|

WORDS TO CONSIDER

The Two Big Reasons You'll Lose Money This Year

There are a lot of you out there that may be happy with your 401K producing an average 3% to 8% annual return. There may be a lot of you that think day trading is the way to go and you are happy with your annualized gains of 12% give or take 3%. Then there are the folks out there who for whatever reason have stagnant if not negative returns and are fed up with the market and the lying analysts. Whatever your case, please read the below article by Porter Stansberry. Now I think Porter is a total self-entitled PRICK and I am by no means endorsing his rip off newsletters. However, he occasionally makes sense and for once isn't blaming anything on President Obama. I think every investor should understand what's really going on in the markets to hedge against the tide. |

By Porter Stansberry

I've got bad news. It's something that I've talked about before: Most of you will never get rich with stocks. I'm fairly certain that, for most of you, investing in stocks will end up costing you money. If your experience is typical, you'll try investing in stocks two or three times in your lifetime.

Each attempt will end in disaster. And then you'll swear off stocks forever.

How do we know this? The market research firm Dalbar has conducted mutual-fund studies for decades. The work consistently shows that

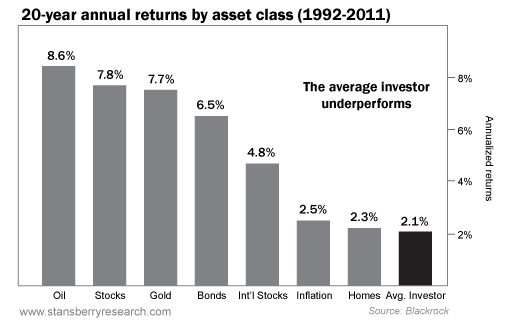

actual investor returns are far worse than the fund's advertised averages. Actual returns for stock-focused mutual funds have been around 3% annually – worse than returns from bonds and barely above the inflation rate. A separate big study from Blackrock shows essentially the same numbers.

I've got bad news. It's something that I've talked about before: Most of you will never get rich with stocks. I'm fairly certain that, for most of you, investing in stocks will end up costing you money. If your experience is typical, you'll try investing in stocks two or three times in your lifetime.

Each attempt will end in disaster. And then you'll swear off stocks forever.

How do we know this? The market research firm Dalbar has conducted mutual-fund studies for decades. The work consistently shows that

actual investor returns are far worse than the fund's advertised averages. Actual returns for stock-focused mutual funds have been around 3% annually – worse than returns from bonds and barely above the inflation rate. A separate big study from Blackrock shows essentially the same numbers.

You've got to remember that if the average return is 3% (or less), a lot of people, probably close to half, are actually losing money in stocks.

And the folks who are most likely to suffer losses are the folks, like newsletter readers, who do the most trading.

Most newsletter publishers wouldn't dare draw your attention to these facts. But I feel a moral obligation to tell you again and again. I believe

my job is to tell you what I'd want to know if our roles were reversed. I'm also telling you because if you can identify why most people lose money

in stocks, then you've got a much better chance of succeeding. I'd say it's almost a lock. So why do most people lose money in stocks?

The biggest reason individual investors lose money in the stock market is because the game is rigged against you. The financial industry does

not exist to enrich its clients. The clients provide all of the wealth required to maintain the financial industry.

If you're doing business with a big brokerage firm, you've got to realize that its real clients are the companies who hire the firm to sell you their stocks and bonds. You're the patsy at that table. Likewise, financial firms make their profits by garnering the most amounts of assets to manage even though everyone knows there's a negative correlation between an investment fund's size and its performance. The mainstream financial industry isn't your friend. They can't be trusted. They're leeches.

The second-most important factor is simply ignorance. Most investors have no idea how to value a security. Nor can they read financial statements. As a result, they always end up buying way too late and paying far too much. Or even worse, they buy stocks that have zero chance of long-term success. It's not hard to learn. It's really not. It will take you about 20 minutes to figure out the basics – if someone would simply sit down and show you. Longtime readers know I don't believe in teaching – only learning. If you'd like to learn, you can now sit down with me... and I'll show you how I analyze stocks.

My team at Stansberry Radio recently recorded a screen-capture video, where I analyze two stocks I covered in my newsletter. One I recommended selling short in 2004, betting it would fail. It is now on the verge of collapse. The other I recommended buying in 2007. It has now doubled in price. In the video, I go through the numbers and show in simple terms how I knew one was a great business and the other would fail. Anyone can use this video to become a vastly better investor. I urge everyone to watch this video. Here's the best part: It's free.

Click Here to view the video.

Now... once you understand how to value a business... asset allocation... and risk management... the other thing you've got to have to make a lot of money in stocks is money to invest. How can you get more money to invest? Rob a bank. No, seriously, there are a lot of proven ways to increase your income. Before you flood the mailbag with e-mails complaining that you've had the same job for a decade and your boss hasn't given you a raise in years, hear me out.

First step: You need to stop waiting on your boss to give you a raise. There are endless opportunities for intelligent and motivated people to earn extra money (sometimes considerable money) while still working a full-time job. And nobody knows more about this than my friend and mentor Mark Ford.

Mark is a serially successful entrepreneur. He's built three $100 million businesses and dozens of other successful small businesses – all while working full-time on other projects. He's also a New York Times bestselling author, who's written seven books on the topic of entrepreneurship. Mark is a master at the fundamentals of wealth creation. How do I know Mark's ideas work? Because I followed his guidance step by step as I built this business, which I founded when I was 26 years old. I know his ideas work.

The fact is, even if you're a great investor, it's almost impossible to get wealthy from investments alone. If you realistically hope to get wealthy in less than a decade, you MUST increase your income. And that means you need to know the principles and specific techniques of wealth creation.

It all begins with a primer on how to spend the money you have now so that you are maximizing your wealth. You must also create multiple streams of income. Rental real estate (which is where I have personally been putting a large part of my wealth) is a great entrepreneurial venture and is

probably the fastest way to build wealth. To increase your income so that you've got plenty of capital to invest... I'd strongly recommend you get to know Mark Ford's ideas.

And the folks who are most likely to suffer losses are the folks, like newsletter readers, who do the most trading.

Most newsletter publishers wouldn't dare draw your attention to these facts. But I feel a moral obligation to tell you again and again. I believe

my job is to tell you what I'd want to know if our roles were reversed. I'm also telling you because if you can identify why most people lose money

in stocks, then you've got a much better chance of succeeding. I'd say it's almost a lock. So why do most people lose money in stocks?

The biggest reason individual investors lose money in the stock market is because the game is rigged against you. The financial industry does

not exist to enrich its clients. The clients provide all of the wealth required to maintain the financial industry.

If you're doing business with a big brokerage firm, you've got to realize that its real clients are the companies who hire the firm to sell you their stocks and bonds. You're the patsy at that table. Likewise, financial firms make their profits by garnering the most amounts of assets to manage even though everyone knows there's a negative correlation between an investment fund's size and its performance. The mainstream financial industry isn't your friend. They can't be trusted. They're leeches.

The second-most important factor is simply ignorance. Most investors have no idea how to value a security. Nor can they read financial statements. As a result, they always end up buying way too late and paying far too much. Or even worse, they buy stocks that have zero chance of long-term success. It's not hard to learn. It's really not. It will take you about 20 minutes to figure out the basics – if someone would simply sit down and show you. Longtime readers know I don't believe in teaching – only learning. If you'd like to learn, you can now sit down with me... and I'll show you how I analyze stocks.

My team at Stansberry Radio recently recorded a screen-capture video, where I analyze two stocks I covered in my newsletter. One I recommended selling short in 2004, betting it would fail. It is now on the verge of collapse. The other I recommended buying in 2007. It has now doubled in price. In the video, I go through the numbers and show in simple terms how I knew one was a great business and the other would fail. Anyone can use this video to become a vastly better investor. I urge everyone to watch this video. Here's the best part: It's free.

Click Here to view the video.

Now... once you understand how to value a business... asset allocation... and risk management... the other thing you've got to have to make a lot of money in stocks is money to invest. How can you get more money to invest? Rob a bank. No, seriously, there are a lot of proven ways to increase your income. Before you flood the mailbag with e-mails complaining that you've had the same job for a decade and your boss hasn't given you a raise in years, hear me out.

First step: You need to stop waiting on your boss to give you a raise. There are endless opportunities for intelligent and motivated people to earn extra money (sometimes considerable money) while still working a full-time job. And nobody knows more about this than my friend and mentor Mark Ford.

Mark is a serially successful entrepreneur. He's built three $100 million businesses and dozens of other successful small businesses – all while working full-time on other projects. He's also a New York Times bestselling author, who's written seven books on the topic of entrepreneurship. Mark is a master at the fundamentals of wealth creation. How do I know Mark's ideas work? Because I followed his guidance step by step as I built this business, which I founded when I was 26 years old. I know his ideas work.

The fact is, even if you're a great investor, it's almost impossible to get wealthy from investments alone. If you realistically hope to get wealthy in less than a decade, you MUST increase your income. And that means you need to know the principles and specific techniques of wealth creation.

It all begins with a primer on how to spend the money you have now so that you are maximizing your wealth. You must also create multiple streams of income. Rental real estate (which is where I have personally been putting a large part of my wealth) is a great entrepreneurial venture and is

probably the fastest way to build wealth. To increase your income so that you've got plenty of capital to invest... I'd strongly recommend you get to know Mark Ford's ideas.