|

Bill Gates Picks Top 2 Stock Picks

Holding onto and wisely disposing of large sums of cash is very, very hard – even for the best companies in the world. Investors must be disciplined by focusing their capital on solid, dividend-paying stocks. And corporate managers must be disciplined by paying out excess capital to shareholders rather than wasting it on bad investments in unprofitable businesses.

The dividend discipline works financial wonders for those who earn dividends and those who pay them. This month, We're recommending a great capital allocator. Its management is dedicated to creating shareholder value and it follows the dividend discipline. So it's a great income stock; and yet right now, it's extremely controversial. |

Our New Controversial Capital Allocator - Sturm, Ruger & Company (NYSE: RGR)

Ruger is one of the largest gun makers in the U.S. It makes and sells rifles and handguns. Ruger sold $595.4 million over the past four quarters. It generated $85.8 million in free cash flow, a thick 14.4% margin. Now before we get into the details of Ruger's strong "dividend discipline" and why we believe it will benefit shareholders for years, let's address one important issue: Guns are a controversial topic.

There have been a number of mass shootings in the news the last few years – most recently, earlier this week at the Navy Yard in Washington, D.C. In the wake of these horrible shootings, many politicians are calling for stricter gun control laws and many Americans support such measures. So why would we invest in a gun-maker if the government is clamping down on weapons ownership, issuing widespread gun bans and putting a crimp in gun-makers' revenues?

You shouldn't worry about this. Despite the anti-gun political environment, guns are still in high demand. Just look at the behavior of people caught up in gun-related tragedies. Last month, the Washington Times reported that the number of gun permit requests in Newtown, Connecticut rose sharply in the months after the tragic December shooting at Sandy Hook Elementary School. Through August, Newtown police received 211 gun permit applications compared to 171 in all of 2012.

A CBS news article reported that gun sales in Colorado jumped following the July 2012 movie theatre shooting in Aurora. Colorado's state government approved 2,887 background checks for gun buyers the Friday following the shooting – 25% more than the average Friday-Sunday period in 2012 and 43% more than the same period the prior week.

Some people say we shouldn't be allowed to carry guns because more people will get shot and more crime will take place. Every time there's a mass shooting, politicians come out in favor of more stringent gun laws and regulations. One month after the Sandy Hook shooting, President Obama signed 23 executive orders related to firearms and proposed 12 Congressional actions.

But the exact opposite has been true for decades. There are over eight million concealed-carry permit holders in the U.S. today. That's an all-time high. And the homicide rate is the lowest it's been in four decades, less than half what it was 20 years ago, according to an Atlantic magazine article last December.

Besides, Ruger makes very few of the politically targeted modern sporting rifles – sometimes called "assault weapons," a term with no objective definition. The popular, often debated AR-15 is in this category. Ruger makes a $2,000 sporting rifle. It says that product category has great growth potential. But it's never made very many of these guns, and an outright ban on them would have little impact on Ruger's financial results.

So yes, there's political risk in the gun business. But so far, anti-gun sentiment has worked in favor of gun makers. I bet you know at least one person who is buying guns and ammo he might not otherwise have bought, due to the government's many threats to try to push new gun control laws.

Again, many ordinary citizens have made it clear they don't want those laws. In Colorado, the citizens recalled two state senators for the first time in the state's history because they voted in favor of a law requiring universal background checks on all gun purchases and limiting gun magazines to a 15-round maximum. Those politicians lost their jobs because they voted to restrict guns.

I'm not expressing a political view here. I'm just telling you how people behave when faced with a gun-related tragedy. They don't want politics. They want protection. So they go out and buy it. Political tailwinds are just one of the reasons that one of the biggest and best-run gun makers in the U.S. is thriving today and paying rapidly growing dividends to shareholders.

The Four Main Reasons for Sturm, Ruger's Rapid Growth

Sturm, Ruger has the "dividend discipline": It has raised its dividend for 12 of the last 18 quarters. Management says it favors dividends over share repurchases these days. So investors should expect this rapidly growing company to pay even higher dividends in the near future.

Since CEO Mike Fifer took over in 2006, Ruger has worked hard to create excellent shareholder value. Every $1 management has reinvested in the business has produced $11 of market cap – a sensational record few other companies can match. Microsoft, on the other hand, has created less than $1 of market cap for every $1 of earnings it has retained and reinvested in the business. Ruger knows what to do with the money it hangs onto. And it pays out the rest in dividends and (less often these days) share repurchases.

Ruger is a great American manufacturing company. Nearly all the parts in all its products are made in the U.S. Every gun it makes is assembled, inspected, and tested by Ruger employees at two manufacturing plants in New Hampshire and Arizona. There, it test fires every gun it ships, including every chamber of every revolver.

Ruger has grown rapidly the last few years. Sales have more than quadrupled from $139 million in 2006 to nearly $600 million today. Let's take a look at why this happened and why the company could grow even more from here.

Management says there are four reasons for Ruger's massive growth…

To understand Ruger's increased manufacturing capacity, you have to understand how much it has changed since Fifer took over as CEO in 2006.

In 1999, Ruger had $241 million in sales and $55 million in pre-tax profit. But after the death of founder William Ruger, Sr. in 2002, things went downhill. By 2006, the company had only $139 million in sales and a pre-tax profit of just $1.8 million.

Ruger used inefficient manufacturing methods, and inventory was piling up. For example, it used batch processing to make guns. Batch processing is like your monthly credit-card bill. The credit-card company collects all the charges and then sends them to you in a batch once a month. In manufacturing, one station on the factory floor makes a large batch of parts before sending them on to the next station. That leaves resources idle until the batch arrives at the next station. Guns were being made in large amounts, regardless of how many could actually be sold to customers. Guns without customer orders for them piled up on the factory floor.

Fifer changed things right away. In his 2007 letter to shareholders, he said he would modernize Ruger's manufacturing by adopting the key principles of the Toyota Production System, developed by Toyota's Taiichi Ohno after visiting the U.S. in the 1930s. Ohno saw Ford Motors using batch processing in Detroit, with one group of workers frantically working and another group idly waiting for the batch to arrive. Unsold inventory piled up. Ohno was not impressed. Then he visited a nearby Piggly Wiggly supermarket and saw goods reordered and restocked only after being removed and purchased by customers. This made more sense to Ohno than the Ford way. Ohno took his new insight home to Japan and created perhaps the most widely studied and imitated manufacturing system in the world today.

Toyota methods have transformed Ruger into a manufacturing powerhouse. In 2006, the company had 1,300 employees doing $139 million in sales. Today, it has over 2,100 employees doing $595.4 million in sales. Ruger is making and selling 3.5-4 times more guns today than in 2006 – using the same two plants.

Ruger had $87 million worth of inventory on hand by the end of 2006. It had just $56 million of inventory on hand at the end of June this year. Inventory made up more than 60% of sales back in 2006. It's less than 10% of annual sales today. If Ruger still used its old methods, it would have around $360 million of inventory at this level of sales. This is a huge improvement…

Inventory uses up cash. Reducing inventory generates cash for shareholder dividends and share repurchases. In 2006, Ruger generated $30 million in cash flow and paid no dividends. Last year, it generated $87 million in cash flow and paid $24 million in regular dividends and another $86 million in a one-time special dividend (out of balance-sheet cash).

If you listen in on Ruger's quarterly conference calls, you'll hear Fifer refer to inventory turnovers often. (Inventory turnover is how many times in a year a company's inventory is sold and replenished. Higher turnover is better than lower.) Fifer knows that's a manufacturer's lifeblood. It can't afford to make products that aren't being sold.

When Fifer took over in 2006, Ruger was turning inventory over an anemic 1.4 times per year. Last year, Ruger turned its inventory six times. It's making new guns, and they are flying off the factory floor to customers. Fifer says inventory turnovers are important "to free up assets, cash, people, space, and [manufacturing] capacity so we can reinvest in top line growth." In other words, every dollar not sitting idle in inventory is a dollar that can be reinvested in growth of the business and the dividend.

New Products

Aside from improved manufacturing methods, Ruger does a great job of introducing new products. New products introduced in 2012 included its 10/22 Takedown Rifle, Ruger American Rifle, SR22 pistol, 22/45 Lite pistol, and Single-Nine revolver.

New-product sales were $182 million, or 38% of sales in 2012 and 31% in the first half of 2013. Ruger targets 33% new product sales each year. After two years, it doesn't consider a product "new" anymore, even though many new products sell much more in years three and four than years one and two. It defines "new" as two years or less to keep itself disciplined to ensure its product line is fresh and growing.

Ruger has teams of engineers and marketing people working together to make new products that will sell. At Ruger, cosmetic changes don't count as new products. A new product has to be a newly engineered gun. It has to exploit Ruger's manufacturing capability. Fifer knows how manufacturing works. Before Ruger, he was president of engineered products of Mueller Industries, which does over $2 billion in sales

and makes a wide variety of copper, brass, plastic, and aluminum manufactured products.

Anti-Gun Political Environment

As we mentioned earlier, gun control is a controversial topic these days. The government is responding to the terrible mass shootings of the last few years by pushing stricter gun laws. The public is responding by going out and purchasing more guns to protect themselves. That's helping make Ruger a much bigger business than it was a few short years ago.

Gun demand remains very strong. The most widely recognized proxy for gun demand in the U.S. is the National Instant Criminal Background Check System (NICS). Background checks are done when new and used firearms are transferred by a Federal Firearms Licensee. They're also done for permit applications and renewals. The National Shooting Sports Foundation adjusts NICS data by removing checks not directly related to a gun sale, like concealed-carry permit applications. This shows a more accurate picture of current gun demand.

The numbers clearly show gun demand soaring. Total background checks grew 46% from 2010 to 2012. And Ruger distributors sold almost twice as many guns to retailers in 2012 as in 2010. Ruger finished 2012 with a record 1.5 million units on backorder. That's 4.5 times 2011's year-end backorders and 14 times 2010 year-end backorders. (NICS background checks fell in the early part of this year but they fall in the first part of almost every year. They could easily rise to new record levels again in the next few months, as they've done in four of the last five years.)

The world is demanding Ruger guns in greater volumes than ever before. It knows its inventories aren't enough to fulfill distributor demand and that its distributors' inventories aren't enough to fulfill record retail demand. So Ruger is starting up a new factory in North Carolina. It bought a 220,000 square foot building in Mayodan, NC. It expects the new facility to be up and running early next year.

Gun demand won't rise forever... But it can probably go up more than you think. I know a few gun people. They tend to buy more than one gun. A friend of mine asked me to go shooting with him. He said he'd bring "a few guns." He brought about 10 handguns and said he had many more at home. Ruger reports the same phenomenon among its customers.

Ruger's new products are increasing demand for its older products, too. New customers discover the company through new product offerings, go home, try them out, and become interested in buying more Ruger guns. That's typical of many successful brands. I never thought about owning an iPhone until I was given an iPad as a gift. Now, I'm hooked on both of them. I'm not worried about gun politics. Guns are in high demand, and Ruger is meeting that demand.

New Gun Owners

The Supreme Court recently affirmed that the Second Amendment means individual Americans have a right to own a gun. There are perhaps 300 million guns in this country already; and there are plenty of new shooters every year. A recent report commissioned by the National Shooting Sports Foundation indicates 20% of all target shooters took up the sport between 2008 and 2012. It also indicates most new shooters are urban-dwelling females under the age of 35. Falling gun demand is simply not a topic we need to worry much about today.

Ruger has benefited and will continue to benefit from strong U.S. gun demand. I think this will depend less on the political environment over the long term. As more people buy guns, their interest in them will have less to do with politics and more to do with self-protection, sport shooting, and learning more about their newfound interest. I can imagine target shooting catching on all over the place, for example. The National Shooting Sports Foundation has provided over $100,000 in grants to form college shooting sports teams, including $7,500 each to Harvard University and Harvard Law School.

Young people are becoming new shooters, which means new customers for companies like Ruger. Gun demand won't go straight up forever. But it should continue to grow steadily with the population. Ruger's ability to produce new products and manufacture them efficiently should help it to take maximum advantage of growth in gun demand. Ultimately, that will spell more profits for the company… and more dividends for shareholders.

The Financial Clues Don't Lie: This Is a Great, Well-Run Business

Ruger isn't a global dominator. It's a "niche dominator" – a smaller company with a commanding presence in a smaller market than is addressed by the Global Dominators. But Ruger has all the financial clues we so often find in global dominator stocks.

Gushing Free Cash Flow

This is the very first thing I tend to look for when examining a company's financial statements. I go to the cash flow statement and look at the top line to see if it's profitable. Then I look at the bottom line of the top section to see the operating cash flow. Then I look below that for the capital expenditures line. If operating cash flows are much larger than capital spending, I'm intrigued. That tells me I'm looking at a business that has a lot of excess cash left over after paying all its expenses, interest payments, and taxes. That excess cash flow is what gives your equity its value, so I like to see plenty of it.

Sturm, Ruger generated $85.8 million in free cash flow over the last 12 months, on nearly $600 million in sales. That means Ruger earns $0.144 in free cash flow on every $1 in sales. I bet that'll increase the next few years as Fifer and his team work to increase inventory turns, generating cash flow faster and more efficiently.

Shareholder Rewards – Dividends and Share Buybacks

Once I find a business that generates plenty of free cash flow, I have to make sure it's good at using it to create shareholder value. There are two primary ways to create shareholder value: dividends and share repurchases. Ruger does a great job with both of these.

Ruger bought back a lot of stock from 2006 to 2009, reducing its share count from 26.9 million on Dec. 31, 2005 to 19.1 million on February 17, 2009. It spent $30 million buying back shares in 2007 and 2008. It backed off in 2009, then spent another $7.7 million on buybacks in 2010 and 2011. Ruger didn't buy back any shares in 2012. I expect it'll continue buying back shares any time it feels they're undervalued.

Ruger has also done a fantastic job at ramping up its dividend. The company is committed to paying out 40% of its earnings per share in dividends. As earnings rise, so will the dividend. It should be expected to fluctuate a bit. It won't necessarily go up every single year, as it has been since 2006. But you're starting at a stout yield of 4.4%, more than double the S&P 500's 1.9% yield. So it's definitely worth owning today. As a fixed percentage of earnings, Ruger's dividend will probably fall some quarters and rise in others. But it'll grow with the overall business.

The quarterly dividend was cut in half in 2004 and eliminated completely in 2005. The dividend was reinstated in May 2009 at $0.086 per share. Today, it's up 655% to $0.65 per share. Ruger has raised its dividend in 12 out of the last 18 quarters. The annual dividend payout has risen every year since 2009. Mike Fifer and his team don't have a long dividend-paying history, but they have a great one.

I consider Ruger's regular quarterly dividend very safe and sustainable. There's also plenty of room for dividend growth. The quarterly dividend hasn't amounted to more than 22% of operating cash flows in any of the last three years. So it could double, and there would still be plenty of room to pay out more in dividends. The company is in expansion mode, starting up a third manufacturing facility. So it'll need some of its cash but not a lot

The third plant will be at an existing facility in North Carolina. The company isn't building a brand-new one. Mike Fifer has been very clear that Ruger will start the new plant in the most efficient, least expensive way. So it won't need to lay out huge amounts of capital to start it up.

Bottom line: I expect Ruger to have plenty of extra cash and continue raising its dividend over the next couple years.

Financial Fortress Balance Sheet

Folks who have plenty of cash on hand and no debt tend to sleep well at night. They have fewer financial worries. If their income falls, they can't go bankrupt by failing to make debt payments. That's Ruger's situation. It has zero debt and $64.8 million in cash.

Ruger likely won't pile up a huge amount of excess cash, the way companies like Apple and Microsoft do. It's far more attuned to shareholder interests than either of those two companies. Apple and Microsoft are great businesses. They gush enormous sums of cash but they don't dispose of the profits nearly as well as Ruger does. They could learn a lot from Ruger about creating value for shareholders.

Consistent Profit Margins

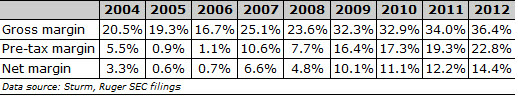

Ruger hasn't had the consistent profit margins we like to find. So, what's the next best thing to consistent margins? Improving margins. Check out the big, steady improvement in Ruger's gross, pretax, and net profit margins since 2004.

Ruger is one of the largest gun makers in the U.S. It makes and sells rifles and handguns. Ruger sold $595.4 million over the past four quarters. It generated $85.8 million in free cash flow, a thick 14.4% margin. Now before we get into the details of Ruger's strong "dividend discipline" and why we believe it will benefit shareholders for years, let's address one important issue: Guns are a controversial topic.

There have been a number of mass shootings in the news the last few years – most recently, earlier this week at the Navy Yard in Washington, D.C. In the wake of these horrible shootings, many politicians are calling for stricter gun control laws and many Americans support such measures. So why would we invest in a gun-maker if the government is clamping down on weapons ownership, issuing widespread gun bans and putting a crimp in gun-makers' revenues?

You shouldn't worry about this. Despite the anti-gun political environment, guns are still in high demand. Just look at the behavior of people caught up in gun-related tragedies. Last month, the Washington Times reported that the number of gun permit requests in Newtown, Connecticut rose sharply in the months after the tragic December shooting at Sandy Hook Elementary School. Through August, Newtown police received 211 gun permit applications compared to 171 in all of 2012.

A CBS news article reported that gun sales in Colorado jumped following the July 2012 movie theatre shooting in Aurora. Colorado's state government approved 2,887 background checks for gun buyers the Friday following the shooting – 25% more than the average Friday-Sunday period in 2012 and 43% more than the same period the prior week.

Some people say we shouldn't be allowed to carry guns because more people will get shot and more crime will take place. Every time there's a mass shooting, politicians come out in favor of more stringent gun laws and regulations. One month after the Sandy Hook shooting, President Obama signed 23 executive orders related to firearms and proposed 12 Congressional actions.

But the exact opposite has been true for decades. There are over eight million concealed-carry permit holders in the U.S. today. That's an all-time high. And the homicide rate is the lowest it's been in four decades, less than half what it was 20 years ago, according to an Atlantic magazine article last December.

Besides, Ruger makes very few of the politically targeted modern sporting rifles – sometimes called "assault weapons," a term with no objective definition. The popular, often debated AR-15 is in this category. Ruger makes a $2,000 sporting rifle. It says that product category has great growth potential. But it's never made very many of these guns, and an outright ban on them would have little impact on Ruger's financial results.

So yes, there's political risk in the gun business. But so far, anti-gun sentiment has worked in favor of gun makers. I bet you know at least one person who is buying guns and ammo he might not otherwise have bought, due to the government's many threats to try to push new gun control laws.

Again, many ordinary citizens have made it clear they don't want those laws. In Colorado, the citizens recalled two state senators for the first time in the state's history because they voted in favor of a law requiring universal background checks on all gun purchases and limiting gun magazines to a 15-round maximum. Those politicians lost their jobs because they voted to restrict guns.

I'm not expressing a political view here. I'm just telling you how people behave when faced with a gun-related tragedy. They don't want politics. They want protection. So they go out and buy it. Political tailwinds are just one of the reasons that one of the biggest and best-run gun makers in the U.S. is thriving today and paying rapidly growing dividends to shareholders.

The Four Main Reasons for Sturm, Ruger's Rapid Growth

Sturm, Ruger has the "dividend discipline": It has raised its dividend for 12 of the last 18 quarters. Management says it favors dividends over share repurchases these days. So investors should expect this rapidly growing company to pay even higher dividends in the near future.

Since CEO Mike Fifer took over in 2006, Ruger has worked hard to create excellent shareholder value. Every $1 management has reinvested in the business has produced $11 of market cap – a sensational record few other companies can match. Microsoft, on the other hand, has created less than $1 of market cap for every $1 of earnings it has retained and reinvested in the business. Ruger knows what to do with the money it hangs onto. And it pays out the rest in dividends and (less often these days) share repurchases.

Ruger is a great American manufacturing company. Nearly all the parts in all its products are made in the U.S. Every gun it makes is assembled, inspected, and tested by Ruger employees at two manufacturing plants in New Hampshire and Arizona. There, it test fires every gun it ships, including every chamber of every revolver.

Ruger has grown rapidly the last few years. Sales have more than quadrupled from $139 million in 2006 to nearly $600 million today. Let's take a look at why this happened and why the company could grow even more from here.

Management says there are four reasons for Ruger's massive growth…

- Increased manufacturing capacity.

- Its ability to introduce new products.

- The ongoing anti-gun political environment.

- New shooters joining the ranks of gun owners.

To understand Ruger's increased manufacturing capacity, you have to understand how much it has changed since Fifer took over as CEO in 2006.

In 1999, Ruger had $241 million in sales and $55 million in pre-tax profit. But after the death of founder William Ruger, Sr. in 2002, things went downhill. By 2006, the company had only $139 million in sales and a pre-tax profit of just $1.8 million.

Ruger used inefficient manufacturing methods, and inventory was piling up. For example, it used batch processing to make guns. Batch processing is like your monthly credit-card bill. The credit-card company collects all the charges and then sends them to you in a batch once a month. In manufacturing, one station on the factory floor makes a large batch of parts before sending them on to the next station. That leaves resources idle until the batch arrives at the next station. Guns were being made in large amounts, regardless of how many could actually be sold to customers. Guns without customer orders for them piled up on the factory floor.

Fifer changed things right away. In his 2007 letter to shareholders, he said he would modernize Ruger's manufacturing by adopting the key principles of the Toyota Production System, developed by Toyota's Taiichi Ohno after visiting the U.S. in the 1930s. Ohno saw Ford Motors using batch processing in Detroit, with one group of workers frantically working and another group idly waiting for the batch to arrive. Unsold inventory piled up. Ohno was not impressed. Then he visited a nearby Piggly Wiggly supermarket and saw goods reordered and restocked only after being removed and purchased by customers. This made more sense to Ohno than the Ford way. Ohno took his new insight home to Japan and created perhaps the most widely studied and imitated manufacturing system in the world today.

Toyota methods have transformed Ruger into a manufacturing powerhouse. In 2006, the company had 1,300 employees doing $139 million in sales. Today, it has over 2,100 employees doing $595.4 million in sales. Ruger is making and selling 3.5-4 times more guns today than in 2006 – using the same two plants.

Ruger had $87 million worth of inventory on hand by the end of 2006. It had just $56 million of inventory on hand at the end of June this year. Inventory made up more than 60% of sales back in 2006. It's less than 10% of annual sales today. If Ruger still used its old methods, it would have around $360 million of inventory at this level of sales. This is a huge improvement…

Inventory uses up cash. Reducing inventory generates cash for shareholder dividends and share repurchases. In 2006, Ruger generated $30 million in cash flow and paid no dividends. Last year, it generated $87 million in cash flow and paid $24 million in regular dividends and another $86 million in a one-time special dividend (out of balance-sheet cash).

If you listen in on Ruger's quarterly conference calls, you'll hear Fifer refer to inventory turnovers often. (Inventory turnover is how many times in a year a company's inventory is sold and replenished. Higher turnover is better than lower.) Fifer knows that's a manufacturer's lifeblood. It can't afford to make products that aren't being sold.

When Fifer took over in 2006, Ruger was turning inventory over an anemic 1.4 times per year. Last year, Ruger turned its inventory six times. It's making new guns, and they are flying off the factory floor to customers. Fifer says inventory turnovers are important "to free up assets, cash, people, space, and [manufacturing] capacity so we can reinvest in top line growth." In other words, every dollar not sitting idle in inventory is a dollar that can be reinvested in growth of the business and the dividend.

New Products

Aside from improved manufacturing methods, Ruger does a great job of introducing new products. New products introduced in 2012 included its 10/22 Takedown Rifle, Ruger American Rifle, SR22 pistol, 22/45 Lite pistol, and Single-Nine revolver.

New-product sales were $182 million, or 38% of sales in 2012 and 31% in the first half of 2013. Ruger targets 33% new product sales each year. After two years, it doesn't consider a product "new" anymore, even though many new products sell much more in years three and four than years one and two. It defines "new" as two years or less to keep itself disciplined to ensure its product line is fresh and growing.

Ruger has teams of engineers and marketing people working together to make new products that will sell. At Ruger, cosmetic changes don't count as new products. A new product has to be a newly engineered gun. It has to exploit Ruger's manufacturing capability. Fifer knows how manufacturing works. Before Ruger, he was president of engineered products of Mueller Industries, which does over $2 billion in sales

and makes a wide variety of copper, brass, plastic, and aluminum manufactured products.

Anti-Gun Political Environment

As we mentioned earlier, gun control is a controversial topic these days. The government is responding to the terrible mass shootings of the last few years by pushing stricter gun laws. The public is responding by going out and purchasing more guns to protect themselves. That's helping make Ruger a much bigger business than it was a few short years ago.

Gun demand remains very strong. The most widely recognized proxy for gun demand in the U.S. is the National Instant Criminal Background Check System (NICS). Background checks are done when new and used firearms are transferred by a Federal Firearms Licensee. They're also done for permit applications and renewals. The National Shooting Sports Foundation adjusts NICS data by removing checks not directly related to a gun sale, like concealed-carry permit applications. This shows a more accurate picture of current gun demand.

The numbers clearly show gun demand soaring. Total background checks grew 46% from 2010 to 2012. And Ruger distributors sold almost twice as many guns to retailers in 2012 as in 2010. Ruger finished 2012 with a record 1.5 million units on backorder. That's 4.5 times 2011's year-end backorders and 14 times 2010 year-end backorders. (NICS background checks fell in the early part of this year but they fall in the first part of almost every year. They could easily rise to new record levels again in the next few months, as they've done in four of the last five years.)

The world is demanding Ruger guns in greater volumes than ever before. It knows its inventories aren't enough to fulfill distributor demand and that its distributors' inventories aren't enough to fulfill record retail demand. So Ruger is starting up a new factory in North Carolina. It bought a 220,000 square foot building in Mayodan, NC. It expects the new facility to be up and running early next year.

Gun demand won't rise forever... But it can probably go up more than you think. I know a few gun people. They tend to buy more than one gun. A friend of mine asked me to go shooting with him. He said he'd bring "a few guns." He brought about 10 handguns and said he had many more at home. Ruger reports the same phenomenon among its customers.

Ruger's new products are increasing demand for its older products, too. New customers discover the company through new product offerings, go home, try them out, and become interested in buying more Ruger guns. That's typical of many successful brands. I never thought about owning an iPhone until I was given an iPad as a gift. Now, I'm hooked on both of them. I'm not worried about gun politics. Guns are in high demand, and Ruger is meeting that demand.

New Gun Owners

The Supreme Court recently affirmed that the Second Amendment means individual Americans have a right to own a gun. There are perhaps 300 million guns in this country already; and there are plenty of new shooters every year. A recent report commissioned by the National Shooting Sports Foundation indicates 20% of all target shooters took up the sport between 2008 and 2012. It also indicates most new shooters are urban-dwelling females under the age of 35. Falling gun demand is simply not a topic we need to worry much about today.

Ruger has benefited and will continue to benefit from strong U.S. gun demand. I think this will depend less on the political environment over the long term. As more people buy guns, their interest in them will have less to do with politics and more to do with self-protection, sport shooting, and learning more about their newfound interest. I can imagine target shooting catching on all over the place, for example. The National Shooting Sports Foundation has provided over $100,000 in grants to form college shooting sports teams, including $7,500 each to Harvard University and Harvard Law School.

Young people are becoming new shooters, which means new customers for companies like Ruger. Gun demand won't go straight up forever. But it should continue to grow steadily with the population. Ruger's ability to produce new products and manufacture them efficiently should help it to take maximum advantage of growth in gun demand. Ultimately, that will spell more profits for the company… and more dividends for shareholders.

The Financial Clues Don't Lie: This Is a Great, Well-Run Business

Ruger isn't a global dominator. It's a "niche dominator" – a smaller company with a commanding presence in a smaller market than is addressed by the Global Dominators. But Ruger has all the financial clues we so often find in global dominator stocks.

Gushing Free Cash Flow

This is the very first thing I tend to look for when examining a company's financial statements. I go to the cash flow statement and look at the top line to see if it's profitable. Then I look at the bottom line of the top section to see the operating cash flow. Then I look below that for the capital expenditures line. If operating cash flows are much larger than capital spending, I'm intrigued. That tells me I'm looking at a business that has a lot of excess cash left over after paying all its expenses, interest payments, and taxes. That excess cash flow is what gives your equity its value, so I like to see plenty of it.

Sturm, Ruger generated $85.8 million in free cash flow over the last 12 months, on nearly $600 million in sales. That means Ruger earns $0.144 in free cash flow on every $1 in sales. I bet that'll increase the next few years as Fifer and his team work to increase inventory turns, generating cash flow faster and more efficiently.

Shareholder Rewards – Dividends and Share Buybacks

Once I find a business that generates plenty of free cash flow, I have to make sure it's good at using it to create shareholder value. There are two primary ways to create shareholder value: dividends and share repurchases. Ruger does a great job with both of these.

Ruger bought back a lot of stock from 2006 to 2009, reducing its share count from 26.9 million on Dec. 31, 2005 to 19.1 million on February 17, 2009. It spent $30 million buying back shares in 2007 and 2008. It backed off in 2009, then spent another $7.7 million on buybacks in 2010 and 2011. Ruger didn't buy back any shares in 2012. I expect it'll continue buying back shares any time it feels they're undervalued.

Ruger has also done a fantastic job at ramping up its dividend. The company is committed to paying out 40% of its earnings per share in dividends. As earnings rise, so will the dividend. It should be expected to fluctuate a bit. It won't necessarily go up every single year, as it has been since 2006. But you're starting at a stout yield of 4.4%, more than double the S&P 500's 1.9% yield. So it's definitely worth owning today. As a fixed percentage of earnings, Ruger's dividend will probably fall some quarters and rise in others. But it'll grow with the overall business.

The quarterly dividend was cut in half in 2004 and eliminated completely in 2005. The dividend was reinstated in May 2009 at $0.086 per share. Today, it's up 655% to $0.65 per share. Ruger has raised its dividend in 12 out of the last 18 quarters. The annual dividend payout has risen every year since 2009. Mike Fifer and his team don't have a long dividend-paying history, but they have a great one.

I consider Ruger's regular quarterly dividend very safe and sustainable. There's also plenty of room for dividend growth. The quarterly dividend hasn't amounted to more than 22% of operating cash flows in any of the last three years. So it could double, and there would still be plenty of room to pay out more in dividends. The company is in expansion mode, starting up a third manufacturing facility. So it'll need some of its cash but not a lot

The third plant will be at an existing facility in North Carolina. The company isn't building a brand-new one. Mike Fifer has been very clear that Ruger will start the new plant in the most efficient, least expensive way. So it won't need to lay out huge amounts of capital to start it up.

Bottom line: I expect Ruger to have plenty of extra cash and continue raising its dividend over the next couple years.

Financial Fortress Balance Sheet

Folks who have plenty of cash on hand and no debt tend to sleep well at night. They have fewer financial worries. If their income falls, they can't go bankrupt by failing to make debt payments. That's Ruger's situation. It has zero debt and $64.8 million in cash.

Ruger likely won't pile up a huge amount of excess cash, the way companies like Apple and Microsoft do. It's far more attuned to shareholder interests than either of those two companies. Apple and Microsoft are great businesses. They gush enormous sums of cash but they don't dispose of the profits nearly as well as Ruger does. They could learn a lot from Ruger about creating value for shareholders.

Consistent Profit Margins

Ruger hasn't had the consistent profit margins we like to find. So, what's the next best thing to consistent margins? Improving margins. Check out the big, steady improvement in Ruger's gross, pretax, and net profit margins since 2004.

Profit margins deteriorated from 2005 to 2006 – years when the rest of the economy was booming. And they improved dramatically beginning in 2007, Fifer's first full year onboard. The 2008-2009 financial crisis doesn't seem to have affected Fifer's ability to wring more profit out of Ruger. Now THAT's a great businessman!

I expect Ruger to put up consistently good profit margins for as long as Fifer is CEO. I also expect his successor to do very well. Guys like Fifer are long-term oriented. I'm confident he'll choose a great successor when the time comes for him to move on.

Consistently High Returns on Equity

If a business were a bank account, return on equity (ROE) would be the interest rate you earn on the money you keep in the account. Let's go back to our Microsoft example to get a better understanding of how shareholder equity works.

Paying out dividends keeps a company's equity base smaller and returns on shareholder equity higher. Microsoft has more than $70 billion of cash it doesn't need. Its shareholder equity is about $79 billion. With $25 billion in free cash flow, it earns around 32% on equity right now.

But Microsoft could easily pay out $70 billion in cash, and still have an excellent balance sheet. In that case, shareholder equity would be around $9 billion. And ROE would be more than 270%. Few businesses outside the software industry have the opportunity to create this kind of value. If Microsoft bought back more shares and reduced its equity, remaining shares would be much more valuable than they are today.

Just as with its earnings, Ruger's ROE has not been consistently great but it's become consistently better since Fifer took over. In 2006, Ruger's ROE was just 1%. A business earning 1% on equity isn't worth owning. Today, its ROE is 63%. That's astounding growth. It's higher than Microsoft, because Microsoft hangs onto enormous amounts of cash it doesn't need. Ruger is much more efficient. And shareholders benefit from that with higher returns on the equity they buy and more dividend cash in their pockets.

Ruger is an incredibly well-managed business, growing like gangbusters. The company's emphasis on Toyota's efficient manufacturing style has helped it ramp production and sales up by several hundred percent in the last seven years. And despite politicians trying to push through restrictive new gun laws, demand for Ruger products is better than ever.

Ruger is a great dividend-payer. The stock yields 4.4% today. And management has made it clear that dividends will be a priority over the next few years. This is a great stock for income investors.

BUY Sturm, Ruger & Company (NYSE: RGR) up to $61 a share. Right now, shares are trading around $60. Use a 25% trailing stop. Please be patient if RGR is trading over our maximum buy price by the time you read this. Never pay a penny more than $61 per share.

I expect Ruger to put up consistently good profit margins for as long as Fifer is CEO. I also expect his successor to do very well. Guys like Fifer are long-term oriented. I'm confident he'll choose a great successor when the time comes for him to move on.

Consistently High Returns on Equity

If a business were a bank account, return on equity (ROE) would be the interest rate you earn on the money you keep in the account. Let's go back to our Microsoft example to get a better understanding of how shareholder equity works.

Paying out dividends keeps a company's equity base smaller and returns on shareholder equity higher. Microsoft has more than $70 billion of cash it doesn't need. Its shareholder equity is about $79 billion. With $25 billion in free cash flow, it earns around 32% on equity right now.

But Microsoft could easily pay out $70 billion in cash, and still have an excellent balance sheet. In that case, shareholder equity would be around $9 billion. And ROE would be more than 270%. Few businesses outside the software industry have the opportunity to create this kind of value. If Microsoft bought back more shares and reduced its equity, remaining shares would be much more valuable than they are today.

Just as with its earnings, Ruger's ROE has not been consistently great but it's become consistently better since Fifer took over. In 2006, Ruger's ROE was just 1%. A business earning 1% on equity isn't worth owning. Today, its ROE is 63%. That's astounding growth. It's higher than Microsoft, because Microsoft hangs onto enormous amounts of cash it doesn't need. Ruger is much more efficient. And shareholders benefit from that with higher returns on the equity they buy and more dividend cash in their pockets.

Ruger is an incredibly well-managed business, growing like gangbusters. The company's emphasis on Toyota's efficient manufacturing style has helped it ramp production and sales up by several hundred percent in the last seven years. And despite politicians trying to push through restrictive new gun laws, demand for Ruger products is better than ever.

Ruger is a great dividend-payer. The stock yields 4.4% today. And management has made it clear that dividends will be a priority over the next few years. This is a great stock for income investors.

BUY Sturm, Ruger & Company (NYSE: RGR) up to $61 a share. Right now, shares are trading around $60. Use a 25% trailing stop. Please be patient if RGR is trading over our maximum buy price by the time you read this. Never pay a penny more than $61 per share.