations. Because investors pay attention to earnings more than any other number, it becomes really tempting to manipulate them. But think about a dividend. A dividend is a fact. When companies pay their dividends, they mail out checks to every shareholder. The money leaves the bank and never comes back. It’s that simple. Regular dividend payments are a real mark of quality. The management and directors know their company better than anyone else. So when a company announces a dividend payout, it’s saying, “We have cash we don’t need.” A strong dividend payment almost always indicates a healthy business. The company is generating cash and wants to say “thank you” to shareholders. And a company knows if it takes the dividend away suddenly, its stock will drop. It’s not always easy to pay out cash to the shareholders every year. Cash is a scarce resource, and it’s critical to every business. So when companies are able to maintain their dividends through bad times, it sends a strong signal to the market that management knows what it’s doing; that it has good control of its' company’s finances. Similarly, rising dividends protect stock prices in bear markets. Thus, dividend stocks are by nature defensive stocks. A rising dividend acts like a pontoon float and prevents the stock price from falling much. Finally, a dividend payment signals management’s intention to reward investors for offering their capital. As a stock analyst, I place great weight on the dividend payments when I size up a company. A regular and increasing dividend payment is a sign of a healthy business. How DRIPs Generate Huge Dividend Yields DRIPs are a convenient, cost-effective tool for investing in stocks. But the real magic in DRIPs happens when you pick stocks that pay larger dividends each year and then you compound your gains by reinvesting the dividends. Say you enroll in a DRIP. Shares trade for $10 each, and you buy 100 shares. Total cost: $1,000. Let’s imagine the stock yields 5%, and the dividend does not grow. We’ll assume the share price stays fixed at $10 for simplicity’s sake. At the end of the first year, you’ll receive $50 in dividends. That’s 5%. You reinvest the dividend. This increases your position to 105 shares. In Year 2, you earn $52.50 in dividends. You reinvest this too, adding another 5.25 shares to your position. You now own 110.5 shares. Repeat this process for 12 years and in the 12th year, you’ll make $90 in dividends. That’s a 9% dividend yield off your initial $1,000 investment. This is what accountants call “compound” investing. Your dividends turn into stock. This extra stock then produces dividends of its own. Compounding interest or dividends is one of the strongest ways to build wealth in finance. Warren Buffett built his fortune by compounding dividends. The chart below shows the effect over 12 years: But we’re not finished yet. Now, let’s imagine a dividend that grows 10% each year. Your position compounds at twice the speed. The 5% dividend yield turns into over 45% yield in the 12th year. Here’s how… Imagine if you could find a company that increases its dividend by 20% a year. You’d double your money in Year 8. And your yield on your initial investment – you’re so-called “yield on cost” would be over 51%. Getting Into DRIPs Not every public company offers a DRIP plan. To check, visit the company’s corporate website and look in the “investor relations” section. That will tell you if the company offers a DRIP. If you’re still not sure, call investor relations (the number will be on the website). Every company has a slightly different DRIP, so it’s important you read each company’s prospectus. For example, some DRIPs let you make initial purchases of stock straight from the company. All you have to do is send a check in the mail. Others require you to buy your shares from a broker, and then they just reinvest the dividends for you, free of charge. Some have maximum investment amounts and others have minimums. Some companies even offer discounts from the market price when you buy their shares through the DRIP.A number of sites help you search for DRIPs. I like to use drip database.com and direct investing.com to search for U.S. companies with DRIPs. Use http://cdndrips.blogspot.com/ to find Canadian companies with DRIPs. One more thing: You will have to pay tax on your dividends, even if they get automatically reinvested. Uncle Sam doesn’t care about your ownership of DRIPs. And if you receive income – and he considers dividends to be income – you have to pay tax on it. Thus, each company sends you a Form1099-DIV at the end of each year, listing the dividends and distributions you received. Simply include these dividends in your tax return. Just like you would with other dividends or interest income. There is one exception – setting up your DRIP in an IRA. For example, McDonald’s and Wal-Mart will let you use this in an IRA account. This is the only way you can shield your dividend income from tax. They may charge you a small fee for your IRA DRIP. To get started with DRIPs, I recommend establishing a position in three stocks to create an initial portfolio of great dividend-paying stocks that also offer solid DRIP programs. DRIP No. 1: V.F. Corp. (NYSE:VFC) Companies that offer lifetime guarantees on their products make me a loyal and lifetime customer. Case in point, V.F. Corp. (NYSE: VFC). You may not recognize the company’s name, but it makes several of my favorite brands of clothing and outdoor gear: Wrangler jeans, North Face, Eagle Creek, and Eastpak. These names are well-known to most consumers. VFC’s product quality is unmatched, and its reputation for standing behind its stuff is truly amazing. Over the past 25 years, I have bought a few Eagle Creek products (travel bags and backpacks). When something would go wrong – say a broken zipper – a quick mailing to the company soon brought me either a fixed bag or a new version of the product. Because of that no-questions-asked/lifetime guarantee, I regularly give Eagle Creek products as gifts; and the company has been successful financially as well. Growing its net tangible asset base 36% during one of the toughest economic times ever takes discipline and marketing excellence. Net tangible assets totaled $877 million in 2008. By the end of 2010, it came to $1.2 billion. From 2008 to 2010, it decreased its liabilities from $2.9 billion to $2.6 billion – almost unheard of for a consumer business in a collapsing consumer economy. Business is steady. Sales ($7.7 billion in 2010) have remained nearly unchanged through the recession. Plus, this is a company that should grow globally during this improving business cycle. I expect to see increasing demand for high-quality products from Chinese and South American consumers. VFC has the lines and quality to meet that demand. Best of all the company has paid an increasing dividend to shareholders for 38 consecutive years. It has increased the dividend at a 17.2% rate the past five years, which is higher than the past10 years. That’s a good sign and could mean growing dividends for us. It currently pays 2.2% – with a safe 41% payout ratio too. VFC allows you to make initial investments in its DRIP. But it does not offer an IRA option to shelter your gains from current taxes. For more information, just call its investor relations at 336-424-6000. You can also call the company that manages its DRIP, Computer share, at 800-662-7232, or visit VFC’s website at: www.vfc.com. DRIP No. 2: Medtronic (NYSE: MDT) In the health care sector, Medtronic (NYSE: MDT)is synonymous with pacemakers. For generations, Medtronics has been a leader in using electronics to stabilize and manage heart rhythms and maintain lives. It was one of the first to create an implantable pacemaker that could withstand the giant magnets of an MRI machine. But the company has grown and diversified. Today, Medtronic gets about 20% of its revenuesfrom cardiovascular devices (e.g., heart valves) and 20% from spinal products (it’s a leader inscoliosis management). The rest comes from its neuromodulation –regulating the nervous system –(10%), diabetes (8%), and surgical technologies. Medtronic has grown steadily during the recession. Sales have grown about 8% in each of thepast three years, a difficult feat for any business. But what excites me about MDT as a DRIP pick is that it’s paid a dividend for 36 years andincreased its dividend for 33 consecutive years. A company that keeps growing by producing cutting-edge technologies and rewarding shareholders is the kind of company we love to own. MDT’s payout ratio is around 29%. Earnings could fall in half, and the dividend would still be safe. Medtronic currently pays a dividend of 2.50% and trades for less than $40 a share. The dividend has grown from 20¢ a share to 97¢ over the past 10 years – an increase of more than 350%. The five-year growth rate is 19% which is even higher than the past 10 years. This makes MDT a perfect investment pick for a DRIP.MDT allows you to make initial investments in its DRIP. It does not offer an IRA option to shelter your gains from current taxes. For more information, just call its investor relations at 763-505-2692 or visit its website at: www.medtronic.com. DRIP No. 3: Pepsico (NYSE: PEP) A household name, Pepsi is a global manufacturer and marketer of foods and beverages. Some of its' leading brand names include Quaker Oats, Fritos, and Gatorade. Its CEO is one of the few female CEOs in the world, a plus in my mind (and research supports better stock performance with females in power). Like many of my favorite picks in Retirement Millionaire, PEP has maintained sales during the recession. It had $43 billion of sales in 2009 and $58 billion in 2010. As the global economy takes off again, the next cycle could easily double revenues and profits to businesses like PEP. Profit margins are not as rich as a technology company, but at 10.1%, sales growth from an improving overall economy could easily add to bottom-line profits. The company is also shareholder-friendly. It has bought back nearly $11 billion in shares the past three years. In addition, it pays a safe 3.1% dividend at a payout ratio of 50%. This is another $10.5billion of cash distributed to shareholders. Pepsi has increased its dividend 38 years in a row too. The past five-year growth rate of its dividend is 13.7%. This is an excellent candidate for a DRIP. PEP allows you to make initial investments in its DRIP. And it does not offer an IRA option to shelter your gains from current taxes. For more information, just call its investor relations at 800-226-0083, or visit its' website at: www.pepsico.com. IR Phone Initial Reinvest Share Price IRA Company Ticker Number Purchase Dividends Discount Option __________________________________________________________________________________________________ Medtronic MDT (888) 648-8154 Yes Yes No No PepsiCo PEP (800) 226-0083 Yes Yes No No V.F. Corp VFC (336) 424-6000 Yes Yes No No __________________________________________________________________________________________________ All three companies have some sort of fee for using the DRIP. Notably, Medtronic’s DRIP not only charges a one-time setup fee, but it also tacks on an extra 5% fee on the dividends you receive. This isn’t good news for us. In addition, all three stocks use different registry companies; lots of extra paper work to keep track of everything. This is ridiculous. Instead… if you already have an online brokerage account, that standard stock trading platform is the best way to reinvest your dividends. Buying all three of the stocks through the same broker makes tracking your positions easier. Plus it’s more cost-effective. Here’s why... Six of the seven brokers don’t charge a fee to reinvest dividends. Setting it up is easy too. Just make an initial purchase and pay the commissions Then you’ll have the option to have the option to have the dividends sent to your “cash” account (or your bank account) or have them reinvested. If you have any trouble finding the option to reinvest your dividends, your brokerage’s customer service department should be able to help over the phone. Bottom line...for convenience and savings don’t use the old school DRIP anymore for new money, go with your online broker’s reinvestment option. And if you don’t already have a broker, it’s easy to get an account. As always, I recommend you put no more than 4% - 5% of your investment portfolio into any one of these companies and maintain a 25% trailing stop. I think it’s critical that everyone take control of his finances to ensure a safe nest egg. If we invest in safe shareholder-friendly companies that grow their dividend steadily and plow those payments into more shares of the company... we’ve got ourselves a money making machine. Starting a compounding program could turn out to be the greatest money decision you ever make! |

RSS Feed

RSS Feed