Special Report______________________The Eagle Ford Emerges As A World Power

|

Here's the scoop on one of the most talked about investment opportunities within the energy sector today.

Regardless of how you play it, Eagle Ford represents an investor's dream come true right here in our own backyard of Texas. Forget OPEC and their sagging agenda. Eagle Ford covers all the bases in long-term profitability and along with other repositories like the Permian Basin, will catapult the US to global dominance in the production and transportation of energy. For the first time in US history, the "Petrol Dollar" in the not so distant future may actually be backed by our own petrol reserves. Learn the importance of this basin and the... Three Small Oil Companies That Will Boom Along With It |

|

By Matt Badiali, Energy Analyst

"I'm sorry, Mr. Badiali. I can only confirm your room for two nights." The hotel was on a back road in southeast Texas. The parking lot looked like a truck dealership. New pickup trucks filled nearly every spot. Like every other hotel in the area, you couldn't book a hotel for three nights. I wanted to book at least three nights but so did thousands of oil workers. Last month, I traveled to the heart of Texas oil country... the Eagle Ford Shale. And I found all the signs of a huge resource boom. I flew into San Antonio and took I-37 South out of the city. It doesn't take long before you leave the suburbs and get into rural Texas. Take a left on Highway 59 and you trundle through sleepy towns that have Wal-Marts and little else. |

However, once you work your way south, the telltale skeletons of drilling rigs poke up above the oak trees. You begin to see hundreds of them. That's how you know you are in the Eagle Ford.

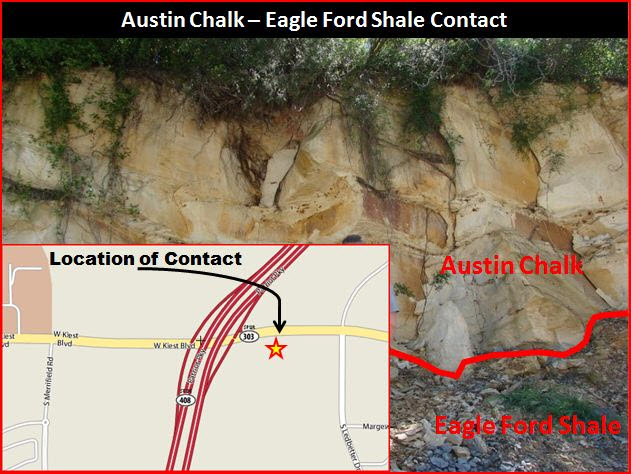

The Eagle Ford is the name of the rocks that filled a deep-water canyon that existed over 100 million years ago in southeast Texas. The trough trapped a thick, continuous layer of organic-rich sediments. Over time, heat and pressure converted the organics into oil and gas. Some of the oil and gas leaked into surrounding rocks, creating some of the legendary Texas oilfields. But today, the "source" rocks are the target.

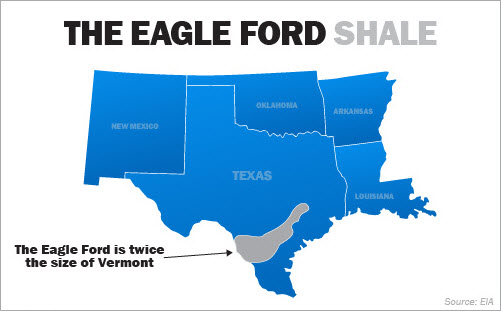

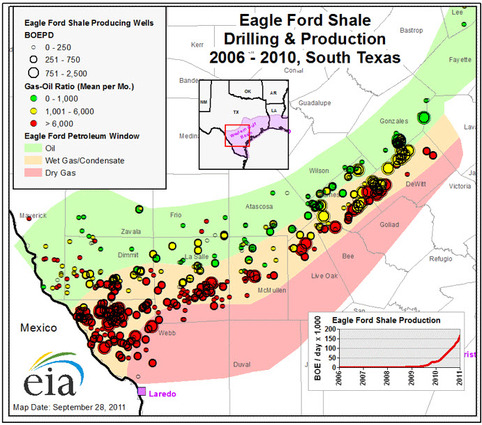

Just five years ago, geologists thought these source rocks were limited to just four key counties in southeast Texas. Today, we know the Eagle Ford runs for 20,000 square miles under a swath of Texas. It stretches from southeast of San Antonio down into Mexico. It's twice the size of Vermont.

The Eagle Ford is the name of the rocks that filled a deep-water canyon that existed over 100 million years ago in southeast Texas. The trough trapped a thick, continuous layer of organic-rich sediments. Over time, heat and pressure converted the organics into oil and gas. Some of the oil and gas leaked into surrounding rocks, creating some of the legendary Texas oilfields. But today, the "source" rocks are the target.

Just five years ago, geologists thought these source rocks were limited to just four key counties in southeast Texas. Today, we know the Eagle Ford runs for 20,000 square miles under a swath of Texas. It stretches from southeast of San Antonio down into Mexico. It's twice the size of Vermont.

|

Although the Eagle Ford is creating an enormous financial boom for the state of Texas, we're still in the early days of learning about this shale.

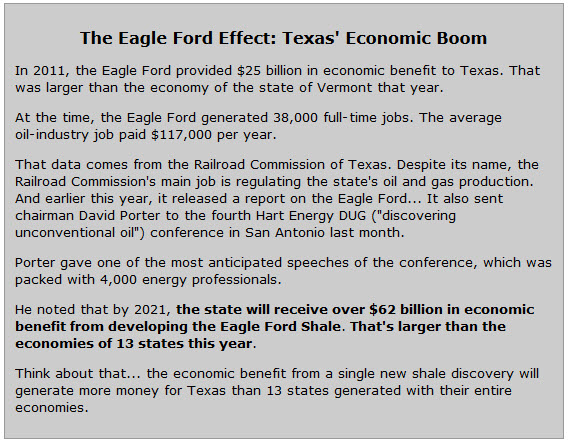

The Eagle Ford boom didn't really start until 2009. In just four years, the area is producing 800,000 barrels of oil per day, which makes it one of the largest fields in the United States. In the spotlight are three small oil companies poised to grow along with the Eagle Ford. I believe these companies could easily double or triple in size as the Eagle Ford grows over the coming years. |

Eagle Ford Growth Will Make Texas a Top Ten Global Oil Producer

Texas oil production is an anomaly. Oil production in places like Saudi Arabia, Nigeria, Mexico, Qatar... practically everywhere else... is in slow decline. Giant conventional oilfields found in the 1950s and 1960s are winding down. Until recently, Texas was following the same trend. From 2004 to 2009, Texas oil production flattened out at around 1.1 million barrels per day but today, Texas oil production is soaring.

From 2009 to 2012, daily oil production rose 140%. By June 2013, Texas' daily oil production hit 2.6 million barrels.

Texas oil production is an anomaly. Oil production in places like Saudi Arabia, Nigeria, Mexico, Qatar... practically everywhere else... is in slow decline. Giant conventional oilfields found in the 1950s and 1960s are winding down. Until recently, Texas was following the same trend. From 2004 to 2009, Texas oil production flattened out at around 1.1 million barrels per day but today, Texas oil production is soaring.

From 2009 to 2012, daily oil production rose 140%. By June 2013, Texas' daily oil production hit 2.6 million barrels.

In 2009, Texas oil production made up just 19% of the total U.S. oil production. It now makes up 36% of the total U.S. daily oil production. To put all this into a global context, Texas produces more oil today than Nigeria, a major international oil producer. It's only 200,000 barrels per day less than Venezuela, another major oil producer.

If Texas were a country, it would be the world's 12th-largest producer

A big part of Texas oil production – about 31% – is Eagle Ford oil production. (Growth in other areas, like the Permian Basin in West Texas, is driving Texas oil production, as well.) Oil production from the Eagle Ford is around 800,000 barrels of oil per day right now. According to investment bank Jefferies & Co, oil production in the Eagle Ford will grow to over 1 million barrels per day by next summer.

Another estimate, from industry research broker ITG Inc., puts the Eagle Ford's production at 3 million barrels per day in 2019. Based on the expected growth in the Eagle Ford and in other areas of Texas, its production will soar to 4 million barrels per day by 2015 – a 53% increase in two years.

If Texas were a country, it would be the world's 12th-largest producer

A big part of Texas oil production – about 31% – is Eagle Ford oil production. (Growth in other areas, like the Permian Basin in West Texas, is driving Texas oil production, as well.) Oil production from the Eagle Ford is around 800,000 barrels of oil per day right now. According to investment bank Jefferies & Co, oil production in the Eagle Ford will grow to over 1 million barrels per day by next summer.

Another estimate, from industry research broker ITG Inc., puts the Eagle Ford's production at 3 million barrels per day in 2019. Based on the expected growth in the Eagle Ford and in other areas of Texas, its production will soar to 4 million barrels per day by 2015 – a 53% increase in two years.

Why the Eagle Ford Is Attracting Big Oil

Giant oil companies are pouring billions of dollars into developing the Eagle Ford. According to Oil and Gas Investor, an industry publication, major international oil companies spent $19.3 billion on Eagle Ford acquisitions since 2010. Those companies included China's CNOOC, the Korea National Oil Corporation, and Japanese conglomerate Marubeni Corp.

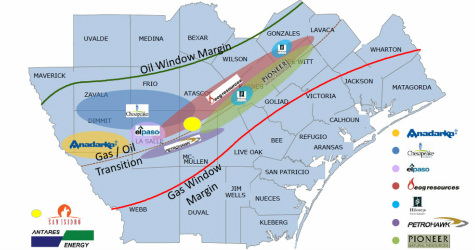

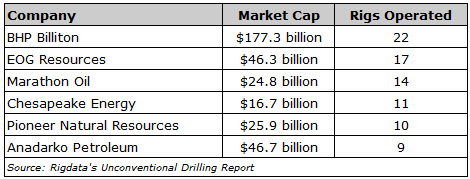

Reliance Industries, an Indian oil company, spent $1.3 billion to become a joint venture partner with mid-tier firm Pioneer Natural Resources. Here are the top operators in the Eagle Ford, by drilling rigs operated:

Giant oil companies are pouring billions of dollars into developing the Eagle Ford. According to Oil and Gas Investor, an industry publication, major international oil companies spent $19.3 billion on Eagle Ford acquisitions since 2010. Those companies included China's CNOOC, the Korea National Oil Corporation, and Japanese conglomerate Marubeni Corp.

Reliance Industries, an Indian oil company, spent $1.3 billion to become a joint venture partner with mid-tier firm Pioneer Natural Resources. Here are the top operators in the Eagle Ford, by drilling rigs operated:

Oil companies are moving into the Eagle Ford for three reasons

First, Eagle Ford oil is "light and sweet." It's low in sulfur, and refiners can make more diesel and gasoline with it. So it sells at a premium to the U.S. benchmark West Texas Intermediate crude price.

Second, it's easy to move the oil. If you can't get your product to buyers, it's not worth much. But the Eagle Ford is close to both Houston and the port of Corpus Christi. In other words, producers have options: They can pipe the oil to Houston refineries or ship it to refineries on the East Coast of the U.S., depending on who's paying the best price.

The third benefit to Eagle Ford producers is that the rocks are "de-risked."

Exploring for oil isn't like operating in other industries. It's almost impossible to build a McDonald's and lose all the money you invested. But it happens all the time in oil exploration. Every time a producer drills a well, there's a chance it'll lose all its capital. But drilling in the Eagle Ford is a lot closer to building a fast-food joint. We know the rocks hold oil... a lot of oil.

Thanks to new technology, some wells can produce 10 times the volume of oil they did just four years ago. Independent oil company EOG now routinely drills wells that produce 2,015 barrels of oil equivalent per day to start... up from roughly 150 barrels per day a few years ago. Even more important is a trend called "downspacing."

A conventional oilfield is like a pitcher of water. The more straws in it, the faster the oil level goes down. But in the Eagle Ford, the oil is held in a relatively small section of rock. Each well is its own small "pitcher." Wells can be much closer together before they begin to suck out the same oil.

In short, companies can drill more wells – and double or triple the amount of oil they produce – without spending money on new land.

In the early days of drilling in the Eagle Ford, companies spaced their wells about 240 acres apart. In other words, they separated wells by nearly 2,000 feet. But Eagle Ford wells didn't need 240 acres. So engineers downsized to 120 acres – about 990 feet between the wells. Even that was too much. Some operators are down to 40 acres... just 330 feet between the wells.

In other words, you can fit six wells in the area you would have put two wells in before. That has two huge implications for the Eagle Ford and for Texas.

Let me use a real example from Penn Virginia, a small oil and gas producer in the Eagle Ford. It used to use 128-acre spacing – about 1,155 feet between its wells. It cut that down to roughly 53-acre spacing, which is about 400 feet between the wells. Oil recovery went up from 3,600 barrels per acre to 8,125 barrels per acre. The value of the land more than doubled, from about $65,000 an acre to $148,000. There is another huge benefit to downspacing.

The Eagle Ford's oil reserves – oil that we know can be produced economically at the current oil price – increased from 133 million barrels in 2009 to 1.1 billion barrels in 2011 (the latest data available). That's a 760% increase in just two years.

This kind of growth is going to mean huge returns for the big producers in the area... and even bigger returns for the small producers. I've found three excellent companies in the Eagle Ford "minor leagues" that look like fantastic buys right now.

Over the next two to three years, their production is going to grow tremendously. That's going to translate into much higher share prices and there's a real possibility that a larger oil company will simply buy them out for their acreage at a big premium. More on that in a minute. First, let me introduce the companies...

Eagle Ford Opportunity No. 1

Sanchez Energy (NYSE: SN) is a $1.2 billion Houston-based junior oil company. Sanchez has acreage in the Haynesville Shale in Louisiana... in the western extension of the Heath, Bakken, and Three Forks trend in Montana... and in the Tuscaloosa Marine Shale in Louisiana and Mississippi. But with 140,000 net acres in the Eagle Ford (78% of its total), Sanchez stands to benefit from the play's enormous growth. ("Net acres" takes into account areas where Sanchez owns a percentage of the land, not the whole thing.)

As of June 30, Sanchez had $252 million in cash and $400 million of debt. Debt and share count will increase, thanks to some recent acquisitions. But the acquisitions grew the company's presence in the Eagle Ford. The company has significant insider ownership: The father-son duo that runs the company holds nearly 8% of its shares. That puts management's interests in line with our own.

Sanchez has proved reserves of 54 million barrels of oil equivalent (BOE): 79% oil and 21% natural gas. At the end of 2012, the company produced 1,874 BOE per day. In June, the company produced 7,726 barrels of oil per day. By the end of 2013, production should be close to 17,000 barrels per day. That's exactly the kind of growth we want to see. Sanchez plans to drill a lot of wells in 2014 as well, so the growth should continue through all of next year.

With that growth, this stock could double by this time next year

In the first six months of 2013, the company generated $90 million in oil and gas revenue. When we use the company's "enterprise value," which takes debt and cash into account, we get a "price to oil revenue" ratio of 7.4.

The company's oil and gas production should hit 6.2 million BOE over the next year. At today's oil and gas prices, that would generate about $521 million in oil revenue. At 7.4 times revenue, I conservatively estimate the company's shares would trade for $79.59 each. That's a gain of 195%.

Action to Take: Buy Sanchez Energy (NYSE: SN) up to $30 per share and use a 33% trailing stop.

This is a small company and can be volatile. We'll use a wider trailing stop to account for that. With a wider trailing stop, we recommend a smaller position size.

Eagle Ford Opportunity No. 2

Carrizo Oil & Gas (Nasdaq: CRZO) is a $1.5 billion Houston-based oil and gas producer. Carrizo produces oil and gas in the Eagle Ford (54,500 net acres), the Niobrara Shale in Colorado (40,800 net acres), and the Marcellus Shale in Pennsylvania (49,200 net acres). It also has an emerging growth play in the Utica Shale in Ohio (15,500 net acres).

Carrizo recently sold its assets in the Barnett Shale in Texas and other non-core assets. The sale let Carrizo focus its efforts on the four shales above. The sales brought in $268 million, too, which will pay down some of its $928 million in debt. Carrizo has major oil-company partners in Lanzhou Haimo Technologies, OIL India, Reliance Industries, and Avista Capital Partners.

In the Eagle Ford, it made a joint venture with Indian oil company GAIL in September 2011. GAIL paid $63.7 million in cash. In addition, it agreed to pay $31.4 million in drilling and completion costs. GAIL receives 20% of the production. That's a modest joint venture, but the extra cash will help Carrizo complete more wells. Carrizo has proved reserves of 64 million BOE.

Oil production should increase by at least 57% by the end of 2013. Carrizo is running three rigs in the Eagle Ford in 2013. Its second-quarter production set a record of 28,187 BOE per day. That's up 6% from the first quarter of 2013.

In the first six months of 2013, Carrizo generated $236 million in oil and gas revenue. Using enterprise value again, we get a "price to oil revenue" ratio of 5.3. The company's oil and gas production growth should put it close to 36,000 BOE per day in 2014. At today's oil and gas prices, that would generate about $687 million in revenue. At 5.3 times revenue, the company's shares would trade for $56.78 each. That's a gain of 46%.

We're being conservative here. Carrizo has 17.5 wells it drilled that haven't been completed for production. It's likely that Carrizo will drill and complete more wells in 2014... which would mean more revenue than we're predicting... which should translate to an even higher share price.

Action to Take: Buy Carrizo Oil and Gas (Nasdaq: CRZO) up to $40 per share and use a 33% trailing stop.

Like with Sanchez, we'll use a wider trailing stop. Use a smaller position size.

Eagle Ford Opportunity No. 3

Penn Virginia Corporation (NYSE: PVA) is a $430 million Pennsylvania-based oil and gas producer. Penn Virginia was historically a gas-focused company. But it is in the process of changing itself into an oil producer. In 2011, Penn Virginia's oil production generated just 40% of its revenue. In 2013, 80% of its revenue will be from oil.

The change is a result of its Eagle Ford acquisitions: In 2010, Penn Virginia owned 6,800 net acres in the Eagle Ford. Today, it owns 62,300 net acres there. It also owns acreage in eastern Texas, Oklahoma, Mississippi, and the Marcellus Shale in Pennsylvania. But two-thirds of its production comes from the Eagle Ford.

First, Eagle Ford oil is "light and sweet." It's low in sulfur, and refiners can make more diesel and gasoline with it. So it sells at a premium to the U.S. benchmark West Texas Intermediate crude price.

Second, it's easy to move the oil. If you can't get your product to buyers, it's not worth much. But the Eagle Ford is close to both Houston and the port of Corpus Christi. In other words, producers have options: They can pipe the oil to Houston refineries or ship it to refineries on the East Coast of the U.S., depending on who's paying the best price.

The third benefit to Eagle Ford producers is that the rocks are "de-risked."

Exploring for oil isn't like operating in other industries. It's almost impossible to build a McDonald's and lose all the money you invested. But it happens all the time in oil exploration. Every time a producer drills a well, there's a chance it'll lose all its capital. But drilling in the Eagle Ford is a lot closer to building a fast-food joint. We know the rocks hold oil... a lot of oil.

Thanks to new technology, some wells can produce 10 times the volume of oil they did just four years ago. Independent oil company EOG now routinely drills wells that produce 2,015 barrels of oil equivalent per day to start... up from roughly 150 barrels per day a few years ago. Even more important is a trend called "downspacing."

A conventional oilfield is like a pitcher of water. The more straws in it, the faster the oil level goes down. But in the Eagle Ford, the oil is held in a relatively small section of rock. Each well is its own small "pitcher." Wells can be much closer together before they begin to suck out the same oil.

In short, companies can drill more wells – and double or triple the amount of oil they produce – without spending money on new land.

In the early days of drilling in the Eagle Ford, companies spaced their wells about 240 acres apart. In other words, they separated wells by nearly 2,000 feet. But Eagle Ford wells didn't need 240 acres. So engineers downsized to 120 acres – about 990 feet between the wells. Even that was too much. Some operators are down to 40 acres... just 330 feet between the wells.

In other words, you can fit six wells in the area you would have put two wells in before. That has two huge implications for the Eagle Ford and for Texas.

Let me use a real example from Penn Virginia, a small oil and gas producer in the Eagle Ford. It used to use 128-acre spacing – about 1,155 feet between its wells. It cut that down to roughly 53-acre spacing, which is about 400 feet between the wells. Oil recovery went up from 3,600 barrels per acre to 8,125 barrels per acre. The value of the land more than doubled, from about $65,000 an acre to $148,000. There is another huge benefit to downspacing.

The Eagle Ford's oil reserves – oil that we know can be produced economically at the current oil price – increased from 133 million barrels in 2009 to 1.1 billion barrels in 2011 (the latest data available). That's a 760% increase in just two years.

This kind of growth is going to mean huge returns for the big producers in the area... and even bigger returns for the small producers. I've found three excellent companies in the Eagle Ford "minor leagues" that look like fantastic buys right now.

Over the next two to three years, their production is going to grow tremendously. That's going to translate into much higher share prices and there's a real possibility that a larger oil company will simply buy them out for their acreage at a big premium. More on that in a minute. First, let me introduce the companies...

Eagle Ford Opportunity No. 1

Sanchez Energy (NYSE: SN) is a $1.2 billion Houston-based junior oil company. Sanchez has acreage in the Haynesville Shale in Louisiana... in the western extension of the Heath, Bakken, and Three Forks trend in Montana... and in the Tuscaloosa Marine Shale in Louisiana and Mississippi. But with 140,000 net acres in the Eagle Ford (78% of its total), Sanchez stands to benefit from the play's enormous growth. ("Net acres" takes into account areas where Sanchez owns a percentage of the land, not the whole thing.)

As of June 30, Sanchez had $252 million in cash and $400 million of debt. Debt and share count will increase, thanks to some recent acquisitions. But the acquisitions grew the company's presence in the Eagle Ford. The company has significant insider ownership: The father-son duo that runs the company holds nearly 8% of its shares. That puts management's interests in line with our own.

Sanchez has proved reserves of 54 million barrels of oil equivalent (BOE): 79% oil and 21% natural gas. At the end of 2012, the company produced 1,874 BOE per day. In June, the company produced 7,726 barrels of oil per day. By the end of 2013, production should be close to 17,000 barrels per day. That's exactly the kind of growth we want to see. Sanchez plans to drill a lot of wells in 2014 as well, so the growth should continue through all of next year.

With that growth, this stock could double by this time next year

In the first six months of 2013, the company generated $90 million in oil and gas revenue. When we use the company's "enterprise value," which takes debt and cash into account, we get a "price to oil revenue" ratio of 7.4.

The company's oil and gas production should hit 6.2 million BOE over the next year. At today's oil and gas prices, that would generate about $521 million in oil revenue. At 7.4 times revenue, I conservatively estimate the company's shares would trade for $79.59 each. That's a gain of 195%.

Action to Take: Buy Sanchez Energy (NYSE: SN) up to $30 per share and use a 33% trailing stop.

This is a small company and can be volatile. We'll use a wider trailing stop to account for that. With a wider trailing stop, we recommend a smaller position size.

Eagle Ford Opportunity No. 2

Carrizo Oil & Gas (Nasdaq: CRZO) is a $1.5 billion Houston-based oil and gas producer. Carrizo produces oil and gas in the Eagle Ford (54,500 net acres), the Niobrara Shale in Colorado (40,800 net acres), and the Marcellus Shale in Pennsylvania (49,200 net acres). It also has an emerging growth play in the Utica Shale in Ohio (15,500 net acres).

Carrizo recently sold its assets in the Barnett Shale in Texas and other non-core assets. The sale let Carrizo focus its efforts on the four shales above. The sales brought in $268 million, too, which will pay down some of its $928 million in debt. Carrizo has major oil-company partners in Lanzhou Haimo Technologies, OIL India, Reliance Industries, and Avista Capital Partners.

In the Eagle Ford, it made a joint venture with Indian oil company GAIL in September 2011. GAIL paid $63.7 million in cash. In addition, it agreed to pay $31.4 million in drilling and completion costs. GAIL receives 20% of the production. That's a modest joint venture, but the extra cash will help Carrizo complete more wells. Carrizo has proved reserves of 64 million BOE.

Oil production should increase by at least 57% by the end of 2013. Carrizo is running three rigs in the Eagle Ford in 2013. Its second-quarter production set a record of 28,187 BOE per day. That's up 6% from the first quarter of 2013.

In the first six months of 2013, Carrizo generated $236 million in oil and gas revenue. Using enterprise value again, we get a "price to oil revenue" ratio of 5.3. The company's oil and gas production growth should put it close to 36,000 BOE per day in 2014. At today's oil and gas prices, that would generate about $687 million in revenue. At 5.3 times revenue, the company's shares would trade for $56.78 each. That's a gain of 46%.

We're being conservative here. Carrizo has 17.5 wells it drilled that haven't been completed for production. It's likely that Carrizo will drill and complete more wells in 2014... which would mean more revenue than we're predicting... which should translate to an even higher share price.

Action to Take: Buy Carrizo Oil and Gas (Nasdaq: CRZO) up to $40 per share and use a 33% trailing stop.

Like with Sanchez, we'll use a wider trailing stop. Use a smaller position size.

Eagle Ford Opportunity No. 3

Penn Virginia Corporation (NYSE: PVA) is a $430 million Pennsylvania-based oil and gas producer. Penn Virginia was historically a gas-focused company. But it is in the process of changing itself into an oil producer. In 2011, Penn Virginia's oil production generated just 40% of its revenue. In 2013, 80% of its revenue will be from oil.

The change is a result of its Eagle Ford acquisitions: In 2010, Penn Virginia owned 6,800 net acres in the Eagle Ford. Today, it owns 62,300 net acres there. It also owns acreage in eastern Texas, Oklahoma, Mississippi, and the Marcellus Shale in Pennsylvania. But two-thirds of its production comes from the Eagle Ford.

|

The company has $19 million in cash and $1.1 billion in debt. The high debt levels make Penn Virginia a higher-risk trade but the company is working to reduce the debt levels.

John Brooks, Senior Vice President of the Gulf Coast Division of Penn Virginia, addressed this topic at the DUG Conference. The company owns over 100 miles of pipelines in the Eagle Ford area and it's planning to sell them. Recent deals for similar assets ranged from $100 million to $325 million. Penn Virginia has proved reserves of 125 million BOE. In the second quarter, it produced 19,200 BOE per day. Penn Virginia is also working on reducing the distance between wells. The earlier wells were spaced at 128 acres. The new wells are spaced at 53 acres. The difference in spacing means the company drills 14 wells where it was drilling five in the past. Penn Virginia generated $192 million in oil and gas revenue in the first six months of 2013. Using enterprise value again, we get a "price to oil revenue" ratio of 4.1. Assuming the company spends $400 million on development, it should hit 5.9 million barrels of production over the next year. At today's oil and gas prices, that would generate about $623 million in oil revenue. At four times revenue, the company's shares would trade for $10.91 each. That's a gain of 63%. We're taking on a little extra risk with Penn Virginia for the chance at much bigger gains. Action to Take: Buy Penn Virginia Corp. (NYSE: PVA) up to $7 per share and use a 33% trailing stop. You should reduce your position to account for the wider trailing stop. |