|

The Shale Story No One is Telling

"Investing is work. There is absolutely, positively no way around it, and in the end, you are on your own as an investor. Everyone in the financial industry is working for himself, so you need to watch out for your own money. Managing your own money is much simpler than most people think it is. The reason people think it's complicated is that Wall Street wants it that way. That's why you shouldn't ask fund managers or brokers about managing money. Instead, ask millionaires and billionaires who made their money buying and selling stocks, bonds, and real estate. They'll tell you what to do... and it'll actually work. If you can't ask one, read or listen to what winners like Warren Buffet, Jim Rodgers and others are doing in the market.

|

|

The Shale Story No One is TellingBy Teeka Tiwari

Geologists have made an astonishing discovery... Called “black rock” by some, it’s not coal, oil, or rare earths. Rather, it’s classified as a “mineral.” However you classify it, this is a major event—a seismic shift in the energy markets. You see, black rock is the Chinese version of shale gas. Yet unlike North American shale, it’s more than twice as plentiful and nearly twice as valuable. China’s black rock shale represents the world’s largest supply of clean-burning natural gas. The U.S. Department of Energy estimates that China could claim more than $5 trillion worth of energy. But there’s a huge roadblock between China and its $5 trillion payday. To access all this black rock, China needs the help of Western technology. I’ve uncovered two American companies poised to help China—and reap huge profits in the process. Today, I’m going to tell you everything you need to know about them. I’ll explain exactly what this situation means to you and how you can use China’s desperation to grow your money 5-8 times. Before I do that, let me give you a brief account of what is creating this unique investing opportunity. The Background on Black RockChina is choking to death on the coal fumes that have powered its industrial revolution for the last 40 years. This air pollution is a by-product of burning coal to run electrical plants. The cheapest way to generate energy in China has been burning coal. Using natural gas has been too expensive. But all that is about to change... You see, in the U.S., we have a glut of natural gas. This is due to the success of tapping into the gas trapped in our own shale formations. Because we have so much of it, the price of natural gas in America is very cheap. We pay only between $3 and $4 per million BTUs. (This stands for “British thermal units.” It’s the standard measurement for gas.) In China, there is no well-developed domestic natural gas industry. That’s why it has to pay $14-20 per million BTUs. The cost difference is staggering. So it’s had to use coal instead of gas to run its electrical generation plants. Anything else was too expensive. But the Chinese have discovered something... Tens of thousands of square miles of shale gas fields exist deep in China’s ground. And the nation is gearing up to be a domestic energy-producing powerhouse. We know this because the country already earmarked $98 billion to develop its own natural gas fields. It now has a mandate to start phasing out coal-fired electrical plants. But China is facing a huge roadblock in reaching this goal. In order to access all the shale gas under the ground, China needs technology that it currently does not possess. For instance, to find the shale, you have to employ sophisticated 3-D seismic imaging. This is a form of “ground X-ray” that peers into the earth. A shale expert then deciphers the image. That’s not all... In order to release the shale gas, you have to pump a high-pressure water and sand mixture to fracture the rocks. This enables the rocks to release the trapped gas. The process is commonly known as “fracking.” But unlike a traditional oil and gas well—where a drill is dropped into the ground like a big straw and the energy is simply “sucked” up—there is no “pool” to drill into with shale gas. You can’t drill straight down and start fracking. The water will simply shoot up the drill hole. So you have to drill horizontally. Because horizontal drilling is so new, the technical expertise to pull it off exists solely in the United States. This is because both fracking technology and horizontal drilling were created and perfected in the U.S. What all this means is China currently doesn’t have the technical knowledge and skill necessary to tap into its massive shale gas reserves. But China wants it... And that’s where our opportunity to profit from China’s shale boom lies. In this report, I will share with you the two companies that are sitting in the sweet spot of China’s shale boom. These companies have the technology, the contacts, and contracts with China to ride this boom for years to come. The smaller of the two is setting up for a multiyear run. As I’ll show you today, I believe that making six times your money is well within your grasp. The second company is about eight times larger. I’m confident this company will move at least 300% higher as its role in the China shale story plays out. I’m going to tell you everything you need to know about these two opportunities right now. Let’s dive right in... China Shale Boom Stock No. 1On October 26, 2012, a very curious event took place. China’s most prominent shale gas player made a puzzling move. It was so strange that I had to investigate further. This petroleum powerhouse took a 14.29% stake in a tiny Houston-based company’s oil and gas assets. The oil/gas field it bought into was the Niobrara Formation in Colorado. Two things made this unusual... One, it was the first-ever investment in an American oil and gas field by a private Chinese company. Two, the deal was tiny. In fact, the entire dollar value came in just a shade under $50 million. Now, $50 million might sound like a lot of money to you and me, but this is nothing for a huge oil and gas company. For example, ConocoPhillips is a huge oil exploration company. On December 6, 2013, it announced its 2014 capital expenditures budget. This simply means it announced how much money it plans to spend on new explorations for oil in 2014. The amount? $16.7 billion. $50 million is only 0.299% of ConocoPhillips’ exploration budget. That’s barely a blip on the radar. Now, you might be asking yourself the same thing I did when I first learned about this deal... On the surface, the answer would appear to be it’s because the Chinese company wants a toehold in the lucrative U.S. shale boom. That idea would make some sense. There are certainly massive amounts of money to be made. One recent report on the boom indicates that the shale explosion will raise U.S. GDP by about $70 billion each year... for the next several decades.

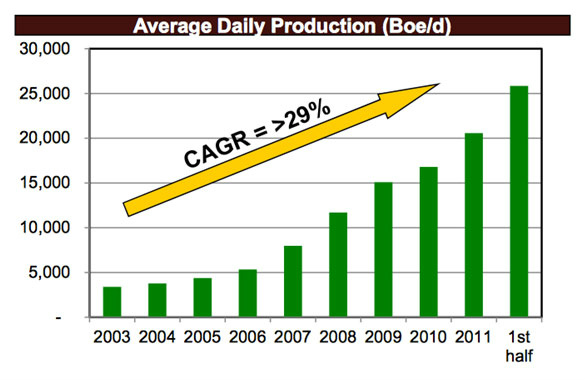

In other words, there’s tremendous wealth here. Especially for the companies that own the prime real estate. My first pick is one such company. This small Texas outfit owns some of the best acreage in America. For instance, consider some of the tracts of shale-rich land it owns: 53,000 acres in the Eagle Ford Formation in South Texas, 36,000 acres in Colorado’s Niobrara Formation, 80,000 acres in Pennsylvania’s Marcellus Shale Region, and 9,600 acres in the Barnett Formation in Fort Worth, Texas. Given all this, it makes sense that this Chinese company might have made its $50 million investment just to tap into these profits. But I’m about to tell you something I don’t think you’ll hear from anyone else... That’s not the real reason the Chinese made this deal. In fact, it’s just a smoke screen. Sure, this Chinese company would love to profit from its investment in U.S. shale fields. But that goal is secondary to its real reason for this partnership. What this deal is about—what it’s always been about—is the transfer of technology and technical knowledge. You see, as I explained earlier, hydraulic fracturing (fracking) and horizontal drilling are a uniquely American invention. No university teaches this technology. You have to go the fields of Barnett, Bakken, Marcellus, Eagle Ford, or Niobrara to learn this game. And even if you know how to conduct a fracking operation, you need a thoroughly trained workforce. Employees must have a deep understanding of 3-D seismic imaging, well placement, and horizontal drilling. If you don’t understand what any of this means, that’s okay. All you need to know is that successful fracking requires highly specialized technologies... that the Chinese don’t currently have. This is why the Chinese have invested in this tiny Houston energy player. It’s because these guys are experts in the interpretation of 3-D seismic imaging. They are experts in the placements of wells. They are experts on how to frack and drill horizontally. So just how good are they? Well, over the last year, they’ve drilled 133 wells. Guess how many of them have been successful... 100%. That’s how good these guys are. And that’s the real reason why this Chinese firm just partnered with them. It wants to learn as much as it can and export that expertise to its domestic “black rock” shale formations. Now, you might be asking: “This sounds like a great deal for the Chinese. But what’s in it for our small Houston energy company?” Money, lots and lots of money. I’ll explain how it all works... How Our First China Shale Company Is Going to BenefitThe first company I’m going to recommend is growing fast—and generating lots of profit. Earnings have exploded about 590% in the last 10 years. But there’s a problem... Even though this company is making tons of money, drilling is an expensive business. It eats up most of the cash this company generates. So the majority of those profits end up reinvested in new wells. For instance, each new well costs the company around $8 million. At this cost, it takes the well about 16 months to pay for itself (from the profits it generates once it’s up and running). If you’re sinking 100 holes per year, that gets expensive fast. And even worse, it puts a limit on how quickly a company is able grow. Think about it: How much cash a company has available for drilling will limit how many wells it can dig. For instance, if a company has only $8 million at its disposal (and a well costs $8 million to make), it can build only one well until more cash comes in, even if it wants to build more. But by that same logic, what if the company had access to more money? Wouldn’t it be able to dig more wells faster and grow at a quicker rate? Absolutely. Now, let’s apply this directly to our small Texas company. To get more working capital, it could go about it the traditional way—by borrowing money from a bank. But there’s a problem with this approach. You see, this company’s management is conservative. It doesn’t want to take on too much debt. High debt payments eat into company profits. What if there were another way? What if a group with lots of money were willing to come in? What if it were willing to shoulder much of the cost of new wells in exchange for a piece of the profits? I think you know where I’m going with this... Here’s the benefit to our tiny Texas firm: By partnering with the Chinese, it gets to shift more than 50% of its initial well costs to them. But it gets to keep 70% of the profits from those new wells. Let’s put some actual numbers on this... The construction of a new well costs around $8 million (but now our company has to put up only $4 million of that). Revenues from a new well will likely run about $11.9 million (at a conservative estimate of $85 per barrel). That means an estimated profit per well of about $3.9 million. Our first shale boom company gets 70% of that—or about $2.7 million. That’s a 67.5% return on its $4 million investment. If the company puts up the entire $8 million itself, its return on investment drops from 67.5% to 48.75%. You see, this deal is a huge win for the company and just a small tuition fee for the Chinese. Both sides win big. But here’s the thing: Our company has been making this same sweetheart deal over and over. In 2011, the company sold a 20% stake in one of its fields and got its partner to foot 50% of the development costs. So it kept 80% of the profits and put up only half of the money. In 2010, it sold 20% of another field and its partner put up 75% of the development costs. It kept 80% of the profits and put up just 25% of the development capital. With the numbers I showed you a moment ago, I hope you’ll agree that this is a recipe for getting seriously rich. Meet the CompanyIn a few moments, I’m going to walk through what I believe you can earn from your investment. But first, let me reveal the company. The name of the company that you want to own is Carrizo Oil & Gas (NASDAQ: CRZO). In the energy world, where giants like Exxon can earn $10 billion in a quarter, these guys are tiny. They make about only $500 million per year in revenue. But even though the company is small size-wise, there has been nothing small about its earnings growth. In 2010, Carrizo posted earnings per share (EPS) of $0.29. In 2012, EPS came in at $1.39 (full-year 2013 numbers aren’t out yet as of the time of this writing). But average analyst estimates for 2013 EPS are $2.36. From $0.29 to $2.61 per share in four years is massive growth. In fact, it’s a compound annual earnings growth rate of about 73%. For comparison, consider this... As I write, the average S&P 500 earnings growth rate is only 9.1%. In other words, Carrizo is trouncing the market. Let’s talk about what this growth means for Carrizo’s valuation. You see, I believe that, given its current growth rate, Carrizo is very cheap. As I write, Carrizo’s stock trades around $44. By the time this opportunity plays out, I expect the share price will increase to at least $155 per share. It might even go as high as $300. I’ll explain how I’m calculating those numbers in the next section. But right now, I just want to show you why your $44 entry price is inexpensive. High-growth stocks such as Carrizo often have P/E ratios that equal their earnings growth rates. [“P/E” stands for “price-to-earnings.” A P/E ratio tells you how many years of earnings it would take to earn back the total value of your investment. Investors use this metric to determine how cheap or expensive a stock is. You calculate it by dividing the stock price by a company’s earnings per share.] As I write this, the P/E ratio of Carrizo is just 20 times this year’s earnings. That’s obviously nowhere close to its 73% compound annual EPS growth rate. That alone is enough to get me thinking this stock is inexpensive, but it gets better. Right now, the independent oil and gas industry averages a P/E ratio of 31.91. That means that Carrizo’s stock price is 37% cheaper than its industry. So even if we don’t factor in Carrizo’s huge growth rate, it’s still inexpensive right now on a relative basis. Now, let me tell you what you’re getting for this inexpensive entry price... Carrizo’s management has been incredibly shrewd. It has 95% of its crude oil output hedged at prices above $90. That means if energy prices drop 50% tomorrow, it won’t matter to Carrizo. That’s because the company’s hedges guarantee it will receive $90 per barrel. Its extraction cost (what it costs to pull a barrel of oil out of the ground) is just $30 per barrel. So Carrizo digs it up for $30 and sells it for $90. Those are huge margins (this just means how much revenue a company retains after paying for the cost of the goods it sells). In fact, Carrizo’s gross margin has stayed mostly in the high 70%s to mid 80%s for a decade. Since Carrizo is making about $60 per barrel it produces, the next question is “Well, how many barrels can it produce? More importantly, can it increase that amount?” Yes. The company’s average daily production is growing at an annual compound growth rate of more than 29%. Compare that to energy giant Exxon Mobil, whose production growth is a measly 2.9%. The chart below illustrates this growth... (You may notice that this chart only carries through the first half of 2012. That’s simply the last time the chart itself was updated. The growth has continued. In fact, for the three months ending September 30, 2013, Carrizo produced 30,011 barrels of oil equivalent per day. You can see on the chart that 30,000 barrels continue the upward trajectory of Carrizo’s growth rate.)

Here’s the sweetener: Carrizo has managed all of this growth by utilizing just 20% of the acreage it owns in Eagle Ford. The company still has another 80% of Eagle Ford land to drill into. In other words, there’s more oil to find and money to make. Under these circumstances, I hope you’re beginning to see we are at only the very beginning of this company’s growth cycle. This mutually beneficial deal with the Chinese will provide a low-priced source of capital that Carrizo will be able to access for many years to come. What I Expect You Will MakeAs I showed you above, Carrizo’s compound annual EPS growth rate from 2010 through estimated 2014 earnings per share comes in at 73%. Some analysts might use this 73% to calculate where Carrizo’s price might climb to in the future. I’m not going to do that because I want to be more conservative. You never know what challenges a company or industry might face going forward. Therefore, let’s cut that rate dramatically. In fact, let’s assume Carrizo grows at only 20% per year. I’ve picked this number because I believe it’s a fair estimate of a conservative, sustainable growth rate for a company in Carrizo’s unique position. Analysts expect Carrizo’s final 2013 EPS will be $2.36. $2.36 growing at a rate of 20% means this company will be earning $5.87 per share in five years. If all the stock does is remain at its current P/E of 20.8, Carrizo’s stock will be valued at $122. (20.8 x $5.87 = $122) Now let’s assume that Carrizo’s P/E rises to match that of its industry. As I told you a moment ago, the average P/E ratio for the independent oil and gas industry is 31.91. If that happens, Carrizo’s stock will climb to $187 (31.91 x $5.87 = $187) But now let’s paint a rosier picture. Instead of the conservative 20% growth rate, let’s assume Carrizo can maintain a 35% growth rate. (Remember, right now that rate is 73%, and Carrizo owns a huge amount of land that is currently undrilled. Therefore, I think this growth rate is well within the realm of possibility.) At a 35% earnings growth rate, in five years the company will have earnings of $10.58. At its current P/E ratio, that would mean a stock price of $220. At the industry average P/E, that would mean a stock price of $337. As always, remember that the stock market is unpredictable. Especially when it concerns small-cap natural resource stocks. Therefore, I’m not guaranteeing these numbers. But based on my analysis, I believe it’s highly likely investors could enjoy these returns. Even with conservative estimates, I’m confident Carrizo is going to make significant money for investors today. But using estimates—which are certainly probable—those returns could be astronomical. Action to take: Buy Carrizo (CRZO) up to $48 per share Price Target: $300-plus Volatility: High Position Size: No more than 2.5% of your stock portfolio Stop Loss: No stop loss China Shale Boom Stock No. 2As you now know, China has the world’s largest deposits of shale gas. But what you may not know is that the country has only 150 shale wells that are currently active. By comparison, in the United States, companies drilled 38,000 wells in 2013 alone. Remember, America pioneered this technology and has a 12-year lead on implementing fracking and horizontal drilling. But over the next seven years, China has pledged to drill 20,000 new “black rock” shale gas wells. What this means to investors is that China is on the verge of spending tens of billions on developing its black rock shale gas. That matters to us because we want to invest in the companies that stand to benefit from China’s shale growth. The second company I’m going to share with you now will absolutely benefit from this growth. It’s about to be “hired” to teach the Chinese how to access their shale gas via cutting-edge fracking technology. This company is hardly new to China, however. It already has a well-developed operation there right now. In fact, over the last three years, this company has installed more than 1 million feet of fracturing “sleeves” in China (this is part of the machinery required for advanced fracking technology). But what this company has done in China up to this point could be just the beginning... A news article by Reuters has rumors swirling. You see, there’s speculation that Sinopec, China’s massive state-run oil firm, is in advanced discussions with my second recommendation. The two companies are considering partnering to work on China’s black rock shale formations. There’s a reason Sinopec is interested in my second recommendation. There’s something different about it... something that makes it even more attractive to the Chinese... You see, it’s at the forefront of a new type of fracking technology. According to JPMorgan Chase, this technology is cutting well development costs by 70%. It’s improving well extraction times by 80%. And it’s doubling the yield of usable oil and gas, compared with conventional fracking. In other words, it’s revolutionizing the business. Let me give you some more background... The Old Way Versus the New Way“Plug-and-perf” is the traditional way of fracking. Plug-and-perf relies on a laborious, time-consuming process of releasing trapped gas from deep within the earth. It’s inefficient and dangerous. And its days are numbered... The future of fracking lies in “sleeve” based systems. You should recognize this term from a moment ago. This approach uses metal sleeves that have built-in inflatable plugs called “packers.” I’m not going to get into all the details and specific terms of the fracking industry. It’s not important that you know them. What is important is that you understand that this new method is much more efficient than the dated “plug-and-perf” technology. It requires far less labor and fewer resources. Let me put these advances in perspective for you... Using the traditional “plug-and-perf” method, it takes four hours to install a plug and fracture a section of the well. This limits “plug-and-perf” operators to five plugs per day. A sleeve-based system can place and frack 15 sections per day. Plus, the sleeve system uses 30% less water, and it doubles the oil and gas recovery rate. Experts predict that 70% of all future energy extraction will rely on hydraulic fracturing technology. In other words, this is a game-changer. Meet the CompanyMy second recommendation is a global leader in this revolutionary drilling technology. It specializes in what’s called the “artificial lift market.” This lift technology brings the energy source to the surface. It is a key technology used by both conventional drillers and fracking operators. The name of the company is Weatherford Intl. (NYSE: WFT). It operates 183 drillings rigs and 284 workover rigs all around the globe. (If these terms don’t mean much to you, that’s okay. I’m just making the point that this company has a broad, international presence.) Weatherford is a formerly American-based company, now domiciled in Switzerland for tax purposes. Weatherford is a leader in this new sleeve-based fracking technology. Its propriety “ZoneSelect” system is the most widely used sleeve system in China. In the past 10 years, Weatherford’s revenues have climbed from $2.5 billion to nearly $16 billion. That’s growth of over 500%. But while companies like Sinopec might be interested in Weatherford for its technology, you as an investor should be interested in Weatherford for its ability to make you money. And that’s something Weatherford takes seriously... In its 2012 annual report, (2013’s is not out as of this writing), CEO Bernard Duroc-Danner recommitted Weatherford to “capital efficiency and financial performance.” Specifically, he wrote... “We will forge a culture of cash—cash returns, that is—and capital efficiency.” But let’s dig deeper now. Let’s talk about Weatherford’s growth and how it affects the way I’m valuing the company right now. Wall Street Is Noticing Weatherford’s Cheap ValuationThe next chapter in Weatherford’s growth story will occur in lock step with the growth of China’s shale gas fields. This is what the experts call a “long lived” trend. This means that we’ll be able to ride this one higher for years to come... over the “long life” of China’s shale boom. If Weatherford becomes the “go-to” company for fracking in China, the stock could be worth at least $100 per share by 2019. I’ll show you exactly how I came to that number in a moment. As I write this, you can own WFT for about $14.50 per share. This is a good entry price. I’ll show you why... One way investors value a company is by comparing its market value to its book value. [Book value is the total value of the company’s assets. Comparing the book value to the market’s value can tell you whether a stock is under- or overpriced.] As I write this, Weatherford’s average peer trades at over two times book value. Weatherford’s two biggest competitors trade at over three times book value. How does this compare to Weatherford? Right now, Weatherford’s stock price trades at only 1.3 times its book value. This makes Weatherford a far better value by comparison. The company is also inexpensive when we look at other metrics. For instance, its forward P/E ratio is only 11.7. (A forward P/E ratio is the same as a normal P/E ratio, except it uses analyst estimates of future earnings rather than earnings over the past 12 months.) For comparison, the average forward P/E ratio of the S&P 500 is almost 16. That means Weatherford is around 25% cheaper than the average S&P 500 stock. At these values, we’re already beginning to see some of the smartest money on Wall Street recognize the value in Weatherford. We know that because various hedge funds have quietly been accumulating positions in the stock. Notable names include Steve Cohen’s SAC Capital. SAC is famous for delivering 30% annual returns for the last 20 years. It now owns a 1.6 million-share stake in Weatherford. Ken Griffin, the hedge fund wizard, owns 2 million shares through his fund Citadel Advisors. In fact, since June 2013, 66 hedge funds and wealth managers have taken sizeable positions in WFT. We’ve also seen 23 separate insider buys over the last 12 months. But let’s talk about what you, as an investor, could make with Weatherford. What I Believe an Investor Could MakeSo what is Weatherford’s stock really worth? Final 2013 numbers are not out as I write. However, analysts predict that Weatherford will have earned $0.79 per share in 2013. Seventeen different analysts following Weatherford estimate earnings will ramp up dramatically in 2014 and 2015. Specifically, they will jump to $1.27 then $1.74, respectively. Going from $0.79 per share to $1.74 per share in only three years works out to a compound annual growth rate of 30%. Now, let’s hold here a moment. I’ll come back to this point... According to the conservative estimates provided by the respected stock research house Value Line WFT has a high price target of $45 per share. (By the way, Value Line is one of the most respected names in the business. It has been the “go-to” source of fundamental information for Warren Buffet for more than 50 years. Its analysis is widely regarded as excellent.) If we use Value Line’s target price of $45 and the expected 2015 earnings of $1.74, that translates into an expected P/E ratio of 25. ($45 / $1.74 = 25.8) But remember earlier, when I told you that growth companies often have P/E ratios that match their growth rates? Well, using that rule of thumb, this P/E of 25 is too low. Instead, let’s now calculate a future target stock price using the 30% growth rate as a proxy for Weatherford’s P/E ratio. When we do this, we calculate a target price of $52.20. (30 x $1.74 = $52.20) However, if Sinopec chooses Weatherford to be its preferred partner in developing its “black rock” shale, $52 per share could prove to be far too low price for this company. It’s certainly possible that a partnership with Sinopec could cause Weatherford’s stock to explode higher—even doubling from these projections (which would mean a $100-per-share stock). The truth is, it’s uncertain just how high the stock could go, because the scale and scope of the work involved with developing a $5 trillion gas field is unknown. No company has ever attempted to work a field of this size. Now, let’s look at one contingency. Smart investors know that they need to analyze a potential investment from all sides before putting their money up. What happens if Sinopec (or any other Chinese company) chooses not to partner with Weatherford? In that situation, I believe a “major” such as Halliburton or Schlumberger will eventually buy out Weatherford. Remember, the company is already on the ground in China conducting operations. It has contacts and assets there that would be very valuable to another company. So what is Weatherford worth under this scenario? To help us answer that, let’s look at a similar buy-out that took place recently. Only months ago, GE purchased the oil service firm Lufkin Industries. It paid 13.5 times the earnings before interest, taxes, depreciation, and amortization. (This is commonly known as “EBITDA.” EBITDA is a calculation that helps investors value, analyze, and compare various companies.) If a competitor were to buy out Weatherford at the same valuation multiple of 13.5 times EBITDA, the stock would go for $41 per share. Once again, you can own it today for about $14.50. In other words, it would sell for nearly three times your investment. To recap, if we value Weatherford based on its earnings growth, I believe this stock will be worth $52 in five years. That’s a return of over 250%. If we assume a buyout scenario from a competitor, I project a $41 stock. That’s a return of about 180%. But if we assume the optimistic scenario, and a partnership with Sinopec leads to explosive growth, a $100 stock is possible. That would mean returns of around 590%. Regardless of which situation eventually plays out, I’m confident you’re going to be pleased with the results if you buy at current prices. Action to take: Buy Weatherford (WFT) up to $16 per share Price Target: $45-plus Volatility: High Position Size: No more than 2.5% of your stock portfolio Stop Loss: No stop loss The United States has been enjoying its shale boom for years now. For most investors, it’s too late to capitalize on that growth story. Fortunately, the same story is about to play out in China, and you’re not too late. I hope you’ll take the time to analyze the two companies I’ve just given you. Both could prove to be huge growth stories for years to come. Good investing, Teeka |