|

______________________________Special Report

It's so simple... so easy... and it can dramatically increase your investment returns. Yet most people don't do it. Heck, I know I have trouble doing it. Still, I know it works because when I manage to do it, I've made a lot of money! So what is it? And are you capable of doing it too?

|

|

One Simple Thing You Can Do to Dramatically Increase Your Returns

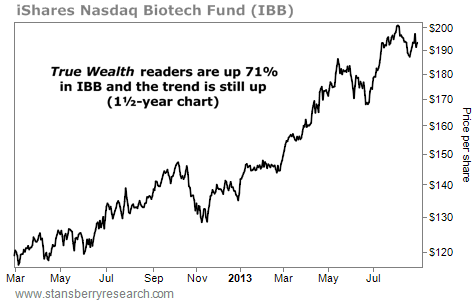

By Dr. Steve Sjuggerud All I'm talking about is simply sticking with a good trade... and not selling too early. You need to keep holding a winning trade until you're really uncomfortable still holding it. This is where you make the big money. Here's what you need to understand: Trends in financial assets tend to go on for much longer than you can possibly imagine. So to make big money, you need to stay with a good trend much longer than you feel comfortable doing. Let me show you an example... Biotech stocks have done nothing but go up for years now. Thankfully, my readers have been in the trade. We're up, A LOT, and we're still in. For example, in my newsletter, we bought the biotech sector through the iShares Nasdaq Biotech Fund (IBB). So far, we’re sitting on a 71% gain in less than two years. Take a look: Let's also cover what a downtrend is. Below is the downtrend in the share price of newspaper giant Gannett, which publishes USA Today. This chart shows Gannett was in a downtrend from 2005 through 2008.

the smart speculator waits for the safe to hit the ground. He waits for the chart to look like this...

Even though we're up from $113 to $193, we're still in the trade. I'm sure some folks would take their profits here. They'd say, "You can't go broke taking profits." But you could have said that any time over the last two-year bull market. And thinking like that will limit you to mediocre returns. So we're going to stay in the biotech trade until our stop loss forces us out.

In order to make real money in stocks – and most assets – you need to be able to stick with a good trade on the way up, even when it feels uncomfortable. Trust me on this. You can dramatically increase your investment returns... if you can simply do this one thing. It's worth repeating: Trends in financial assets tend to go on for much longer than you can possibly imagine. That's one "truth" that has proven itself over and over in my career. Don't forget it. And use it to your advantage. Stay in that trade longer than is comfortable. I can't overestimate the power of this one idea in making money. Go with me on this... Always maintain a stop loss. But don't cut out early. You have to believe you'll make a lot more money in your investments than you already are. Anaconda Trading | Options, Trading, and Short-Term Investing

An Interview With Dr. David Eifrig As a former professional trader, "Doc" (as we like to call him) is an expert at finding low-risk, high-reward investment opportunities safe enough for even the most risk-averse investor. Below, Doc shares one of his favorite investment strategies... a "big" idea responsible for some of his most successful trades. Whether you're just getting started with investing or on the verge of retirement, this idea could dramatically increase your returns while saving you a huge amount of time and money. Stansberry & Associates: Doc, your advisories – Retirement Millionaire and Retirement Trader – are centered around an idea you call "anaconda trading." Can you define this idea for us? Dr. David Eifrig: Sure... First, "anaconda trading" doesn't pertain to a particular trading strategy. Instead, it's a framework to think about trading and investing. It's how many of the world's richest and most successful investors grow and protect their wealth. I realize it might seem like a silly comparison, but I've found the most useful way to describe this approach is in terms of the anaconda. Anacondas are the largest snakes in the world. And they're one of the deadliest, most efficient predators... but they don't hunt like most other animals. Anacondas don't "zip" around chasing after their prey. They don't get into long battles with them. In fact, they don't hunt in a traditional sense at all. Instead, they lie around in rivers for long periods of time. They wait for an unsuspecting animal to pass by or stop for a drink of water. Only then do they strike... by slowly wrapping themselves around the prey and holding on until the animal stops breathing. Then, with their large mouth, they swallow their prey whole. It's a unique strategy in nature. They're nature's "cheap shot" artists. Said another way, anacondas aren't interested in fair fights... They'll only strike when the odds are overwhelmingly on their side. They're "no risk" operators. And they take their time waiting for their prey and, once it's captured, waiting for the capture to pay off. Anacondas can grow to enormous size because they don't spend much time or energy chasing every animal that comes along. S&A: How do you apply this idea to investing? Eifrig: Well, that's how the world's best investors think about buying stocks, bonds, and commodities. They act only when the odds are heavily stacked in their favor. In a similar way, their portfolios can grow to enormous size because they're greatly reducing risk. If you begin to think about investing this way, you can avoid a huge amount of worry and wasted time, and set yourself up to make extraordinary returns. Like the anaconda, you can rest along the river bank until the right opportunity presents itself. S&A: Can you give us an example of how you've used this approach? Eifrig: Sure, a great example was in 2010 when bank analyst Meredith Whitney went on 60 minutes and predicted hundreds of billions of dollars of losses in the municipal bond market. Muni bonds collapsed in price, but I thought it was a major overreaction... the predictions were factually incorrect. So we were able to buy these bonds at a major discount with little risk, simply by waiting for a fantastic opportunity to come to us. And we made great, safe returns over the next several years. S&A: How about an example of how this idea applies to shorter-term trading? Eifrig: One of my favorite ways to use this idea for trading is to take advantage of spikes in volatility. The Volatility Index, also known as the "VIX" or "fear index," tends to rise as stocks fall and investors become more fearful. The VIX is also used to determine option prices... When volatility spikes, options become more expensive. Yet these periods of high volatility typically don't last long... and as any professional trader will tell you, most options expire worthless. So when we occasionally see a big spike in volatility, it often makes sense to sell – essentially short-sell – puts on stocks you'd like to own anyway. The ins and outs of selling puts are beyond the scope of this interview, but this is an ideal "anaconda" situation. One of the best examples of this is the stock crash of late 2008 and early 2009. Investors who were patient and prudent were able to collect a huge amount of low-risk income, and pick up some of the world's best companies at absurdly cheap prices. S&A: Are there any risks or hurdles with "anaconda trading?" Eifrig: Because it's a framework rather than a specific strategy, there aren't really risks in the traditional sense. Followed prudently, it can only help you. It's a simple idea, but it can be quite difficult for the novice investor to apply consistently. You'll learn patience and discipline. Few people are naturally wired with the patience required to be successful investors. In fact, it's often just the opposite. Many investors act as though frequent buying and selling is the ticket to huge wealth. But it's exactly this behavior that ensures the average investor will never build real wealth through investing. It doesn't help that Wall Street does all it can to encourage this behavior – that's where the commissions are made – and the financial media are constantly talking about the latest hot stock picks. For most people, this is something they have to work at... a skill they have to build. But it's one of the best things you can do to improve your investing and trading results immediately. I recommend everyone give it a try. S&A: Thanks for talking with us, Doc. Eifrig: You're welcome. Before You Sell a Single Share of Stock, Read This

By Dr. David Eifrig Imagine this simple scenario... Say you own two stocks. You bought each at $50 a share. Over the course of your investment, one has risen to $75 per share. The other has fallen to $25. Suddenly, you need to raise money. Perhaps a car you've wanted is on sale at the local dealer or a cabin on a lake where you want to retire is suddenly on the market. You need to raise some cash. You decide to sell one of your investments. But which stock do you sell? If you're like most people, you choose to "capture" your gains... sell the $75 winner and keep holding the $25 loser. You may think the loser stock seems to have more upside potential, and you've probably been waiting to "get even" on the position... It's a nearly universal impulse... but it's a terrible investing choice. We love to sell our winners too soon and ride our losers too long. A slew of behavioral finance studies show it. One, by University of California at Berkeley professor Terry Odean, found investors are almost twice as likely (1.7 times) to sell a winning stock as they are to sell a losing stock. Following similar logic (urges, really), investors held losing stocks for 124 days and unloaded their winning stocks after 102 days. But you may wonder, "Maybe the winning stock had grown overvalued and its gains were behind it." It turns out, the winning stocks (which had been sold) subsequently outperformed the losing stocks (which investors were still holding). It depends on what time frame you look at, but the general consensus is that over six- to eight-month periods, stocks that are moving up tend to keep moving up, and stocks that are falling keep falling. It's a phenomenon called "auto-correlation." This confirms the old adage: "Let your winners run and cut your losers short." OK... But how do you know when to cut your losers... and when your winners have had enough time to run? In other words, how do you know when to sell your stock? There's no single rule that will tell you when to sell... because there's no rule that tells you when to buy. The strategy for selling is determined by why you bought in the first place – and should be determined at the time of your initial investment. It's critical when you buy to know exactly what you expect to get out of the investment and what would lead you to sell. So when I buy stocks, I do three things: 1. I write down WHY I bought it. 2. I write down WHEN I'll sell it. 3. I review my investment at least once a year (but preferably every six months). One trick I use when I'm deciding whether to sell a stock is to ask myself whether I'd buy more right now or recommend it to friends or family members. If the answer is no, it's probably time to sell. And in my newsletter, I recommend 25% trailing stops with our stock investments. We sell if the stock falls that far from its high point during our holding period. Trailing stops are a simple, easy-to-understand way to eliminate your emotions and get out of losing positions before they get too large. If I'm really worried that I'm making a mistake selling a stock, I remind myself that I can always open a new position after a 30- or 60-day break. There's nothing magical about the time frame. It just serves as a cooling-off period for my emotions. Most likely, a good investment will still be attractive at that point. And in many cases, I've found better opportunities by then. Yesterday, stocks hit all-time highs. And if you're like most people, you're starting to worry. You're wondering if you should "take some money off the table." Before you let your emotions make the decision, consider whether you're making the common mistake of "capturing" gains. And think about putting a better plan in place. Here's to our health, wealth, and a great retirement, |