|

______________________________Special Report

The Consumer Price Index (CPI) recently announced inflation was at 1.4%. But that's a lie. They rig the inflation-calculating formula to keep it artificially low. According to the CPI, milk prices haven't changed in 5 years. That's not true at my grocery store and I bet it isn't at yours. If you were to truly calculate inflation, it would be a whopping 9.2%! The government lies so you won't freak out. Don't freak out.

|

|

The Government Wants You to Think

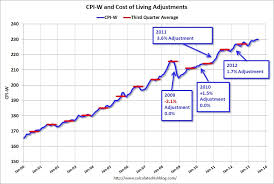

Inflation Is Just 1.4% But It’s More Like 9.2% and Here’s Why If you listen to the bureaucrats in Washington, inflation is nothing to worry about. The latest reading by the Bureau of Labor Statistics was just 1.4%—a non-issue. I don’t think that’s even close to the truth. When you’re buying groceries or filling up your gas tank, it’s obvious that prices are rising a lot faster than 1.4% a year. Anyone who eats, drives a car or buys insurance can tell you that. Bottom line, I’m convinced that inflation is a much bigger problem than the Consumer Price Index suggests. Fact is, the CPI doesn’t even measure inflation anymore. And that’s because the CPI is no longer a price index—it is a “cost of living” index, and the government admits it. Most people have no idea, but the BLS is constantly tinkering with the formula it uses to calculate inflation. If we were still using the formula the BLS relied on in the 1980s, the current inflation rate would be 9.2%. The formula from the 1990s would yield 4.9% inflation right now. Only by using the government’s current rosier methodology do we get a reading of 1.4%. The game wasn’t always rigged this way. Originally, the CPI was determined by comparing the price of a fixed basket of goods and services at two points in time. So there was no way to fudge it. But Congress has decided that the CPI should reflect the cost of maintaining a standard of living. So the statisticians now account for “substitution.” In other words, if the price of steak goes up and people eat more Spam instead, then they reduce the weight of steak prices in the CPI formula. By this logic, if the cost of back surgery shoots up and people who can’t afford it pop aspirin to deal with the pain, they have “substituted” aspirin for surgery. Since the price of aspirin hasn’t risen, then by the magic of the CPI, there has been no inflation! Think about it: The politicians and bureaucrats who create inflation in the first place also get to decide how to measure it. If that’s not a conflict of interest, I don’t know what is. According to the government, the price of milk hasn’t changed in five years. Yet I know for a fact that I pay more for a gallon of milk than I did five years ago. It gets even more absurd when you look at “core CPI,” which is supposed to measure long-term trends in inflation. Core CPI excludes food costs. If you can find a substitute for food, let me know. It’s Time to Defend Yourself If we were just talking about abstract statistics, I wouldn’t care. But this deception is doing real harm to millions of Americans. These phony low-ball CPI numbers not only shortchange anyone who receives payments tied to the cost of living, but they’re hiding a cancer in our economy that will eat away at every asset you own. Inflation is a money disease. Its symptom is rising prices and its cause is a weak currency. Debt is the destroyer of a currency’s health. Our politicians have hung a $16 trillion yoke of debt around our necks. Like a taxi meter spinning faster and faster, we are slipping $3.9 billion deeper into the hole every day—at a rate of $163 million per hour. |

|

Your mortgage is a powerful inflation fighter itself. Being owed money is a bad thing under inflation, but owing it to others is a great idea. Over time, the value of your debt shrinks in real terms. In other words, the dollar value of the house will go up with inflation, but the mortgage won’t. That’s bad for the bank, but great for you. |

|

Warning: The Old Inflation Fighters Don’t Work Anymore

There is a lot of investment folklore about what will and won’t protect you against inflation and anyone clinging to the old ways of inflation protection may be in for a rude awakening. Traditional safe-haven assets are no longer acting as they are “supposed” to. For example… Cash no longer saves you—T-bills and money market funds used to yield enough to stay ahead of inflation. The return on these cash-equivalents was almost always several percentage points above inflation from 1960 to 1990. That’s not true anymore. For most of the past decade, cash has paid less than inflation, because central banks are holding rates down in face of the financial crisis. |

|

Stocks are unreliable inflation protectors—Many companies can raise the price of their products to keep pace with rising costs. So corporate profits generally adjust for inflation but their stock prices don’t always follow suit because P/E ratios tend to drop during periods of high inflation.

During the inflationary 1970s, the S&P rose an average of 4.4% a year, while inflation averaged 7.3%. Yes, stock owners also got dividends, but by 1980 their principal was worth only 74% of the value it held at the start of 1970. The problem is that high inflation usually coincides with tough economic times; and those are bad times to own many types of stocks. TIPS don’t pay—Treasury Inflation-Protected Securities sound great on the surface. In addition to paying interest, their face value increases with inflation. So if you buy one of these bonds for $1,000, and inflation goes up by 60% over the 10 years until it matures, you will get $1,600 when you redeem it but that guarantee comes at a steep cost. TIPs pay next to nothing in interest. (Rates were actually negative for 18 months until popping back into the plus column just recently.) |

So you get the real value of your money back, and essentially nothing else. Another problem with TIPS is that

they’re tied to the CPI, which does a lousy job of tracking the real inflation rate.

they’re tied to the CPI, which does a lousy job of tracking the real inflation rate.

|

Even gold won’t save you—In the past, gold was a reliable inflation protector. The real value of gold doubled in the past 30 years with prices skyrocketing in the past decade.

But the good times may be over—not only for gold bulls but also for anyone who simply needs to protect themselves from a sinking dollar. The price of gold flat-lined for most of 2012, before falling off a cliff and shedding 35% from its 2011 highs—even as inflation is ticking up. |

The problem with gold is that it has become a speculative bet on global risk, not just as a store of value.

When the global financial crisis had investors wondering if the entire capitalist system was going the way

of the dodo, they flocked to gold. Now that growth is returning, money is flowing out of the metal, keeping

gold prices stagnant even in the face of higher expectations for inflation.

It’s Time to Build Your First Line of Defense

There shouldn't be a big inflation move in the next 12 months, because the Fed is going through a policy

transition right now. However, within a year the Fed will have to start pulling money out of the system.

I’ll bet my bottom dollar that the Fed is going to be too slow to start that procedure. (As we’ve seen, the Fed

isn’t exactly Johnny-on-the-spot when it comes to curtailing excesses, bubbles and booms.) The dollar will

start dropping fast and that’s when inflation will kick in. Since all commodities are priced in dollars, prices

will shoot up.

It’s hard to know exactly when inflation will accelerate, because we’ve never seen a period exactly like what

we’re facing today. There is no real parallel. Never before has a central bank pumped so much money into

an economy.

History does show that whenever a country prints even half as much money as the U.S. has and artificially

keeps interest rates near lows for years, the end result is inflation. If you’ve never invested when inflation is

high, it’s a tough slog. Just ask anyone who tried it during the 1970s.

Inflation hurts everyone, rich and poor alike. If you have a $1 million nest egg, every percentage-point rise in

inflation rips $10,000 from your true wealth. You’ll still have $1 million in the bank but it will only spend like

$990,000. Imagine what will happen if inflation leaps by five… six… or even seven points. It’s not a pretty

picture.

If you’ve been earning 5% on your money, that’s $50,000 per year you can spend without touching your

principal. That could be crucial to maintaining your standard of living.

Except that inflation is already eating away the purchasing power of your money. Even at just 3%, that

$50,000 of income you count on is actually worth only $48,500 when you spend it at the end of the year.

And it will only be worth $32,804 10 years from now.

How to Survive Inflation—and Thrive Instead

You can’t stop inflation. But you can survive it—and even thrive if you take the right steps. There are ways

to turn this threat into an opportunity and a handful of investment options that not only protect your

money but that can actually make you richer as prices rise.

To touch on just a few, I recommend looking into some international REITs, Japanese real estate companies,

foreign currency ETFs, some U.S. blue chip stocks and price-elastic exporters who can raise their prices

at will. If you play your cards right, you could build a large amount of wealth. Otherwise, you’ll end up like

most people, finding your wealth decimated.

There are other painless ways to position yourself for a spike in inflation, including…

* Floating-rate loans. If inflation spikes, it’s okay, because when inflation jumps, interest rates usually do,

too.

* Timber ETFs. Timber usually does well during moderate inflation and can be a big winner when inflation

surges. Historically, timber and land stocks outperform during inflationary times.

* High-yielding stocks from commodity-rich countries such as Australia, Brazil and Canada. A host of

ETFs invest in countries that rely on commodities that should do well as inflation increases.

* Real estate. It made plenty of millionaires in the inflationary 1970s. Housing has historically held its

value against inflation. What’s more, it gives you shelter while it appreciates, especially if it’s priced in

other currencies.

Even better, you can finance a house at rates as low as you’re ever likely to find, even before you factor in

the favorable tax treatment.

The dollar has steadily eroded in value for many, many decades. A dollar from 1942 is now worth seven cents.

Do you honestly think that with years of deficit spending still ahead, our dollar is suddenly going to reverse

course and get stronger instead of weaker? Don't go running for the hills and putting everything in gold like

the broken-clock advisors who’ve been beating the inflation drum for decades now.

Let’s recap…

Every time liquidity has been pumped into the system, like today, inflation has always followed. The only

reason it hasn’t surged already is because our economy is so slack. When the economy turns up, inflation

will hit hard, as it always has.

And there won’t be any grand announcement when it strikes. Most folks will just look back one day, as they

analyze their shrinking portfolio, and realize that inflation slowly ate away a good portion of their wealth.

Please don’t make the mistake of ignoring it, hoping it will pass. A lot of people will stick their heads in the

sand, realizing too late that they should have done something when they had the chance.

Don’t let that happen to you. Don't do anything and allow Washington to destroy all of your savings.

Protect yourself from out-of-control government spending. Turn the problem on its head and make some

money off it instead.

When the global financial crisis had investors wondering if the entire capitalist system was going the way

of the dodo, they flocked to gold. Now that growth is returning, money is flowing out of the metal, keeping

gold prices stagnant even in the face of higher expectations for inflation.

It’s Time to Build Your First Line of Defense

There shouldn't be a big inflation move in the next 12 months, because the Fed is going through a policy

transition right now. However, within a year the Fed will have to start pulling money out of the system.

I’ll bet my bottom dollar that the Fed is going to be too slow to start that procedure. (As we’ve seen, the Fed

isn’t exactly Johnny-on-the-spot when it comes to curtailing excesses, bubbles and booms.) The dollar will

start dropping fast and that’s when inflation will kick in. Since all commodities are priced in dollars, prices

will shoot up.

It’s hard to know exactly when inflation will accelerate, because we’ve never seen a period exactly like what

we’re facing today. There is no real parallel. Never before has a central bank pumped so much money into

an economy.

History does show that whenever a country prints even half as much money as the U.S. has and artificially

keeps interest rates near lows for years, the end result is inflation. If you’ve never invested when inflation is

high, it’s a tough slog. Just ask anyone who tried it during the 1970s.

Inflation hurts everyone, rich and poor alike. If you have a $1 million nest egg, every percentage-point rise in

inflation rips $10,000 from your true wealth. You’ll still have $1 million in the bank but it will only spend like

$990,000. Imagine what will happen if inflation leaps by five… six… or even seven points. It’s not a pretty

picture.

If you’ve been earning 5% on your money, that’s $50,000 per year you can spend without touching your

principal. That could be crucial to maintaining your standard of living.

Except that inflation is already eating away the purchasing power of your money. Even at just 3%, that

$50,000 of income you count on is actually worth only $48,500 when you spend it at the end of the year.

And it will only be worth $32,804 10 years from now.

How to Survive Inflation—and Thrive Instead

You can’t stop inflation. But you can survive it—and even thrive if you take the right steps. There are ways

to turn this threat into an opportunity and a handful of investment options that not only protect your

money but that can actually make you richer as prices rise.

To touch on just a few, I recommend looking into some international REITs, Japanese real estate companies,

foreign currency ETFs, some U.S. blue chip stocks and price-elastic exporters who can raise their prices

at will. If you play your cards right, you could build a large amount of wealth. Otherwise, you’ll end up like

most people, finding your wealth decimated.

There are other painless ways to position yourself for a spike in inflation, including…

* Floating-rate loans. If inflation spikes, it’s okay, because when inflation jumps, interest rates usually do,

too.

* Timber ETFs. Timber usually does well during moderate inflation and can be a big winner when inflation

surges. Historically, timber and land stocks outperform during inflationary times.

* High-yielding stocks from commodity-rich countries such as Australia, Brazil and Canada. A host of

ETFs invest in countries that rely on commodities that should do well as inflation increases.

* Real estate. It made plenty of millionaires in the inflationary 1970s. Housing has historically held its

value against inflation. What’s more, it gives you shelter while it appreciates, especially if it’s priced in

other currencies.

Even better, you can finance a house at rates as low as you’re ever likely to find, even before you factor in

the favorable tax treatment.

The dollar has steadily eroded in value for many, many decades. A dollar from 1942 is now worth seven cents.

Do you honestly think that with years of deficit spending still ahead, our dollar is suddenly going to reverse

course and get stronger instead of weaker? Don't go running for the hills and putting everything in gold like

the broken-clock advisors who’ve been beating the inflation drum for decades now.

Let’s recap…

Every time liquidity has been pumped into the system, like today, inflation has always followed. The only

reason it hasn’t surged already is because our economy is so slack. When the economy turns up, inflation

will hit hard, as it always has.

And there won’t be any grand announcement when it strikes. Most folks will just look back one day, as they

analyze their shrinking portfolio, and realize that inflation slowly ate away a good portion of their wealth.

Please don’t make the mistake of ignoring it, hoping it will pass. A lot of people will stick their heads in the

sand, realizing too late that they should have done something when they had the chance.

Don’t let that happen to you. Don't do anything and allow Washington to destroy all of your savings.

Protect yourself from out-of-control government spending. Turn the problem on its head and make some

money off it instead.