7.8% Yield Every Week

|

Amber Hestla has proven to be a creative and informed trader over the years. She shares with us a snapshot of her personal portfolio and options strategy. You want to know how people make so much money in the market and seem to have extraordinary returns? well trading options is how it's done. Of course, research and timing is a major part of the strategy but if executed correctly you can make a sizable return in a relatively short time frame. Aside from devising a long dividend strategy for my clients and my own portfolio, trading options is the primary strategy I employ. I do things a little differently than most but the results speak for themselves. To me, options aren't the hedge for an equity position but just the opposite. The equity positions are the perfect hedge for the options. I don't believe every trade should result in a premium but in that instance I will lock in on a covered position.

|

|

I'm Collecting A 7.8% Yield Every Week -- And So Can You

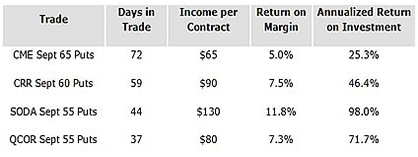

By Amber Hestla I'm Collecting a 7.8% Yield Every Week and So Can You! For the seventh month in a row, my options trades I've recommended have been profitable. How am I doing it? You see, every time I make a trade, I get "Instant Income." And when the options I use to make the trade expire worthless, that income is pure profit. My September contracts posted an annualized gain ranging from 25% to 98%. And, as I'll explain in a moment, I think the future holds even higher returns for option traders. So, in case you aren't familiar, how does my "Instant Income" strategy work? It involves one of the most misunderstood corners of the investing world. Many investors steer clear of options because they have a reputation for being risky, but that's not always the case. While it is a fact that 80% to 90% of options buyers lose money, there's a flip side. It means that 80% to 90% of options sellers (like me) make money. I've have closed 25 options trades and each one has been profitable. No trade has resulted in a loss. This is because, each week, I look for a low-risk income trade and only recommend trades when the probability of a win is very high. On the remote chance that we do end up owning shares, that's OK -- these are all stocks I am bullish on anyway. Below are the four recommendations I closed in September (you can view all of my closed trades here) |

|

The complete history of closed trades shows that I have enjoyed steady income trades since February. And I don't see anything in the current market environment that threatens this strategy.

On average, I have held positions for about six weeks. Our shortest trade lasted only nine days while the longest lasted 92. In the current environment, I expect to see positions that will be open for at least six weeks. So far, I've generated income averaging $81 a week per contract, and the average trade has required a margin of $1,040. Each week, I'm generating an average return of 7.8% on margin. Because we are looking at options that will expire six weeks or more after we write them, I am focused only on high-quality companies, and I want to sell the put at an exercise price that provides a big margin of safety. Questcor Pharmaceuticals (Nasdaq: QCOR) is a perfect example of that. This is a company with earnings of $3.73 in the past 12 months, and it is expected to grow earnings per share by 26% a year for the next five years. I believe QCOR should be trading at about $75 a share, which would be 13 times expected earnings for 2014. That's a conservative estimate. Until late last week, the market seemed to agree with me that QCOR is deeply undervalued. The stock gained 180% from its 2012 close to its 2013 high before selling off last week. I think we simply saw some profit-taking -- there was no news to explain the decline. Back in August, I recommended selling a put on QCOR with a strike price at $55 -- more than 20% below the market price at the time. Although the stock traded down toward the strike price, it closed above $55 on Sept. 20, and the puts were not exercised. If the puts had been exercised,I would have owned a growth stock at a bargain price with a P/E ratio of less than 10 based on next year's estimated earnings. Instead, readers who followed this trade earned $80 per contract for a 7.3% return on a margin deposit of $1,100 (remember, you can buy as many contracts as you want -- and scale up the amount of Instant Income you collect). I actually have mixed emotions about that put not being exercised. I believe QCOR will be a great income stock for years to come. I expect to see significant dividend increases every year for at least the next few years, and I would have been happy to own this stock. Although I came close, the margin of safety built into each trade recommendation prevented the put from being exercised. After the price decline, QCOR still offers higher-than-average option premiums. I believe the company is worth considering now for very aggressive investors, but I would like to wait to see if news related to the sell-off is released or I at least see a small consolidation pattern on the chart before we take a new position. A QCOR trade today would be exciting, but I don't believe in "excitement." I am analyzing these stocks from the perspective of an income investor. Each put option I recommend will have a high probability of expiring worthless, which means I expect the stock price to rise before the option expires. My objective is not to speculate on short-term stock market moves. Rather than looking for stocks that could deliver short-term gains, my recommendations will always be on stocks I expect to deliver the best income opportunities, and these stocks will often offer multiple opportunities to profit. The track record in the first 33 weeks is promising. Of course, there is no guarantee that I'll do this well in the future. However, this track record includes one of the most challenging times imaginable for options sellers. Options premiums rise in a falling market, and I have not yet had a chance to profit from that kind of environment. Since the initital trade, the S&P 500 has gone up more than 12%. The deepest sell-off in that time has been less than 8% and lasted less than five weeks. If I return to a more volatile market environment, it is possible that the Instant Income I earn from selling options could increase. Good investing! |