By Matt Badiali

Not long ago, a new royalty investment went public on the New York Stock Exchange. It's located in a different part of the country than the opportunities I showed you in the companion report to this one – Oil & Gas Royalties: The Real Secret to Generating Huge Returns in America's Petroleum Markets. And its primary focus is on a different type of natural resource.

It's located in a part of the country that Bloomberg says has "among the largest and most active producing reserves" of its kind in the U.S. And production in this region is expected to jump 60% by 2016. That translates into potentially huge streams of income for investors who get in early on this opportunity.

As longtime S&A Resource Report readers have heard me say many times... royalties are a "backdoor" way to get paid over and over again. You make just one investment... or control one valuable asset... and get paid over and over again, while somebody else takes on the risk of marketing, development, and distribution. That's the secret to royalty success.

As resource investors, we want to use this secret to collect royalties on one of the world's most vital energy commodities. The royalty investment you'll learn about in this report is currently yielding 12% a year. And like the royalty investments I've already told you about, you avoid all the normal risks of doing business... and simply collect incredible streams of income for owning some of the country's most valuable assets.

We're Getting Tax-Free Money From SandRidge Energy's Third Royalty Trust

As you may recall from the companion report... Owning royalty companies is one of the easiest and safest ways to turn a small investment into incredible wealth.

Royalty trusts generate cash by selling the production of natural resources – such as oil, natural gas, and coal. In this report, we are focusing on a company created around oil and gas royalties – the Permian Trust (NYSE: PER). It's the third trust spun-off from SandRidge Energy.

As we'll show... through the Permian Trust, you avoid all the normal risks of exploring for oil and gas... and simply own a company that collects incredible streams of income from wells in one of the world's best oil and gas fields. The Permian Trust doesn't spend capital on exploration. It doesn't spend it on developing projects or on maintaining them. The royalty trust is built solely around income from existing projects.

It also has no physical operations and no management or employees. It is basically just a lawyer and an accountant. SandRidge – the "parent company" – operates the wells and pays the overhead and costs for new production. The royalty trust just gets paid.

Like SandRidge's other trusts, the Permian Trust has a 20-year lifespan. That means it will receive royalty checks from SandRidge's wells in the Permian Basin – and pass that money along to shareholders – for the next two decades. The Permian Trust is built upon both existing wells and proved, undeveloped reserves (PUDs). In other words, shareholders get paid for both current production and future production from new wells yet to be drilled in the area.

Based on the Permian Trust's current share price – and using ultra-conservative commodities price estimates – we believe this trust is a bargain today. It has the potential for capital gains. And it pays out at least a 12% yield. Ever better, we could keep up to 39.6% of that cash tax-free...

Reducing Risk with Our Royalty Trust Model

We developed a model to figure out a realistic estimate of the value of the Permian Trust... and how much it would pay us.

The operator of the trust, SandRidge Energy, secured prices for – or "hedged" – 60% of the production from the trust. That means we know the price of a set amount of the oil and gas that will be produced in a year. And we'll get that money even if the prices of oil or natural gas collapse.

That reduces the range of possible outcomes... and makes our model results that much more reliable. The volume of oil and natural gas produced from the wells is harder to gauge. Production in every oil well begins to decline as soon as it's put into production. That's why oil companies must constantly drill new wells to replace production. And this Permian Trust is no different.

It was created around existing production and a number of new wells drilled over the first three to four years of the trust's life. That means those first three to four years of the trust will capture the most production. (The Permian Trust is two years old.) One risk with this company is that the cash flow in the trust is subject to commodity price and production swings. That means there can be changes from quarter-to-quarter in the amounts of money paid out by this trust.

Also, we can't know the exact volume of oil and natural gas produced in a period. But we can make an accurate estimate. And in our model, we are conservative. Our estimates were less than the production estimates produced by the trust's engineers. That way, if something goes wrong, we are covered.

One thing that could go wrong with the Permian Trust is SandRidge. You see, we aren't completely insulated from that company... SandRidge operates the trust. That means it drills and maintains the wells. So if it can't drill new wells, we won't get the new production. However, I see that as a minor risk to us. SandRidge owns 11 drill rigs. It plans to spend $1.75 billion drilling new wells in 2013. And many of those will be for the trusts. So I don't see a lack of new wells as a potential problem.

And the last major risk to this investment is that the Permian Trust is "finite." In other words, it exists for 20 years and then ends. By the end of 2031, the trust will close. That means the company will sell off the remaining assets and pay out one last distribution to both SandRidge Energy and the trust's shareholders.

However, as the trust ages, the distributions become smaller. And more of it is simply our original investment coming back to us, instead of dividends – our "return of capital." Let me explain.

Oil and gas wells are finite resources. That means they run out. So if we spend $1 million to drill a well and we get $1.1 million back from selling the oil and gas, we didn't make $1.1 million in profit. We made $100,000 in profit. The rest of that money was a return of our original capital. The same thing is going on here. Our initial investment in the trust can be thought of as our share of the drilling costs.

As SandRidge drills off the wells, it will keep the production stable. However, when the wells are done, the production will begin to decline. We want to be out before that happens. That's why we will only hold the Permian Trust for up to three years. We'll skim the cream and get out before the wells begin to decline. By the end of 2015, we will cash out. We should be able to take a small capital gain on the sale, depending on the prices of oil and natural gas. At the same time, we'll cash out the Permian Trust's double-digit gains from the past three years. Now let's take a look at this royalty investment.

Not long ago, a new royalty investment went public on the New York Stock Exchange. It's located in a different part of the country than the opportunities I showed you in the companion report to this one – Oil & Gas Royalties: The Real Secret to Generating Huge Returns in America's Petroleum Markets. And its primary focus is on a different type of natural resource.

It's located in a part of the country that Bloomberg says has "among the largest and most active producing reserves" of its kind in the U.S. And production in this region is expected to jump 60% by 2016. That translates into potentially huge streams of income for investors who get in early on this opportunity.

As longtime S&A Resource Report readers have heard me say many times... royalties are a "backdoor" way to get paid over and over again. You make just one investment... or control one valuable asset... and get paid over and over again, while somebody else takes on the risk of marketing, development, and distribution. That's the secret to royalty success.

As resource investors, we want to use this secret to collect royalties on one of the world's most vital energy commodities. The royalty investment you'll learn about in this report is currently yielding 12% a year. And like the royalty investments I've already told you about, you avoid all the normal risks of doing business... and simply collect incredible streams of income for owning some of the country's most valuable assets.

We're Getting Tax-Free Money From SandRidge Energy's Third Royalty Trust

As you may recall from the companion report... Owning royalty companies is one of the easiest and safest ways to turn a small investment into incredible wealth.

Royalty trusts generate cash by selling the production of natural resources – such as oil, natural gas, and coal. In this report, we are focusing on a company created around oil and gas royalties – the Permian Trust (NYSE: PER). It's the third trust spun-off from SandRidge Energy.

As we'll show... through the Permian Trust, you avoid all the normal risks of exploring for oil and gas... and simply own a company that collects incredible streams of income from wells in one of the world's best oil and gas fields. The Permian Trust doesn't spend capital on exploration. It doesn't spend it on developing projects or on maintaining them. The royalty trust is built solely around income from existing projects.

It also has no physical operations and no management or employees. It is basically just a lawyer and an accountant. SandRidge – the "parent company" – operates the wells and pays the overhead and costs for new production. The royalty trust just gets paid.

Like SandRidge's other trusts, the Permian Trust has a 20-year lifespan. That means it will receive royalty checks from SandRidge's wells in the Permian Basin – and pass that money along to shareholders – for the next two decades. The Permian Trust is built upon both existing wells and proved, undeveloped reserves (PUDs). In other words, shareholders get paid for both current production and future production from new wells yet to be drilled in the area.

Based on the Permian Trust's current share price – and using ultra-conservative commodities price estimates – we believe this trust is a bargain today. It has the potential for capital gains. And it pays out at least a 12% yield. Ever better, we could keep up to 39.6% of that cash tax-free...

Reducing Risk with Our Royalty Trust Model

We developed a model to figure out a realistic estimate of the value of the Permian Trust... and how much it would pay us.

The operator of the trust, SandRidge Energy, secured prices for – or "hedged" – 60% of the production from the trust. That means we know the price of a set amount of the oil and gas that will be produced in a year. And we'll get that money even if the prices of oil or natural gas collapse.

That reduces the range of possible outcomes... and makes our model results that much more reliable. The volume of oil and natural gas produced from the wells is harder to gauge. Production in every oil well begins to decline as soon as it's put into production. That's why oil companies must constantly drill new wells to replace production. And this Permian Trust is no different.

It was created around existing production and a number of new wells drilled over the first three to four years of the trust's life. That means those first three to four years of the trust will capture the most production. (The Permian Trust is two years old.) One risk with this company is that the cash flow in the trust is subject to commodity price and production swings. That means there can be changes from quarter-to-quarter in the amounts of money paid out by this trust.

Also, we can't know the exact volume of oil and natural gas produced in a period. But we can make an accurate estimate. And in our model, we are conservative. Our estimates were less than the production estimates produced by the trust's engineers. That way, if something goes wrong, we are covered.

One thing that could go wrong with the Permian Trust is SandRidge. You see, we aren't completely insulated from that company... SandRidge operates the trust. That means it drills and maintains the wells. So if it can't drill new wells, we won't get the new production. However, I see that as a minor risk to us. SandRidge owns 11 drill rigs. It plans to spend $1.75 billion drilling new wells in 2013. And many of those will be for the trusts. So I don't see a lack of new wells as a potential problem.

And the last major risk to this investment is that the Permian Trust is "finite." In other words, it exists for 20 years and then ends. By the end of 2031, the trust will close. That means the company will sell off the remaining assets and pay out one last distribution to both SandRidge Energy and the trust's shareholders.

However, as the trust ages, the distributions become smaller. And more of it is simply our original investment coming back to us, instead of dividends – our "return of capital." Let me explain.

Oil and gas wells are finite resources. That means they run out. So if we spend $1 million to drill a well and we get $1.1 million back from selling the oil and gas, we didn't make $1.1 million in profit. We made $100,000 in profit. The rest of that money was a return of our original capital. The same thing is going on here. Our initial investment in the trust can be thought of as our share of the drilling costs.

As SandRidge drills off the wells, it will keep the production stable. However, when the wells are done, the production will begin to decline. We want to be out before that happens. That's why we will only hold the Permian Trust for up to three years. We'll skim the cream and get out before the wells begin to decline. By the end of 2015, we will cash out. We should be able to take a small capital gain on the sale, depending on the prices of oil and natural gas. At the same time, we'll cash out the Permian Trust's double-digit gains from the past three years. Now let's take a look at this royalty investment.

SandRidge Permian Trust (NYSE: PER)

In May 2011, SandRidge spun out its Permian Trust around existing and future wells in the Permian Basin. The terms of the trust say it will terminate on March 31, 2031. But we plan to sell in three years. The trust is in an "oily" part of the Permian Basin. That's why about 86% of this trust's assets are oil... the rest is natural gas.

The Permian Trust's IPO price was $18 per share. And its market value at its IPO was $945 million. Today, it trades around $14.04 per share and its market value is $737 million. It has 52.5 million shares outstanding. Like the Mississippian trusts, the Permian Trust suffered as SandRidge imploded from its tremendous debt burden, as you can see from the chart below. It sank 43% from its March 2012 high.

In May 2011, SandRidge spun out its Permian Trust around existing and future wells in the Permian Basin. The terms of the trust say it will terminate on March 31, 2031. But we plan to sell in three years. The trust is in an "oily" part of the Permian Basin. That's why about 86% of this trust's assets are oil... the rest is natural gas.

The Permian Trust's IPO price was $18 per share. And its market value at its IPO was $945 million. Today, it trades around $14.04 per share and its market value is $737 million. It has 52.5 million shares outstanding. Like the Mississippian trusts, the Permian Trust suffered as SandRidge imploded from its tremendous debt burden, as you can see from the chart below. It sank 43% from its March 2012 high.

SandRidge built the trust around 509 existing horizontal wells and 888 to be drilled by March 31, 2016. As of today, SandRidge Energy drilled 508 of the required 888 wells. That means we can expect 380 more wells to continue to add new production volumes as the older wells decline.

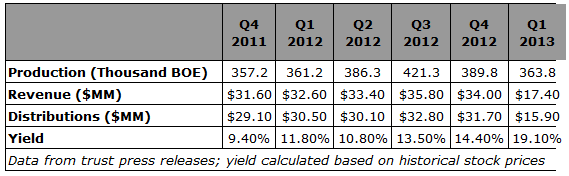

The trust owns an 80% net royalty interest on the production from those first 517 vertical wells and a 70% net royalty interest on the production from the 888. The wells produce a mix of 5% natural gas and 95% oil and natural gas liquids. Here's what the Permian Trust's production and distribution history looks like.

The trust owns an 80% net royalty interest on the production from those first 517 vertical wells and a 70% net royalty interest on the production from the 888. The wells produce a mix of 5% natural gas and 95% oil and natural gas liquids. Here's what the Permian Trust's production and distribution history looks like.

Today, the Permian Trust trades around $14.04 per share with a 16.2% yield, based on the last 12 months of distributions. Again, that means the market is pricing in a huge fall in distributions. We built a conservative model to predict the future distributions, based on the company's oil and gas production.

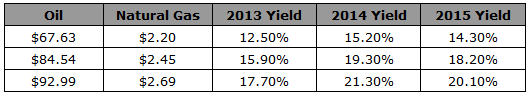

From the creation of the Permian Trust, SandRidge Energy hedged nearly 80% of the expected revenues that will be used to pay distributions through March 31, 2015. In other words, the price is already locked in on some of the production, at around $100 per barrel through 2015. Taking that into account, here are our expected yields, based on three different price assumptions.

From the creation of the Permian Trust, SandRidge Energy hedged nearly 80% of the expected revenues that will be used to pay distributions through March 31, 2015. In other words, the price is already locked in on some of the production, at around $100 per barrel through 2015. Taking that into account, here are our expected yields, based on three different price assumptions.

As you can see in the table above, our price assumptions are slightly different than the Mississippian Trust I. That's because the oil and gas prices paid in the Permian Basin are different from those paid in Kansas and Oklahoma. However, the company's hedges lock in the price for a large volume of oil. That means the spot price isn't much of a factor for the distributions. It would take an enormous fall in the oil price for the yield to drop below 12%. That provides us with an excellent level of safety with our investment.

Based on our model, we expect the Permian Trust to pay out $1.75 per share in 2013. That means we can lock in 12% yield this year if we buy shares below $14.60. At its current price of $14.04, we get a 12.5% yield.

Action to take: Buy SandRidge Permian Trust (NYSE: PER) up to $14.60 per share. Use a 25% trailing stop.

Based on our model, we expect the Permian Trust to pay out $1.75 per share in 2013. That means we can lock in 12% yield this year if we buy shares below $14.60. At its current price of $14.04, we get a 12.5% yield.

Action to take: Buy SandRidge Permian Trust (NYSE: PER) up to $14.60 per share. Use a 25% trailing stop.

How to Earn Tax-Free Income from Our Royalty Trusts

I do not provide individual tax advice. So before purchasing any trust, you should consult a tax professional. But this information should get you started.

The Permian Trust is trust is a partnership. Partnerships do not pay U.S. federal income taxes. As a result, the trusts have additional cash flow to give to investors in the form of "distributions." Distributions are like dividends paid on a normal stock... but they are not taxable right away. Instead, they reduce an investor's cost basis in the investment.

For example, the Permian Trust estimates original trust investors will pay federal taxes on 55% of the cash they receive through 2013. In other words, only $0.55 of each $1 they receive is taxable. So assume you made a $10,000 investment into a trust with a 15% yield. You only pay tax on 55% of $1,500 in distributions received ($10,000 * 15%). You only pay tax on $825.

Investors in the top tax bracket pay $594 in tax on $1,500 on ordinary dividends ($1,500 * 39.6%). But since you are taxed on $825 in distributions, you save $267 in tax. The untaxed portion of the $1,500 distribution is $675 ($1,500 - $825). For tax purposes, this is a return of capital. You don't pay taxes on this amount right away. Instead, you reduce your cost basis in the stock by $675.

Your initial cost basis is the same as your original investment. Your adjusted cost basis is equal to your original investment less the $675 reduction, or $9,325. If you sell your shares now, you calculate your taxable gain or loss by subtracting your adjusted cost basis of $9,325 from the sale price. If your adjusted basis is above zero, tax on your distributions is deferred until you sell your units. And if you die and the units pass to your heirs... the prior distributions are not taxed.

The trusts provide specific tax information to each partner after the end of the year. This information comes on a form called a "Schedule K-1." The K-1 includes your share of the trust's income and deduction activity for the year.

I do not provide individual tax advice. So before purchasing any trust, you should consult a tax professional. But this information should get you started.

The Permian Trust is trust is a partnership. Partnerships do not pay U.S. federal income taxes. As a result, the trusts have additional cash flow to give to investors in the form of "distributions." Distributions are like dividends paid on a normal stock... but they are not taxable right away. Instead, they reduce an investor's cost basis in the investment.

For example, the Permian Trust estimates original trust investors will pay federal taxes on 55% of the cash they receive through 2013. In other words, only $0.55 of each $1 they receive is taxable. So assume you made a $10,000 investment into a trust with a 15% yield. You only pay tax on 55% of $1,500 in distributions received ($10,000 * 15%). You only pay tax on $825.

Investors in the top tax bracket pay $594 in tax on $1,500 on ordinary dividends ($1,500 * 39.6%). But since you are taxed on $825 in distributions, you save $267 in tax. The untaxed portion of the $1,500 distribution is $675 ($1,500 - $825). For tax purposes, this is a return of capital. You don't pay taxes on this amount right away. Instead, you reduce your cost basis in the stock by $675.

Your initial cost basis is the same as your original investment. Your adjusted cost basis is equal to your original investment less the $675 reduction, or $9,325. If you sell your shares now, you calculate your taxable gain or loss by subtracting your adjusted cost basis of $9,325 from the sale price. If your adjusted basis is above zero, tax on your distributions is deferred until you sell your units. And if you die and the units pass to your heirs... the prior distributions are not taxed.

The trusts provide specific tax information to each partner after the end of the year. This information comes on a form called a "Schedule K-1." The K-1 includes your share of the trust's income and deduction activity for the year.

RSS Feed

RSS Feed