| | RETIRE RICH I chose to put this article I saw in this section because I hear so many times even from my own parents that, "if I just let the money sit in the account it will be there when I need it years down the road". Yeah, right! Inflation erodes our wealth and eats into any residual profits. That's why we as investors need to always have a strict strategy in place to thwart what Ronald Reagan called, "The Thief in the Night". After you read it, I hope you're scared...very SCARED! |

Your wealth is in imminent danger!

By Phil Ash

Thirty years ago, Ronald Reagan gave this insidious robber a name: "the Thief in the Night". Now this stealthy crook is out to steal 10% of your wealth this year and 50% by 2018.

Four warning lights are flashing on our financial dashboard, signaling that we've entered a dangerous era of "Preflation." You may not be familiar with the term, but I think you get the idea. It probably wouldn't surprise you to discover that your money's buying power is being stolen while you work, play and even while you sleep.

In this current period of Preflation—i.e., the steady run-up to what

will likely be 1970s-style double-digit inflation—you're being robbed

every hour of every day.

It doesn't matter how smart an investor you are. Even worse, inflation invades like a cat burglar—so quietly you barely notice until you realize HALF YOUR BUYING POWER HAS VANISHED in less than five

years.

It's happening right now and it's just the beginning. Sooner than most folks imagine, thousands of investors will look back and wonder "why didn't we recognize the blatant theft of our wealth while it was happening right in front of us?"

Here's why: "The Thief in the Night" is being aided and abetted by one of the biggest lies in our nation's history.

The "422% Lie" Deliberately Spread By Our Own Government

The four indicators flashing red today warn of an inflationary surge that will attack your wealth and deal a nasty wallop to anyone who depends on investment income. These indicators are the classic predictors of soaring inflation. In fact, they have preceded numerous bouts of hyperinflation in the past century.

They are: (1) persistent global unrest and multiple ongoing wars; (2) intense international competition for critical commodities; (3) massive government spending; and (4) continuing currency debasement (in the U.S. we call this QE 1, 2 and 3.)

I suspect these conditions have a familiar ring. In fact, they're the day's top headlines—and they don't bode well for investors and savers. Ultimately, should these conditions persist (as I believe they will), many folks will find themselves **running out of money in their lifetime.**

Slow-Motion Robbery Is Still Robbery

At the moment, we are in a period of "Preflation." Today's inflation is like a jet on the tarmac powering its engines prior to takeoff. Rather than roaring down the runway on a straight line to hyperinflation, there will be speedups and slowdowns.

This volatility, as in the past, is distracting investors until the worst possible time—when it's too late, **after** they've discovered the Thief in the Night has robbed them blind.

The time to protect your wealth is NOW.

You can't trust the government's reporting of the actual cost of living. As you're about to discover below, the official CPI number is one of the most shocking examples of government "disinformation" in our history. You can't stop inflation yourself but you CAN do something besides helplessly watching your money erode. You can even make double-digit profits if you follow exactly the right strategies.**

I believe that we are perched on the precarious limb of Preflation—though we both doubt one investor in 10 realizes it. Don't look for headlines warning, "Inflation Is Back." Rather, there will be an awful awakening one day down the road when millions of investors realize that inflation—drip by drip—has drained away their wealth.

As obvious as it might seem to you and me, preparing for inflation is a step that most people will never take. Because most people like to pretend that the government has things under control.

Surely the SEC was looking out for investors, making sure that the dot-com start-ups raising billions of dollars were legitimate businesses and not run by fraudsters, right? Surely regulators were preventing banks from making no-money-down loans to people with no jobs and allowing them to buy multiple homes, right? Surely our own government would never recklessly spend so much money that it had to run the printing presses day and night, sapping the value of our savings and threatening the very existence of the dollar. Right?

A Cruel Lie

At this very moment, thousands of Americans believe their investments will reward them with a rich retirement—unaware that the buying power of their nest egg is melting away. And their own government is NOT warning them. Instead, it's feeding them false numbers and disinformation.

Take the retired small business owner who believes his hard-won nest egg of $400,000 will actually be worth $400,000 in buying power. In fact, it's losing almost 10% of its value this year and is likely to be worth 50% less in five years.

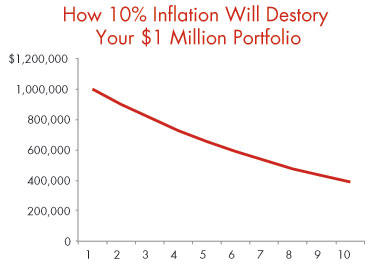

A soon-to-be-retired couple would be stunned to discover the income from their $1 million portfolio will buy only HALF as much before the decade is over.

In short, the U.S. government's repeated assurance that inflation is below 2%—and thus nothing to be concerned about—is a lie of breathtaking magnitude.

Because in truth today's REAL inflation rate is closer to 10%—a staggering 422% higher than the official number our own government is hoping we'll believe. Here are the facts: The "official" inflation rate according to the government is 1.8%. But the "rea" inflation rate is actually 9.4%—a staggering 422% higher.

Of course, we all know politicians tend to lie—and lie easily. It really doesn't matter if they're Democrats or Republicans, liberals or conservatives; most of them play fast and loose with the truth. But it DOES matter when they lie about something such as inflation—you need to know the truth about.

Imagine visiting a doctor who lies to you about the severity of an illness. Well, our country's money is "sick"

and threatening your future—and the quacks in Washington are telling you, "Don't worry, you're fine!"

How the Lie Is Spread

It begins, as you might expect, deep in the bowels of the federal government. Down here, the "official" inflation rate, known as the core Consumer Price Index (CPI), is concocted and issued by the Bureau of Labor Statistics (BLS). (As you'll see, the term "core" is brilliantly devious—it allows

politicians to finagle the inflation number any way they wish.)

Yes, the BLS bureaucrats themselves are supposedly "non-political." Yes, the CPI number disseminated by these government bean-counters is the one you almost always read in the paper or hear on TV. To most Americans, the CPI is the trustworthy rate of inflation, the gospel truth. After all, didn't their own government determine the number and their favorite anchorperson confirm it on TV?

But is the figure really credible? You be the judge. The latest BLS release—I have it right in front of me—puts the core CPI at just 1.8%. That's quite low by historical standards. However, there are strong reasons you should regard this number with extreme skepticism. Chiefly because the core CPI—the "official" rate of inflation—has been brazenly manipulated over the past three decades for political

purposes.

For example…

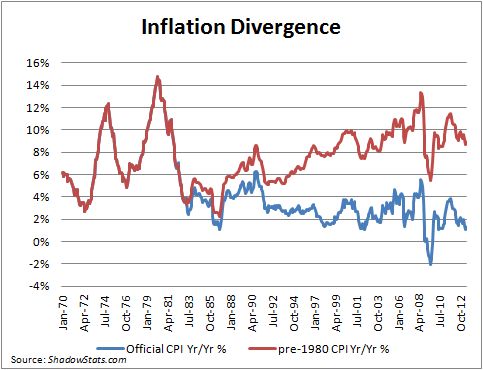

If the rate of inflation were still calculated (as it should be) the way it was back in 1980, it would be a staggering 9.4% and angry citizens would be storming Washington with pitchforks. The graph below reveals the truth.

Note: The red line indicates inflation as calculated by the formula the BLS used in 1980. The blue line represents today's formula.

By Phil Ash

Thirty years ago, Ronald Reagan gave this insidious robber a name: "the Thief in the Night". Now this stealthy crook is out to steal 10% of your wealth this year and 50% by 2018.

Four warning lights are flashing on our financial dashboard, signaling that we've entered a dangerous era of "Preflation." You may not be familiar with the term, but I think you get the idea. It probably wouldn't surprise you to discover that your money's buying power is being stolen while you work, play and even while you sleep.

In this current period of Preflation—i.e., the steady run-up to what

will likely be 1970s-style double-digit inflation—you're being robbed

every hour of every day.

It doesn't matter how smart an investor you are. Even worse, inflation invades like a cat burglar—so quietly you barely notice until you realize HALF YOUR BUYING POWER HAS VANISHED in less than five

years.

It's happening right now and it's just the beginning. Sooner than most folks imagine, thousands of investors will look back and wonder "why didn't we recognize the blatant theft of our wealth while it was happening right in front of us?"

Here's why: "The Thief in the Night" is being aided and abetted by one of the biggest lies in our nation's history.

The "422% Lie" Deliberately Spread By Our Own Government

The four indicators flashing red today warn of an inflationary surge that will attack your wealth and deal a nasty wallop to anyone who depends on investment income. These indicators are the classic predictors of soaring inflation. In fact, they have preceded numerous bouts of hyperinflation in the past century.

They are: (1) persistent global unrest and multiple ongoing wars; (2) intense international competition for critical commodities; (3) massive government spending; and (4) continuing currency debasement (in the U.S. we call this QE 1, 2 and 3.)

I suspect these conditions have a familiar ring. In fact, they're the day's top headlines—and they don't bode well for investors and savers. Ultimately, should these conditions persist (as I believe they will), many folks will find themselves **running out of money in their lifetime.**

Slow-Motion Robbery Is Still Robbery

At the moment, we are in a period of "Preflation." Today's inflation is like a jet on the tarmac powering its engines prior to takeoff. Rather than roaring down the runway on a straight line to hyperinflation, there will be speedups and slowdowns.

This volatility, as in the past, is distracting investors until the worst possible time—when it's too late, **after** they've discovered the Thief in the Night has robbed them blind.

The time to protect your wealth is NOW.

You can't trust the government's reporting of the actual cost of living. As you're about to discover below, the official CPI number is one of the most shocking examples of government "disinformation" in our history. You can't stop inflation yourself but you CAN do something besides helplessly watching your money erode. You can even make double-digit profits if you follow exactly the right strategies.**

I believe that we are perched on the precarious limb of Preflation—though we both doubt one investor in 10 realizes it. Don't look for headlines warning, "Inflation Is Back." Rather, there will be an awful awakening one day down the road when millions of investors realize that inflation—drip by drip—has drained away their wealth.

As obvious as it might seem to you and me, preparing for inflation is a step that most people will never take. Because most people like to pretend that the government has things under control.

Surely the SEC was looking out for investors, making sure that the dot-com start-ups raising billions of dollars were legitimate businesses and not run by fraudsters, right? Surely regulators were preventing banks from making no-money-down loans to people with no jobs and allowing them to buy multiple homes, right? Surely our own government would never recklessly spend so much money that it had to run the printing presses day and night, sapping the value of our savings and threatening the very existence of the dollar. Right?

A Cruel Lie

At this very moment, thousands of Americans believe their investments will reward them with a rich retirement—unaware that the buying power of their nest egg is melting away. And their own government is NOT warning them. Instead, it's feeding them false numbers and disinformation.

Take the retired small business owner who believes his hard-won nest egg of $400,000 will actually be worth $400,000 in buying power. In fact, it's losing almost 10% of its value this year and is likely to be worth 50% less in five years.

A soon-to-be-retired couple would be stunned to discover the income from their $1 million portfolio will buy only HALF as much before the decade is over.

In short, the U.S. government's repeated assurance that inflation is below 2%—and thus nothing to be concerned about—is a lie of breathtaking magnitude.

Because in truth today's REAL inflation rate is closer to 10%—a staggering 422% higher than the official number our own government is hoping we'll believe. Here are the facts: The "official" inflation rate according to the government is 1.8%. But the "rea" inflation rate is actually 9.4%—a staggering 422% higher.

Of course, we all know politicians tend to lie—and lie easily. It really doesn't matter if they're Democrats or Republicans, liberals or conservatives; most of them play fast and loose with the truth. But it DOES matter when they lie about something such as inflation—you need to know the truth about.

Imagine visiting a doctor who lies to you about the severity of an illness. Well, our country's money is "sick"

and threatening your future—and the quacks in Washington are telling you, "Don't worry, you're fine!"

How the Lie Is Spread

It begins, as you might expect, deep in the bowels of the federal government. Down here, the "official" inflation rate, known as the core Consumer Price Index (CPI), is concocted and issued by the Bureau of Labor Statistics (BLS). (As you'll see, the term "core" is brilliantly devious—it allows

politicians to finagle the inflation number any way they wish.)

Yes, the BLS bureaucrats themselves are supposedly "non-political." Yes, the CPI number disseminated by these government bean-counters is the one you almost always read in the paper or hear on TV. To most Americans, the CPI is the trustworthy rate of inflation, the gospel truth. After all, didn't their own government determine the number and their favorite anchorperson confirm it on TV?

But is the figure really credible? You be the judge. The latest BLS release—I have it right in front of me—puts the core CPI at just 1.8%. That's quite low by historical standards. However, there are strong reasons you should regard this number with extreme skepticism. Chiefly because the core CPI—the "official" rate of inflation—has been brazenly manipulated over the past three decades for political

purposes.

For example…

If the rate of inflation were still calculated (as it should be) the way it was back in 1980, it would be a staggering 9.4% and angry citizens would be storming Washington with pitchforks. The graph below reveals the truth.

Note: The red line indicates inflation as calculated by the formula the BLS used in 1980. The blue line represents today's formula.

As you can see, inflation surges during the Ford and Carter administrations, then drops sharply during the Reagan years, with the U.S. enjoying the longest economic boom in its history.

However, when Reagan departs the White House, REAL inflation (the red line) begins its steady rise again—but the official CPI version (the blue line) remains curiously lower than the red line.

Why the divergence? Answer: Political manipulation of the core CPI. Count on it! If the Gipper were alive today, he'd be thundering. "Mr. Obama, tear down this phony CPI!"

After all, how can you trust a CPI that excludes energy costs simply because they are "too volatile"? How can you trust a CPI where tofu replaces steak when the price of beef goes up?

Yes, that's what they do at the BLS when the real inflation numbers are politically inconvenient! They call it "substitution." I call it a scam.

The game wasn't always rigged this way. Originally, the CPI was determined by comparing the price of a FIXED basket of goods and services at two points in time. So there was no way to fudge it. But now, if the price of steak goes up and people eat tofu instead, the BLS reduces the weight of steak prices in the CPI formula. Voila, less inflation!

The Fox Is Guarding The Henhouse

Think about it: The politicians and bureaucrats who create inflation in the first place also get to decide how to measure it. If that's not a conflict of interest, I don't know what is. If we were just talking about abstract statistics, I wouldn't care. But this deception is doing real harm to millions of Americans. These phony

low-ball CPI numbers not only shortchange anyone who receives payments tied to the cost of living, but they're hiding a cancer in our economy that will eat away at every asset you own. Let's call this practice what it really is: disinformation spread by a government addicted to racking up trillions in debt.

I live in Washington, about four miles from Capitol Hill. My neighbors on both sides of the block are Congressional staffers and campaign hacks. These D.C. denizens are, first, last and always, "men and women of government" and their Number One goal is to create and market more of the only "product" they know: "government".

Which requires them to spend and spend—even if they have to print money by the trainload. And that's the rub. It's an ironclad law: If you print too much money, it loses value. The more dollars our government prints, the less each new dollar is worth. Why do you think a dollar from 1942 is worth just 7¢ today?

The Gas Pump Isn't Lying

However, when Reagan departs the White House, REAL inflation (the red line) begins its steady rise again—but the official CPI version (the blue line) remains curiously lower than the red line.

Why the divergence? Answer: Political manipulation of the core CPI. Count on it! If the Gipper were alive today, he'd be thundering. "Mr. Obama, tear down this phony CPI!"

After all, how can you trust a CPI that excludes energy costs simply because they are "too volatile"? How can you trust a CPI where tofu replaces steak when the price of beef goes up?

Yes, that's what they do at the BLS when the real inflation numbers are politically inconvenient! They call it "substitution." I call it a scam.

The game wasn't always rigged this way. Originally, the CPI was determined by comparing the price of a FIXED basket of goods and services at two points in time. So there was no way to fudge it. But now, if the price of steak goes up and people eat tofu instead, the BLS reduces the weight of steak prices in the CPI formula. Voila, less inflation!

The Fox Is Guarding The Henhouse

Think about it: The politicians and bureaucrats who create inflation in the first place also get to decide how to measure it. If that's not a conflict of interest, I don't know what is. If we were just talking about abstract statistics, I wouldn't care. But this deception is doing real harm to millions of Americans. These phony

low-ball CPI numbers not only shortchange anyone who receives payments tied to the cost of living, but they're hiding a cancer in our economy that will eat away at every asset you own. Let's call this practice what it really is: disinformation spread by a government addicted to racking up trillions in debt.

I live in Washington, about four miles from Capitol Hill. My neighbors on both sides of the block are Congressional staffers and campaign hacks. These D.C. denizens are, first, last and always, "men and women of government" and their Number One goal is to create and market more of the only "product" they know: "government".

Which requires them to spend and spend—even if they have to print money by the trainload. And that's the rub. It's an ironclad law: If you print too much money, it loses value. The more dollars our government prints, the less each new dollar is worth. Why do you think a dollar from 1942 is worth just 7¢ today?

The Gas Pump Isn't Lying

| You don't need a chart to realize prices have been rising for just about everything you buy. You know you've been paying more lately for gasoline, food, clothing, rent—you name it. But your own U.S. government keeps flat-out INSISTING that inflation is low and not a threat. You live in the real world—so you know differently. |

Just five years ago, the average price of gasoline was $1.84 a gallon. Currently, gas costs about $3.60—up more than 95%. In some cities, signs read $4.00 a gallon. But not to worry. Gasoline, which is energy-related, isn't calculated into the core CPI. Nor is the 42% more you've been paying for electricity since 2002. (Like the proverbial tree that falls unheard in a forest, if a price increase isn't counted in the CPI, it never happened—at least according to the government.)

Are you paying for a child's or grandchild's college education? Since 1986, the cost has risen a mind-boggling 598%. Since 2002, you're paying:

26% more for milk…

73% more for eggs…

90% more for coffee…

39% more for a loaf of bread…

56% more for turkey…

44% more for spaghetti…

143% more for margarine…

61% more for ground beef…

The average increase over the past 11 years for each of these everyday items: 48.3%. And that's just for supermarket staples. What about something BIG—like healthcare?

Since 2002, healthcare costs have more than DOUBLED for American families, according to the independent Milliman Medical Index. As of 2011, counting both employee and employer contributions, the total healthcare costs for a family of four have soared to over $19,000 per year—up more than $10,000 in just nine years. This has already placed a huge burden on both employers and workers. But

it may become worse—far worse.

According to a new report released by the U.S. House Energy and Commerce Committee, Obamacare could raise the average health insurance premium by nearly 100%. Scary? Of course it is. But what should frighten investors out of their skin is what creeping inflation can do to their investment income.

The Retirement Wrecker

If you've never invested when inflation is high, it's a house of horrors. Just ask anyone who tried it in the 1970s. Most of your stock gains will be steadily washed away, like castles in the sand. If you're retired and dependent on income, inflation could decimate your lifestyle. That's no exaggeration—just fifth-grade arithmetic.

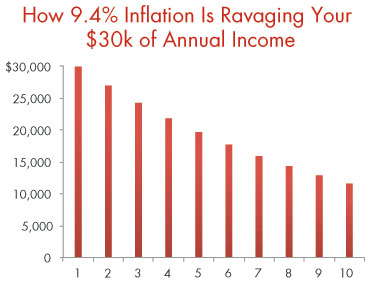

Today's 9.4% real inflation rate makes mincemeat of the pathetic returns on Treasuries, CDs and money market accounts. It even wipes out solid 4%… 6%… and 8% dividends on high-yielding stocks (if you're lucky enough to have them).

Imagine you're retired with a nest egg of $750,000. Let's say you've been earning about 4% on your money.

That's $30,000 of income per year you can take out without touching your principal—and it's crucial to maintaining your standard of living, right?

The bad news is that even at the government's phony 2%-to-3% inflation rate, that $30,000 is actually worth only $29,100 when you spend it at the end of the year, and it will dwindle to about $22,000 just 10 years from now. But that's ONLY if you believe the official CPI—which is like swallowing financial hemlock.

Remember, REAL inflation as calculated using the BLS's own 1980 formula is 9.4%… meaning your money's buying power is shrinking THREE TIMES FASTER than the government admits. Look what happens to $30,000 of income when inflation hits 9.4%.

Are you paying for a child's or grandchild's college education? Since 1986, the cost has risen a mind-boggling 598%. Since 2002, you're paying:

26% more for milk…

73% more for eggs…

90% more for coffee…

39% more for a loaf of bread…

56% more for turkey…

44% more for spaghetti…

143% more for margarine…

61% more for ground beef…

The average increase over the past 11 years for each of these everyday items: 48.3%. And that's just for supermarket staples. What about something BIG—like healthcare?

Since 2002, healthcare costs have more than DOUBLED for American families, according to the independent Milliman Medical Index. As of 2011, counting both employee and employer contributions, the total healthcare costs for a family of four have soared to over $19,000 per year—up more than $10,000 in just nine years. This has already placed a huge burden on both employers and workers. But

it may become worse—far worse.

According to a new report released by the U.S. House Energy and Commerce Committee, Obamacare could raise the average health insurance premium by nearly 100%. Scary? Of course it is. But what should frighten investors out of their skin is what creeping inflation can do to their investment income.

The Retirement Wrecker

If you've never invested when inflation is high, it's a house of horrors. Just ask anyone who tried it in the 1970s. Most of your stock gains will be steadily washed away, like castles in the sand. If you're retired and dependent on income, inflation could decimate your lifestyle. That's no exaggeration—just fifth-grade arithmetic.

Today's 9.4% real inflation rate makes mincemeat of the pathetic returns on Treasuries, CDs and money market accounts. It even wipes out solid 4%… 6%… and 8% dividends on high-yielding stocks (if you're lucky enough to have them).

Imagine you're retired with a nest egg of $750,000. Let's say you've been earning about 4% on your money.

That's $30,000 of income per year you can take out without touching your principal—and it's crucial to maintaining your standard of living, right?

The bad news is that even at the government's phony 2%-to-3% inflation rate, that $30,000 is actually worth only $29,100 when you spend it at the end of the year, and it will dwindle to about $22,000 just 10 years from now. But that's ONLY if you believe the official CPI—which is like swallowing financial hemlock.

Remember, REAL inflation as calculated using the BLS's own 1980 formula is 9.4%… meaning your money's buying power is shrinking THREE TIMES FASTER than the government admits. Look what happens to $30,000 of income when inflation hits 9.4%.

One thing you can say about inflation: It doesn't discriminate. It's an equal-opportunity dream destroyer.

Inflation ravages everyone, rich or poor.

Let's say you've done well—your nest egg is worth $1 million. Did you know that every single percentage-point rise in inflation rips $10,000 from your real wealth—and continues ripping you off year after year?

Imagine what would happen to your personal standard of living if "official" inflation jumped by five… six… or even seven points… and REAL inflation reached double digits.

Inflation ravages everyone, rich or poor.

Let's say you've done well—your nest egg is worth $1 million. Did you know that every single percentage-point rise in inflation rips $10,000 from your real wealth—and continues ripping you off year after year?

Imagine what would happen to your personal standard of living if "official" inflation jumped by five… six… or even seven points… and REAL inflation reached double digits.

Yes, it's an ugly picture—but frighteningly possible. After all, official inflation hit 15% under Carter in 1980. Who says it can't happen again? Especially with the Fed's multiple rounds of Quantitative Easing, which printed money by the truckload.

Even "good" news can hold inflationary danger.

Suppose the snail-like economic recovery suddenly picks up speed. Against the background of years of record-breaking deficit spending and non-stop currency debasing, a red-hot economy would put enormous inflationary stress on the dollar.

History is full of examples of aggressive currency printing leading to rampant inflation. Look at Argentina today. It's an advanced, First World nation. It has rich natural resources, a highly literate population and a diversified industrial base.

Right now in Argentina, inflation is 24.9%. It's forecasted to reach 30% next year. I'm not predicting that for the U.S. any time soon, but the point is that if it can happen to them, it can to us. At 9.4% real inflation, we're already one-third of the way there.

Imagine how the purchasing power of your income would plummet in that scenario. When official inflation (calculated with the current, highly politicized method) hits 9% or even 10%… real inflation could easily top 30%.

Hyperinflation is truly frightening, and it's happened 47 times around the world since 1944. And it will clobber your wealth—eating it away so rapidly that it leaves you facing the ultimate financial catastrophe: outliving your money.

The reality is that fiat currencies always fail eventually—for one simple reason: Governments overspend and overpromise. It's in their DNA. The message is clear: It's time for a strong, anti-inflation defense

perimeter around your nest egg.

Given the historic level of government debt and massive printing of debased dollars, I give us a 50% chance of entering hyperinflation in the next five years. Failing to develop a strategy to deal with serious inflation is like driving in the dark with no headlights.

Remember, those key indicators I spoke of—persistent conflict, intense global competition for commodities, massive government spending and relentless Federal Reserve money printing—are still in place. Worse, I see no easy end to any of them.

Whenever the Fed even so much as hints at the end of QE and higher interest rates, the markets react violently to the downside. No one in Washington wants to take the blame for derailing the economy—again.

Note also, the U.S. isn't the only country aggressively stimulating its economy. Central banks around the world are running their own money-printing programs. We've got a tidal wave of liquidity chasing the same goods and services—the classic runaway-inflation scenario.

The Question Remains…What to do about it?

America's last period of high inflation, the 1970s, happened four decades ago. The era of disco, leisure suits and double-digit inflation is a distant memory to most financial advisors.

Many of today's advisors weren't even alive when President Ford handed out "Whip Inflation Now" buttons and Jimmy Carter set price controls on oil and gas. But we were there in the trenches, helping investors through the most vicious American bout of inflation of the 20th century.

We're convinced that the specter of inflation—the Thief in the Night, as President Reagan so aptly named it—is stalking investors once again. A crucial point to take to heart about inflation is…Not everyone loses money.

Even during the stagflation horror of the 1970s, many investors profited, and some actually built fortunes.

They did a lot more than protect their existing wealth. They actually leveraged inflation to make themselves richer. You can do the same today. Just as in the '70s, a handful of investments exist that can earn you double-digit profits no matter how hard inflation hits in the next few years. In fact, the harder it hits, the more money you'll make.

Be warned: Many of the traditional safe havens and inflation fighters you'll hear bandied about on the financial channels aren't working like they used to.

For example…

Should you seek refuge in cash? Not in these unusual times. With real inflation approaching 10%, cash equivalents like T-bills and money market funds don't yield nearly enough to keep up. For most of the past decade, cash has paid next to nothing because central banks are holding rates down.

Do the math. How do the 1%-to-3% returns typical of today's cash equivalents fare versus 9.4% real inflation? It's a mismatch—inflation wins in a knockout.

What about stocks? Rising inflation will take a toll on most stocks. Never forget, rising inflation debases the U.S. dollar—as well as any asset tied to the dollar, including stocks. While corporate profits might rise, stock prices won't follow suit, because P/E ratios tend to drop with inflation.

During the 1970s, the S&P rose an average of 4.4% a year, but inflation averaged 7.3%. Even factoring in dividends, stock owners found their principal was worth only 74% of the value it held at the start of the decade. Indeed, a snapshot of the years 1976 to 1982 shows the Dow plunged more than 25%. These years will forever be recalled as a nightmare for stocks. Investors fled the market in droves—some never to return.

What about TIPS? You've no doubt heard much chatter about TIPS—Treasury Inflation-Protected Securities. TIPS come with the guarantee that their face value increases with inflation. Sounds good. However, beware: TIPS are tied to the core, or "official," CPI, which, as we've amply explained, is a fraud. So as you read this, TIPS are recognizing inflation as 1.8% and paying accordingly, while the true inflation rate gnawing away at your money is a whopping 9.4%.

What about gold? It's long been a traditional inflation hedge, but that assumption has come under serious fire as of late. Gold isn't exactly glittering these days. The yellow metal peaked in 2011 after investors flocked to it in the panicky years after the Crash of 2008. Now that most folks no longer feel financial Armageddon breathing down their necks, money is flowing out of gold.

You can do better—much better—than relying on the old ways to guard against the Thief in the Night.

Smart Strategies to Grow Your Wealth

If you get into the right assets beforehand, you'll actually welcome inflation when it hits. Because those assets are leveraged to rising prices, and will increase your wealth while millions of your fellow citizens grow poorer.

Chief Strategist Ben Shepherd, a recognized ETF, mutual fund and stock expert, has spent years studying and writing about macroeconomics, and is confident that wealth-sapping inflation is not a matter of if, but when. Ben is also an accomplished stock picker, where he looks for profit plays in Brazil, Russia, India, China and other rising economic powers.

From the market bottom on October 27, 2008, through the end of 2012, Ben's portfolio has returned 196.0%. That crushes the return of his benchmark, the MSCI Emerging Markets Index. And it's also a heck of a lot better than the 84.6% gain turned in by the S&P 500.

Ben has enlisted Richard Stavros to help him keep his finger on the pulse of inflation for you. Richard advises corporations, investment houses and governments on corporate valuations, mergers and acquisitions, and various strategic initiatives.

Ben and Richard agree with me that we're now in an unusual, perhaps unprecedented, economic situation we've decided to call "Preflation." You can think of Preflation as a rocket in countdown mode. But it won't be like a spectacular launch at Cape Canaveral.

In fact, it's hard to know exactly when this Preflation rocket will blast off and reach hyperinflation altitude, because we've never seen a period exactly like the one we're facing today. There is no real parallel. Never before has a central bank pumped so much money into an economy—$85 billion per month at last count.

The Federal Reserve has injected $2.5 trillion into the U.S. economy since 2008, in an effort to keep interest rates low and spur economic growth. History shows that whenever a country prints even half as much money as the U.S. has and artificially keeps interest rates low for years; the end result is inflation.

It won't be long before you can divide investors into two distinct groups: those who prepared for the wealth destruction inflation inflicts—and those who never saw it coming. It's time to make sure you're in the first group.

The Inflation Blacklist: Investments Guaranteed to be CLOBBERED by Inflation. Do you own any stocks at the mercy of commodity prices (like General Mills)? How about any REITs leveraged to the hilt (like American Capital Agency Corp.)? Or companies that could run into a wall when fuel prices spike (like Swift Transportation)? Dump them. These stocks are highly vulnerable to inflation. And there are dozens more. We name names in The Blacklist. If you own even one, you need to replace it now.

You take deductions to reduce your tax bill, don't you? So why pay the full "inflation tax" of 9.4% when you can limit the bite inflation takes from your wealth? Remember, many investors in the 1970s became rich by switching to investments that PROSPER during inflationary times. There is no reason you shouldn't do the same.

Please don't make the mistake of ignoring the problem, hoping it will pass. A lot of people will stick their heads in the sand, realizing too late that they should have done something when they had the chance.

Lately, I've noticed columnists calling for price controls on medicine… a South Carolina legislator demanding price controls on gas and the Massachusetts Attorney General recommending hospital price controls. Beware. There's no surer sign higher inflation looms than when politicians and journalists start howling for price controls.

Remember, the Thief in the Night is an "equal-opportunity portfolio robber." Inflation relentlessly steals wealth—regardless of your age or experience. No one is immune except those who defend their money.

Stop the thief.

Even "good" news can hold inflationary danger.

Suppose the snail-like economic recovery suddenly picks up speed. Against the background of years of record-breaking deficit spending and non-stop currency debasing, a red-hot economy would put enormous inflationary stress on the dollar.

History is full of examples of aggressive currency printing leading to rampant inflation. Look at Argentina today. It's an advanced, First World nation. It has rich natural resources, a highly literate population and a diversified industrial base.

Right now in Argentina, inflation is 24.9%. It's forecasted to reach 30% next year. I'm not predicting that for the U.S. any time soon, but the point is that if it can happen to them, it can to us. At 9.4% real inflation, we're already one-third of the way there.

Imagine how the purchasing power of your income would plummet in that scenario. When official inflation (calculated with the current, highly politicized method) hits 9% or even 10%… real inflation could easily top 30%.

Hyperinflation is truly frightening, and it's happened 47 times around the world since 1944. And it will clobber your wealth—eating it away so rapidly that it leaves you facing the ultimate financial catastrophe: outliving your money.

The reality is that fiat currencies always fail eventually—for one simple reason: Governments overspend and overpromise. It's in their DNA. The message is clear: It's time for a strong, anti-inflation defense

perimeter around your nest egg.

Given the historic level of government debt and massive printing of debased dollars, I give us a 50% chance of entering hyperinflation in the next five years. Failing to develop a strategy to deal with serious inflation is like driving in the dark with no headlights.

Remember, those key indicators I spoke of—persistent conflict, intense global competition for commodities, massive government spending and relentless Federal Reserve money printing—are still in place. Worse, I see no easy end to any of them.

Whenever the Fed even so much as hints at the end of QE and higher interest rates, the markets react violently to the downside. No one in Washington wants to take the blame for derailing the economy—again.

Note also, the U.S. isn't the only country aggressively stimulating its economy. Central banks around the world are running their own money-printing programs. We've got a tidal wave of liquidity chasing the same goods and services—the classic runaway-inflation scenario.

The Question Remains…What to do about it?

America's last period of high inflation, the 1970s, happened four decades ago. The era of disco, leisure suits and double-digit inflation is a distant memory to most financial advisors.

Many of today's advisors weren't even alive when President Ford handed out "Whip Inflation Now" buttons and Jimmy Carter set price controls on oil and gas. But we were there in the trenches, helping investors through the most vicious American bout of inflation of the 20th century.

We're convinced that the specter of inflation—the Thief in the Night, as President Reagan so aptly named it—is stalking investors once again. A crucial point to take to heart about inflation is…Not everyone loses money.

Even during the stagflation horror of the 1970s, many investors profited, and some actually built fortunes.

They did a lot more than protect their existing wealth. They actually leveraged inflation to make themselves richer. You can do the same today. Just as in the '70s, a handful of investments exist that can earn you double-digit profits no matter how hard inflation hits in the next few years. In fact, the harder it hits, the more money you'll make.

Be warned: Many of the traditional safe havens and inflation fighters you'll hear bandied about on the financial channels aren't working like they used to.

For example…

Should you seek refuge in cash? Not in these unusual times. With real inflation approaching 10%, cash equivalents like T-bills and money market funds don't yield nearly enough to keep up. For most of the past decade, cash has paid next to nothing because central banks are holding rates down.

Do the math. How do the 1%-to-3% returns typical of today's cash equivalents fare versus 9.4% real inflation? It's a mismatch—inflation wins in a knockout.

What about stocks? Rising inflation will take a toll on most stocks. Never forget, rising inflation debases the U.S. dollar—as well as any asset tied to the dollar, including stocks. While corporate profits might rise, stock prices won't follow suit, because P/E ratios tend to drop with inflation.

During the 1970s, the S&P rose an average of 4.4% a year, but inflation averaged 7.3%. Even factoring in dividends, stock owners found their principal was worth only 74% of the value it held at the start of the decade. Indeed, a snapshot of the years 1976 to 1982 shows the Dow plunged more than 25%. These years will forever be recalled as a nightmare for stocks. Investors fled the market in droves—some never to return.

What about TIPS? You've no doubt heard much chatter about TIPS—Treasury Inflation-Protected Securities. TIPS come with the guarantee that their face value increases with inflation. Sounds good. However, beware: TIPS are tied to the core, or "official," CPI, which, as we've amply explained, is a fraud. So as you read this, TIPS are recognizing inflation as 1.8% and paying accordingly, while the true inflation rate gnawing away at your money is a whopping 9.4%.

What about gold? It's long been a traditional inflation hedge, but that assumption has come under serious fire as of late. Gold isn't exactly glittering these days. The yellow metal peaked in 2011 after investors flocked to it in the panicky years after the Crash of 2008. Now that most folks no longer feel financial Armageddon breathing down their necks, money is flowing out of gold.

You can do better—much better—than relying on the old ways to guard against the Thief in the Night.

Smart Strategies to Grow Your Wealth

If you get into the right assets beforehand, you'll actually welcome inflation when it hits. Because those assets are leveraged to rising prices, and will increase your wealth while millions of your fellow citizens grow poorer.

Chief Strategist Ben Shepherd, a recognized ETF, mutual fund and stock expert, has spent years studying and writing about macroeconomics, and is confident that wealth-sapping inflation is not a matter of if, but when. Ben is also an accomplished stock picker, where he looks for profit plays in Brazil, Russia, India, China and other rising economic powers.

From the market bottom on October 27, 2008, through the end of 2012, Ben's portfolio has returned 196.0%. That crushes the return of his benchmark, the MSCI Emerging Markets Index. And it's also a heck of a lot better than the 84.6% gain turned in by the S&P 500.

Ben has enlisted Richard Stavros to help him keep his finger on the pulse of inflation for you. Richard advises corporations, investment houses and governments on corporate valuations, mergers and acquisitions, and various strategic initiatives.

Ben and Richard agree with me that we're now in an unusual, perhaps unprecedented, economic situation we've decided to call "Preflation." You can think of Preflation as a rocket in countdown mode. But it won't be like a spectacular launch at Cape Canaveral.

In fact, it's hard to know exactly when this Preflation rocket will blast off and reach hyperinflation altitude, because we've never seen a period exactly like the one we're facing today. There is no real parallel. Never before has a central bank pumped so much money into an economy—$85 billion per month at last count.

The Federal Reserve has injected $2.5 trillion into the U.S. economy since 2008, in an effort to keep interest rates low and spur economic growth. History shows that whenever a country prints even half as much money as the U.S. has and artificially keeps interest rates low for years; the end result is inflation.

It won't be long before you can divide investors into two distinct groups: those who prepared for the wealth destruction inflation inflicts—and those who never saw it coming. It's time to make sure you're in the first group.

The Inflation Blacklist: Investments Guaranteed to be CLOBBERED by Inflation. Do you own any stocks at the mercy of commodity prices (like General Mills)? How about any REITs leveraged to the hilt (like American Capital Agency Corp.)? Or companies that could run into a wall when fuel prices spike (like Swift Transportation)? Dump them. These stocks are highly vulnerable to inflation. And there are dozens more. We name names in The Blacklist. If you own even one, you need to replace it now.

You take deductions to reduce your tax bill, don't you? So why pay the full "inflation tax" of 9.4% when you can limit the bite inflation takes from your wealth? Remember, many investors in the 1970s became rich by switching to investments that PROSPER during inflationary times. There is no reason you shouldn't do the same.

Please don't make the mistake of ignoring the problem, hoping it will pass. A lot of people will stick their heads in the sand, realizing too late that they should have done something when they had the chance.

Lately, I've noticed columnists calling for price controls on medicine… a South Carolina legislator demanding price controls on gas and the Massachusetts Attorney General recommending hospital price controls. Beware. There's no surer sign higher inflation looms than when politicians and journalists start howling for price controls.

Remember, the Thief in the Night is an "equal-opportunity portfolio robber." Inflation relentlessly steals wealth—regardless of your age or experience. No one is immune except those who defend their money.

Stop the thief.

RSS Feed

RSS Feed