| RETIRE RICH PROFILED: Kinder Morgan Management, LLC (NYSE: KMR) It's very important to understand the tax implications of investing in MLPs. I highly recommend seeking the advice of a tax professional, preferably a certified public accountant or licensed attorney with years of experience in taxes, before jumping in to any position. |

Tax Pitfalls for Young MLP Investors

MLP investments work well for older, retired investors. But if you're a young person, you might want to think twice about owning an MLP for too long. According to the National Association of Publicly Traded Partnerships, "As long as your adjusted [cost] basis is above zero, tax on your distributions is deferred until you sell your units."

Notice in that quote it says, "as long as your adjusted [cost] basis is above zero." Your cost basis is how much you paid for your MLP units. When you receive a distribution that's qualified as "return of capital," it isn't counted as income but it does reduce your cost basis.

For example, if you paid $20 a share and receive a $1 return of capital distribution, your new cost basis is $19 for future tax purposes. So after $20 in distributions, your cost basis goes to zero. When that happens, all future distributions paid to you are no longer sheltered as return of capital, but instead become fully taxable. So when an MLP's cost basis gets to zero, one of the primary reasons for owning it disappears.

So if you're young, invest in an MLP, and own it for a long time... your adjusted cost basis could go below zero. If that happens, you could incur a huge tax liability when you sell.

A Safe, High-Yield Stock for Your Retirement Account

There's one primary reason you want to own MLPs: high-yield, tax-advantaged income.

These companies pay out the bulk of their cash flow in dividends. Most MLPs pay much higher yields than regular stocks. The average S&P 500 stock pays less than 2%. You can't retire on that. Many MLPs pay 7% and higher. One of our current recommendations, Vanguard Natural Resources (NYSE: VNR), has a current yield of almost 9% today. Now that's a retirement-sized income.

They also have excellent tax benefits... You don't usually have to pay any tax on income until you sell your shares. And according to the National Association of Publicly Traded Partnerships, if you leave your MLP units to your heirs, they don't need to pay tax on the income you collected. Imagine earning a high-yield income in the last few decades of your life, paying little or no tax on it, then leaving the MLP units to your heirs knowing they won't pay tax on your distributions, either.

MLPs are great investments. But there's one big problem that has kept many investors from earning a high-yield income in MLPs. Investing in MLPs through your IRA or other retirement account can eliminate the tax advantages that come with the MLP. You could wind up paying tax on your retirement account. Your tax-advantaged income could become regular taxable income. For most investors, putting an MLP into a retirement account defeats the whole purpose of both the MLP and the retirement account. We've found a way around these risks.

There is a way for you to earn high-yield, growing income in your retirement account, without giving up any of the tax advantages of an MLP. Even better, this month's recommendation doesn't require the tedious paperwork at tax time that is normally associated with MLPs.

The Best Way to Avoid MLP Tax Headaches and Still Earn a High Yield in Your Retirement Account

Our opportunity this month is a rare one. It's a special type of MLP you can put in your tax-advantaged retirement account. It doesn't expose you to additional tax risk. It doesn't require extra paperwork at tax time. And it still earns you a high yield, just like a good MLP should. Before we go any further, let's make something very, very clear.

We've done plenty of research on the opportunity we're about to describe. We believe that for many investors, it'll rid them of "unrelated business taxable income" (UBTI) and other tax-related headaches. But we're just making a generalization. We don't give individual tax advice. So before putting your money into any type of MLP or MLP-related investment, you should always check with a tax professional first.

Now that we've got that out of the way, let's take a look at the best way to avoid MLP tax headaches and still earn a high-yield income in your retirement account.

Our brand-new recommendation this month is pipeline operator Kinder Morgan Management, LLC (NYSE: KMR). It's not Kinder Morgan Energy Partners (KMP), the well-known MLP. Nor is it Kinder Morgan, Inc. (KMI), KMP's general partner.

KMR is a company created simply to eliminate the tax problems and extra paperwork that comes with an MLP. It has no employees. It has no properties. And it has only one asset – its holding of KMP units... but with one difference. KMR doesn't pay cash distributions to its shareholders. (And because of that, there are no K-1 or 1099 tax forms to fill out.) It "pays" shareholders by issuing new shares.

KMP unitholders receive cash distributions. KMR also receives distributions from KMP. But it doesn't receive those distributions in cash. It receives them in additional, non-cash paying units called i-units. KMR shareholders in turn receive their distributions in additional KMR shares.

You can think of KMR like a zero-hassle dividend reinvestment plan (DRIP) for KMP. Owning KMR won't give you cash income now, but it will compound your income by automatically reinvesting your KMP distributions in new shares. Each quarter when KMP pays out a cash distribution (it currently yields 6.2%), you'll receive whole or partial shares of KMR that are of a similar value to the KMP cash payment. (This should look familiar to anyone who already participates in a DRIP.) You could wind up with $108,000 for every $10,000 invested.

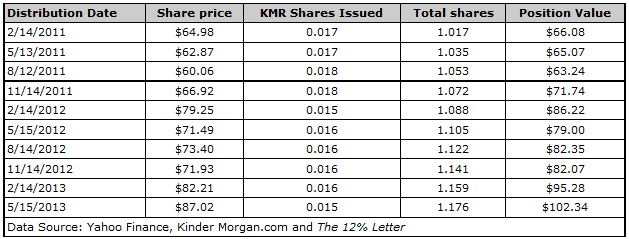

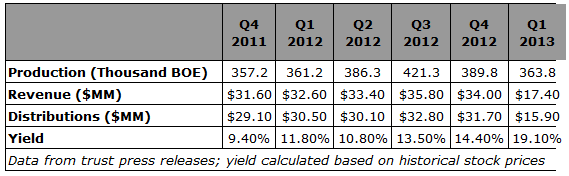

Here's an example using the last two years of KMP distributions... To keep it simple, let's say you bought just one share of KMR at $64.89 in early 2011. KMP paid a distribution to KMR on February 14. You received 0.017393 KMR shares (we shorten that number in the table below) leaving you with 1.017393 shares and a total position value of $66.08. Here's how that would have played out over the following two years.

MLP investments work well for older, retired investors. But if you're a young person, you might want to think twice about owning an MLP for too long. According to the National Association of Publicly Traded Partnerships, "As long as your adjusted [cost] basis is above zero, tax on your distributions is deferred until you sell your units."

Notice in that quote it says, "as long as your adjusted [cost] basis is above zero." Your cost basis is how much you paid for your MLP units. When you receive a distribution that's qualified as "return of capital," it isn't counted as income but it does reduce your cost basis.

For example, if you paid $20 a share and receive a $1 return of capital distribution, your new cost basis is $19 for future tax purposes. So after $20 in distributions, your cost basis goes to zero. When that happens, all future distributions paid to you are no longer sheltered as return of capital, but instead become fully taxable. So when an MLP's cost basis gets to zero, one of the primary reasons for owning it disappears.

So if you're young, invest in an MLP, and own it for a long time... your adjusted cost basis could go below zero. If that happens, you could incur a huge tax liability when you sell.

A Safe, High-Yield Stock for Your Retirement Account

There's one primary reason you want to own MLPs: high-yield, tax-advantaged income.

These companies pay out the bulk of their cash flow in dividends. Most MLPs pay much higher yields than regular stocks. The average S&P 500 stock pays less than 2%. You can't retire on that. Many MLPs pay 7% and higher. One of our current recommendations, Vanguard Natural Resources (NYSE: VNR), has a current yield of almost 9% today. Now that's a retirement-sized income.

They also have excellent tax benefits... You don't usually have to pay any tax on income until you sell your shares. And according to the National Association of Publicly Traded Partnerships, if you leave your MLP units to your heirs, they don't need to pay tax on the income you collected. Imagine earning a high-yield income in the last few decades of your life, paying little or no tax on it, then leaving the MLP units to your heirs knowing they won't pay tax on your distributions, either.

MLPs are great investments. But there's one big problem that has kept many investors from earning a high-yield income in MLPs. Investing in MLPs through your IRA or other retirement account can eliminate the tax advantages that come with the MLP. You could wind up paying tax on your retirement account. Your tax-advantaged income could become regular taxable income. For most investors, putting an MLP into a retirement account defeats the whole purpose of both the MLP and the retirement account. We've found a way around these risks.

There is a way for you to earn high-yield, growing income in your retirement account, without giving up any of the tax advantages of an MLP. Even better, this month's recommendation doesn't require the tedious paperwork at tax time that is normally associated with MLPs.

The Best Way to Avoid MLP Tax Headaches and Still Earn a High Yield in Your Retirement Account

Our opportunity this month is a rare one. It's a special type of MLP you can put in your tax-advantaged retirement account. It doesn't expose you to additional tax risk. It doesn't require extra paperwork at tax time. And it still earns you a high yield, just like a good MLP should. Before we go any further, let's make something very, very clear.

We've done plenty of research on the opportunity we're about to describe. We believe that for many investors, it'll rid them of "unrelated business taxable income" (UBTI) and other tax-related headaches. But we're just making a generalization. We don't give individual tax advice. So before putting your money into any type of MLP or MLP-related investment, you should always check with a tax professional first.

Now that we've got that out of the way, let's take a look at the best way to avoid MLP tax headaches and still earn a high-yield income in your retirement account.

Our brand-new recommendation this month is pipeline operator Kinder Morgan Management, LLC (NYSE: KMR). It's not Kinder Morgan Energy Partners (KMP), the well-known MLP. Nor is it Kinder Morgan, Inc. (KMI), KMP's general partner.

KMR is a company created simply to eliminate the tax problems and extra paperwork that comes with an MLP. It has no employees. It has no properties. And it has only one asset – its holding of KMP units... but with one difference. KMR doesn't pay cash distributions to its shareholders. (And because of that, there are no K-1 or 1099 tax forms to fill out.) It "pays" shareholders by issuing new shares.

KMP unitholders receive cash distributions. KMR also receives distributions from KMP. But it doesn't receive those distributions in cash. It receives them in additional, non-cash paying units called i-units. KMR shareholders in turn receive their distributions in additional KMR shares.

You can think of KMR like a zero-hassle dividend reinvestment plan (DRIP) for KMP. Owning KMR won't give you cash income now, but it will compound your income by automatically reinvesting your KMP distributions in new shares. Each quarter when KMP pays out a cash distribution (it currently yields 6.2%), you'll receive whole or partial shares of KMR that are of a similar value to the KMP cash payment. (This should look familiar to anyone who already participates in a DRIP.) You could wind up with $108,000 for every $10,000 invested.

Here's an example using the last two years of KMP distributions... To keep it simple, let's say you bought just one share of KMR at $64.89 in early 2011. KMP paid a distribution to KMR on February 14. You received 0.017393 KMR shares (we shorten that number in the table below) leaving you with 1.017393 shares and a total position value of $66.08. Here's how that would have played out over the following two years.

In 2011, your KMR share was worth $64.89. On May 15, 2013, KMR closed at $87.02. So after two years of compounding, your KMR stake would have been worth $102.34 – a 57.5% return. That's two years of compounding at an astounding rate: 25.5% a year. No income taxes to pay. No K-1s or 1099s. No DRIP to enroll in. Plus, the stock has earned a higher return than KMP over the last 12 years.

Since KMR went public in early 2001, it has generated a 15.2% compound total return. KMP generated a total return of just 14.6% during the same period. Since 2001, KMR has outperformed KMP, the S&P 500, and the Alerian MLP index – a composite of the 50 most prominent MLPs. Just look at the chart below.

Since KMR went public in early 2001, it has generated a 15.2% compound total return. KMP generated a total return of just 14.6% during the same period. Since 2001, KMR has outperformed KMP, the S&P 500, and the Alerian MLP index – a composite of the 50 most prominent MLPs. Just look at the chart below.

MLPs did better than the rest of the stock market. KMP did better than most MLPs. And KMR did the best out of all of them. Not only is KMR's total return outperforming that of KMP, but the stock is more popular with many Kinder Morgan insiders than KMP is. Company insiders have bought $14.7 million worth of KMR since 2001. They bought just $4.5 million worth of KMP units since then.

KMP is one of the most popular MLP stocks around. It's got a stellar reputation. And KMR has consistently been a better way to own the MLP than buying KMP outright. The bottom line is this: An investment in KMR is essentially an investment in KMP with the same tax benefits but none of the hassles. So to better understand our investment, let's take a look at the energy pipeline operator that gives KMR its value...Kinder Morgan Energy Partners.

This Highly Diversified, Blue-Chip MLP is Right for Most Income Investors

Kinder Morgan Energy Partners was founded by chairman and CEO Rich Kinder when he left energy, commodities, and services company Enron in 1997.

Kinder wanted to become CEO of Enron. If he'd gotten the job, I bet Enron would still be around today and thriving. But his bid for the top spot was blocked by Ken Lay. Lay went on to play a key role in the fraud that destroyed Enron in one of the biggest corporate bankruptcies in history.

Before he left the company, Kinder negotiated a deal to buy a business called Enron Liquids Pipelines (ELP). ELP's assets included two natural gas liquids (NGLs) pipelines (to transport hydrocarbons like propane, butane, and ethane), one carbon dioxide pipeline, and a coal-shipping terminal. Kinder then contacted an old classmate, Bill Morgan, and ELP became Kinder Morgan.

The company hasn't changed its basic strategy since the day it started up in 1997. In his 2012 shareholder letter, Kinder wrote...

Kinder Morgan Energy Partners, L.P. (NYSE: KMP) has implemented the same strategy since current management took over in February of 1997. Unimaginative? Boring? We don't think so. We focus on owning and operating stable, fee-based assets that are core to North American energy infrastructure.

KMP earned $8.6 billion in revenues last year. Its latest balance sheet shows total assets of $35 billion. Most of its assets earn fees that aren't exposed to changes in commodity prices. So it's a classic MLP, generating plenty of stable income.

It has five main business groups: Natural gas pipelines (including natural gas storage), refined products pipelines (like gasoline and jet fuel), terminals (transportation hubs for moving commodities), carbon dioxide (for getting more oil out of old wells), and Kinder Morgan Canada, which owns a crude oil pipeline system.

Over the last 10 years, KMP's debt has never reached more than 3.8 times earnings before interest, taxes, depreciation, and amortization (EBITDA) – a key cash flow metric that lenders and bondholders use to make sure a company doesn't have too much debt. Less than four times EBITDA is conservative for a company like KMP... that produces steady income through long-term contracts with its customers. Based on history, we don't need to worry about KMP piling up debt.

KMP is just one of four publicly traded companies that make up the third-largest energy company in North America, Kinder Morgan. The other three are KMR, the general partner (KMI), and an affiliated company called El Paso Pipeline Partners (EPB). The company has a dominant presence in several energy-related markets.

Kinder Morgan is the largest natural gas pipeline network in the U.S., with 23% of the nation's total gas pipeline mileage. It owns interest in 70,000 miles of natural gas pipeline and operates almost all of it. The company's natural gas pipeline network is connected to every major natural gas shale play in the U.S.: Eagle Ford (Texas), Marcellus (Pennsylvania), Utica (Ohio), Uintah (Utah), Haynesville (Louisiana), Fayetteville (Arkansas), and Barnett (Texas). Its geographic diversification helps reduce your risk exposure to any single area of the country.

Kinder Morgan is the largest natural gas storage operator in the U.S. It has over 320 billion cubic feet of natural gas storage. According to the U.S. Energy Information Administration, that's more than 7% of the total underground natural gas storage capacity in the U.S Most of its storage is associated with its larger natural gas pipeline networks. For example, the two largest pipeline systems in Kinder Morgan's Texas intrastate pipeline group consist of 5,800 miles of natural gas pipelines within the state of Texas. Also connected to that system is 125 billion cubic feet of natural gas storage. That's a massive amount of storage.

Kinder Morgan is the largest independent transporter of refined petroleum products in the U.S. It transports approximately 1.9 million barrels per day of gasoline, jet fuel, diesel fuel, NGLs, and other fuels through over 8,000 miles of pipelines. This business also includes 62 transportation terminals and petroleum processing around the U.S.

Kinder Morgan is the largest transporter of carbon dioxide in the U.S. Carbon dioxide is pumped into oil wells to get more oil out of them. Kinder Morgan moves about 1.3 billion cubic feet of carbon dioxide per day through roughly 1,300 miles of pipelines. It serves the Permian Basin, which accounts for 20% of U.S. oil production.

Kinder Morgan is the largest independent terminal operator in the U.S. It owns interests in or operates about 180 refined petroleum and dry-bulk terminals in every region of the U.S. and in western Canada. (These terminals are like bus stations for energy commodities. But instead of buses, commodities travel by truck, barge, and rail.) Kinder Morgan terminals handle 112 million barrels a year of refined petroleum products – like gasoline, jet fuel, and diesel – and 106 million tons a year of dry-bulk commodities – like coal, petroleum coke, and various steel products.

Kinder Morgan owns the only Canadian oil sands pipeline serving the west coast of North America. The pipeline transports 300,000 barrels per day of heavy oil from western Canada's oil sands region to Vancouver, Washington. It's currently working to expand the capacity to 890,000 barrels per day. By investing in Kinder Morgan, you get a piece of an enormous, diversified portfolio of energy infrastructure assets.

As you can see, Kinder Morgan plays a big role in energy transportation and storage. That makes it an excellent way to exploit the American Industrial Renaissance (the "AIR").

Three Growth Prospects From Our Newest "AIR" Play

Huge new discoveries of oil and natural gas are being made every day in America. We call it the American Industrial Renaissance. Massive supplies have created an abundance of cheap fuel and raw materials for hundreds of manufactured products including diesel fuel, plastics, clothing, fencing, tires, and toys. This creates an opportunity to profit on the companies that specialize in transporting, storing, and processing large amounts of oil and gas. There isn't a larger source of high-yield income ideas right now than the AIR. And Kinder Morgan is the next company set to profit from it.

KMP owns pipelines and other assets in or near most of the major oil- and gas-producing shales in the United States. It has a five-year backlog of more than $13 billion of expansion projects. And it has three growth projects in place to exploit one aspect of the AIR you likely won't hear about in the financial press.

It's called condensate. Condensate is like a very light version of crude oil. It naturally occurs suspended in natural gas as a liquid, like other NGLs. Condensate is used to produce naphtha, a key raw material used to make chemicals and gasoline.

Today, huge amounts of oil and natural gas are being produced in the Eagle Ford Shale in Texas. There's also an enormous amount of condensate coming out of the Eagle Ford. The Texas Railroad Commission estimates 229 barrels per day of condensate were produced in the Eagle Ford in 2008. It estimates that 97,000 barrels per day were produced in the first quarter of 2013 – a 423-fold increase in about five years.

Kinder Morgan has a contract with condensate producer BP North America to process the Eagle Ford condensate. To fulfill the contract, KMP is building a "condensate splitter" – which separates condensate from other liquids – near its Galena Park terminal in the Houston Ship Channel, a major transportation point for hydrocarbons in North America. BP is one of the top five landholders in the Eagle Ford – with over 400,000 acres. So it will produce a lot of condensate for many years to come. And Kinder Morgan will ship much of it.

Kinder Morgan also built a crude oil/condensate pipeline, the KMCC. This pipeline links the Eagle Ford to multiple shipping terminals in the Houston Ship Channel, eventually serving refineries and chemical plants along the Gulf Coast. For its third growth project, Kinder Morgan is spending about $260 million to reverse the flow of its Cochin Pipeline to ship condensate from Kankakee County, Illinois to terminals in Alberta, Canada. Kinder Morgan has commitments to ship 85,000 barrels per day for a minimum of 10 years. The project includes construction of a 1 million barrel tank farm for storing condensate.

Condensate shipments are expected to begin moving through Cochin by July 1, 2014. Condensate will be shipped to Canada so it can be used to dilute Canada's "gooey" heavy oil deposits, enabling them to flow through pipelines. Kinder Morgan also anticipates it will invest $60 million in a pipeline project designed to help move Canadian oil to U.S. refineries. I expect we'll hear more about condensate in the next few years.

Besides its huge, diversified presence in North American energy infrastructure, Kinder Morgan also has a healthy management culture...

This Isn't Your Typical Shareholder-Funded Gravy Train

Energy Transfer Partners (ETP) CEO Kelcy Warren gets $1 in annual salary and receives no other bonus or compensation, except for just over $3,000 a year in payroll deductions for medical benefits. Otherwise, the only compensation he gets is the same as Energy Transfer unitholders: the cash distributions paid out by the company he manages. That means shareholder value is likely at the top of his mind at all times. If shareholders make money, he makes money.

Kinder Morgan CEO Rich Kinder has the same deal. Kinder gets just $1 in annual salary. He has no other compensation and no retirement benefits. He owns 315,979 KMP units and 294,952 KMR shares. He also owns shares in the general partner, KMI. So he gets paid the same way you do – through his stake in the company.

Naturally, shareholder value is always at the top of Kinder's mind. He sees company money as shareholder money, and he doesn't like executives (including himself) to waste it. He reimburses the company for his portion of the health care premiums and parking expenses. The guy pays for his own parking. This is highly unusual. Nearly every CEO at every publicly traded company in existence wants all the salary and perks he can get. Kinder and Warren aren't like that.

Kinder Morgan has no executive perquisites, no supplemental executive retirement plans, and no deferred compensation or split-dollar life insurance programs. It has no executive company cars or executive car allowances. It doesn't pay for financial planning services. It doesn't own a corporate jet. And it doesn't pay for executives to fly first class.

Kinder Morgan admits in its annual report that its executive compensation package is not competitive with similar companies, but it has no plans to start offering executive perks. Kinder Morgan doesn't have employment agreements with anyone except Richard Kinder. It doesn't have fancy change of control agreements, either, where executives get a big bonus if the company is acquired. Shareholder value is clearly important to Kinder Morgan. And it delivers.

Turn $8,300 into $108,000 With KMR

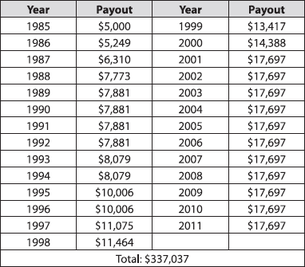

KMP has raised its cash distributions every year since 1997. For the last 10 years, it's grown its distribution at about 7.5% per year.

KMP is one of the most popular MLP stocks around. It's got a stellar reputation. And KMR has consistently been a better way to own the MLP than buying KMP outright. The bottom line is this: An investment in KMR is essentially an investment in KMP with the same tax benefits but none of the hassles. So to better understand our investment, let's take a look at the energy pipeline operator that gives KMR its value...Kinder Morgan Energy Partners.

This Highly Diversified, Blue-Chip MLP is Right for Most Income Investors

Kinder Morgan Energy Partners was founded by chairman and CEO Rich Kinder when he left energy, commodities, and services company Enron in 1997.

Kinder wanted to become CEO of Enron. If he'd gotten the job, I bet Enron would still be around today and thriving. But his bid for the top spot was blocked by Ken Lay. Lay went on to play a key role in the fraud that destroyed Enron in one of the biggest corporate bankruptcies in history.

Before he left the company, Kinder negotiated a deal to buy a business called Enron Liquids Pipelines (ELP). ELP's assets included two natural gas liquids (NGLs) pipelines (to transport hydrocarbons like propane, butane, and ethane), one carbon dioxide pipeline, and a coal-shipping terminal. Kinder then contacted an old classmate, Bill Morgan, and ELP became Kinder Morgan.

The company hasn't changed its basic strategy since the day it started up in 1997. In his 2012 shareholder letter, Kinder wrote...

Kinder Morgan Energy Partners, L.P. (NYSE: KMP) has implemented the same strategy since current management took over in February of 1997. Unimaginative? Boring? We don't think so. We focus on owning and operating stable, fee-based assets that are core to North American energy infrastructure.

KMP earned $8.6 billion in revenues last year. Its latest balance sheet shows total assets of $35 billion. Most of its assets earn fees that aren't exposed to changes in commodity prices. So it's a classic MLP, generating plenty of stable income.

It has five main business groups: Natural gas pipelines (including natural gas storage), refined products pipelines (like gasoline and jet fuel), terminals (transportation hubs for moving commodities), carbon dioxide (for getting more oil out of old wells), and Kinder Morgan Canada, which owns a crude oil pipeline system.

Over the last 10 years, KMP's debt has never reached more than 3.8 times earnings before interest, taxes, depreciation, and amortization (EBITDA) – a key cash flow metric that lenders and bondholders use to make sure a company doesn't have too much debt. Less than four times EBITDA is conservative for a company like KMP... that produces steady income through long-term contracts with its customers. Based on history, we don't need to worry about KMP piling up debt.

KMP is just one of four publicly traded companies that make up the third-largest energy company in North America, Kinder Morgan. The other three are KMR, the general partner (KMI), and an affiliated company called El Paso Pipeline Partners (EPB). The company has a dominant presence in several energy-related markets.

Kinder Morgan is the largest natural gas pipeline network in the U.S., with 23% of the nation's total gas pipeline mileage. It owns interest in 70,000 miles of natural gas pipeline and operates almost all of it. The company's natural gas pipeline network is connected to every major natural gas shale play in the U.S.: Eagle Ford (Texas), Marcellus (Pennsylvania), Utica (Ohio), Uintah (Utah), Haynesville (Louisiana), Fayetteville (Arkansas), and Barnett (Texas). Its geographic diversification helps reduce your risk exposure to any single area of the country.

Kinder Morgan is the largest natural gas storage operator in the U.S. It has over 320 billion cubic feet of natural gas storage. According to the U.S. Energy Information Administration, that's more than 7% of the total underground natural gas storage capacity in the U.S Most of its storage is associated with its larger natural gas pipeline networks. For example, the two largest pipeline systems in Kinder Morgan's Texas intrastate pipeline group consist of 5,800 miles of natural gas pipelines within the state of Texas. Also connected to that system is 125 billion cubic feet of natural gas storage. That's a massive amount of storage.

Kinder Morgan is the largest independent transporter of refined petroleum products in the U.S. It transports approximately 1.9 million barrels per day of gasoline, jet fuel, diesel fuel, NGLs, and other fuels through over 8,000 miles of pipelines. This business also includes 62 transportation terminals and petroleum processing around the U.S.

Kinder Morgan is the largest transporter of carbon dioxide in the U.S. Carbon dioxide is pumped into oil wells to get more oil out of them. Kinder Morgan moves about 1.3 billion cubic feet of carbon dioxide per day through roughly 1,300 miles of pipelines. It serves the Permian Basin, which accounts for 20% of U.S. oil production.

Kinder Morgan is the largest independent terminal operator in the U.S. It owns interests in or operates about 180 refined petroleum and dry-bulk terminals in every region of the U.S. and in western Canada. (These terminals are like bus stations for energy commodities. But instead of buses, commodities travel by truck, barge, and rail.) Kinder Morgan terminals handle 112 million barrels a year of refined petroleum products – like gasoline, jet fuel, and diesel – and 106 million tons a year of dry-bulk commodities – like coal, petroleum coke, and various steel products.

Kinder Morgan owns the only Canadian oil sands pipeline serving the west coast of North America. The pipeline transports 300,000 barrels per day of heavy oil from western Canada's oil sands region to Vancouver, Washington. It's currently working to expand the capacity to 890,000 barrels per day. By investing in Kinder Morgan, you get a piece of an enormous, diversified portfolio of energy infrastructure assets.

As you can see, Kinder Morgan plays a big role in energy transportation and storage. That makes it an excellent way to exploit the American Industrial Renaissance (the "AIR").

Three Growth Prospects From Our Newest "AIR" Play

Huge new discoveries of oil and natural gas are being made every day in America. We call it the American Industrial Renaissance. Massive supplies have created an abundance of cheap fuel and raw materials for hundreds of manufactured products including diesel fuel, plastics, clothing, fencing, tires, and toys. This creates an opportunity to profit on the companies that specialize in transporting, storing, and processing large amounts of oil and gas. There isn't a larger source of high-yield income ideas right now than the AIR. And Kinder Morgan is the next company set to profit from it.

KMP owns pipelines and other assets in or near most of the major oil- and gas-producing shales in the United States. It has a five-year backlog of more than $13 billion of expansion projects. And it has three growth projects in place to exploit one aspect of the AIR you likely won't hear about in the financial press.

It's called condensate. Condensate is like a very light version of crude oil. It naturally occurs suspended in natural gas as a liquid, like other NGLs. Condensate is used to produce naphtha, a key raw material used to make chemicals and gasoline.

Today, huge amounts of oil and natural gas are being produced in the Eagle Ford Shale in Texas. There's also an enormous amount of condensate coming out of the Eagle Ford. The Texas Railroad Commission estimates 229 barrels per day of condensate were produced in the Eagle Ford in 2008. It estimates that 97,000 barrels per day were produced in the first quarter of 2013 – a 423-fold increase in about five years.

Kinder Morgan has a contract with condensate producer BP North America to process the Eagle Ford condensate. To fulfill the contract, KMP is building a "condensate splitter" – which separates condensate from other liquids – near its Galena Park terminal in the Houston Ship Channel, a major transportation point for hydrocarbons in North America. BP is one of the top five landholders in the Eagle Ford – with over 400,000 acres. So it will produce a lot of condensate for many years to come. And Kinder Morgan will ship much of it.

Kinder Morgan also built a crude oil/condensate pipeline, the KMCC. This pipeline links the Eagle Ford to multiple shipping terminals in the Houston Ship Channel, eventually serving refineries and chemical plants along the Gulf Coast. For its third growth project, Kinder Morgan is spending about $260 million to reverse the flow of its Cochin Pipeline to ship condensate from Kankakee County, Illinois to terminals in Alberta, Canada. Kinder Morgan has commitments to ship 85,000 barrels per day for a minimum of 10 years. The project includes construction of a 1 million barrel tank farm for storing condensate.

Condensate shipments are expected to begin moving through Cochin by July 1, 2014. Condensate will be shipped to Canada so it can be used to dilute Canada's "gooey" heavy oil deposits, enabling them to flow through pipelines. Kinder Morgan also anticipates it will invest $60 million in a pipeline project designed to help move Canadian oil to U.S. refineries. I expect we'll hear more about condensate in the next few years.

Besides its huge, diversified presence in North American energy infrastructure, Kinder Morgan also has a healthy management culture...

This Isn't Your Typical Shareholder-Funded Gravy Train

Energy Transfer Partners (ETP) CEO Kelcy Warren gets $1 in annual salary and receives no other bonus or compensation, except for just over $3,000 a year in payroll deductions for medical benefits. Otherwise, the only compensation he gets is the same as Energy Transfer unitholders: the cash distributions paid out by the company he manages. That means shareholder value is likely at the top of his mind at all times. If shareholders make money, he makes money.

Kinder Morgan CEO Rich Kinder has the same deal. Kinder gets just $1 in annual salary. He has no other compensation and no retirement benefits. He owns 315,979 KMP units and 294,952 KMR shares. He also owns shares in the general partner, KMI. So he gets paid the same way you do – through his stake in the company.

Naturally, shareholder value is always at the top of Kinder's mind. He sees company money as shareholder money, and he doesn't like executives (including himself) to waste it. He reimburses the company for his portion of the health care premiums and parking expenses. The guy pays for his own parking. This is highly unusual. Nearly every CEO at every publicly traded company in existence wants all the salary and perks he can get. Kinder and Warren aren't like that.

Kinder Morgan has no executive perquisites, no supplemental executive retirement plans, and no deferred compensation or split-dollar life insurance programs. It has no executive company cars or executive car allowances. It doesn't pay for financial planning services. It doesn't own a corporate jet. And it doesn't pay for executives to fly first class.

Kinder Morgan admits in its annual report that its executive compensation package is not competitive with similar companies, but it has no plans to start offering executive perks. Kinder Morgan doesn't have employment agreements with anyone except Richard Kinder. It doesn't have fancy change of control agreements, either, where executives get a big bonus if the company is acquired. Shareholder value is clearly important to Kinder Morgan. And it delivers.

Turn $8,300 into $108,000 With KMR

KMP has raised its cash distributions every year since 1997. For the last 10 years, it's grown its distribution at about 7.5% per year.

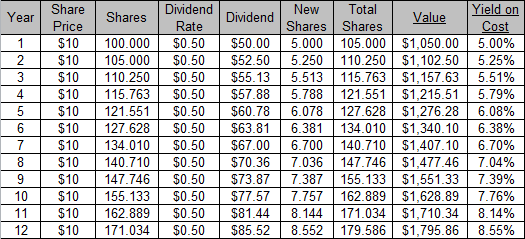

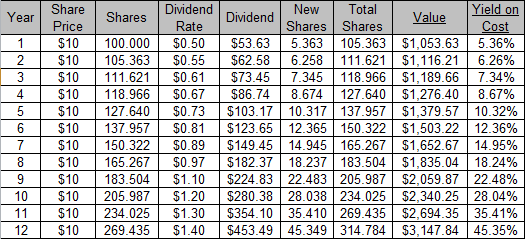

We always recommend reinvesting dividends with every investment you make. It's a great way to compound money over time. KMR pays you shares roughly equal to KMP's dividend. So it automatically reinvests KMP distribution payments into new shares for you. You get KMP's growing income stream – without the tax hassles and extra paperwork of owning an MLP.

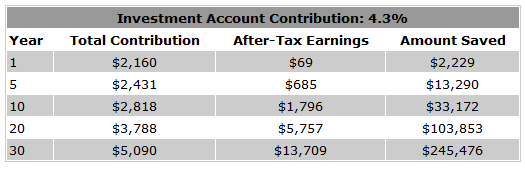

KMR is essentially a one-step, no-hassle DRIP for KMP. Let's assume you buy 100 shares of KMP at $83 and reinvest your dividends for the next 20 years. Let's also assume the dividend keeps growing at 7.5% per year, as it has over the last 10 years.

KMR is essentially a one-step, no-hassle DRIP for KMP. Let's assume you buy 100 shares of KMP at $83 and reinvest your dividends for the next 20 years. Let's also assume the dividend keeps growing at 7.5% per year, as it has over the last 10 years.

You could start out with $8,300 and find yourself with more than $108,000 after 20 years. KMR has performed better than KMP in most periods since it went public in 2001. So it's possible you could make even more money by owning KMR.

The utter convenience of KMR, the high yield of KMP, and the high quality of the Kinder Morgan organization make KMR one of the best income stocks we've ever found.

We'll track KMR a little differently than we track our other stocks and MLPs. We'll have to adjust KMR's cost basis each quarter to properly reflect the effect of KMR stock distributions. For example, if you pay $80 for KMR today and it issues shares worth $1, we'll adjust the cost basis to $79 the next quarter.

How KMP Stacks up Against Our Seven-Step MLP Selection Model

We utilize a model to help us select only the best MLPs. Without it we wouldn't recommend MLPs that can't pass this selection model.

The model boils down to seven key questions we ask about every MLP. The questions are designed to find those MLPs that do the best job of creating value – and income – for investors. Some answers are short (since they require only a quick examination of certain key metrics). Some are longer. But all are complete and tell you what you need to know to understand how KMP can provide you with a growing, high-yield, tax-advantaged income for several years.

Remember, we're recommending KMR, not KMP. But KMR's only asset is its ownership in KMP. So we're running KMP through our MLP Selection Model. You'll find that KMP stacks up well.

1. What are the prospects for future growth?

KMP is loaded with excellent growth prospects. It has completed $22 billion of acquisitions and $16 billion of expansion projects from its founding in 1997, through the first quarter of 2013.

And it has identified more than $13 billion of expansion projects over the next five years, including those we mentioned above. That doesn't include acquisitions and several ongoing expansion projects, like natural gas pipeline expansions to the Mexican border, and the build-out of more natural gas liquefaction capacity (so-called LNG, necessary for exporting natural gas around the world in ships).

KMP is a huge company and has the financial resources to take on virtually any large North American energy infrastructure project it wishes. It has billions of dollars of ready capital at any given moment.

KMP spent about $2.1 billion on acquisitions and expansions, excluding assets dropped down from its general partner. ("Dropdowns" refer to assets it bought from the general partner rather than an outside third party.) This year, KMP expects to spend about $2.8 billion. If you include acquisitions and dropdowns, KMP will spend about $10 billion on growth this year. That's more than double another MLP holding, Enterprise Products Partners (NYSE: EPD), which expects to spend $4.2 billion on growth this year.

KMP's relationship with KMR helps it grow. KMP winds up with more growth capital on hand, since it doesn't have to pay cash to KMR. KMP estimates about $625 million of the equity needed to fund its 2013 growth investment program will come from cash retained by not paying cash distributions to KMR.

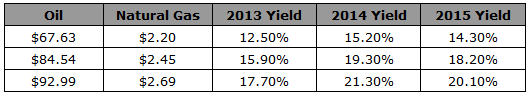

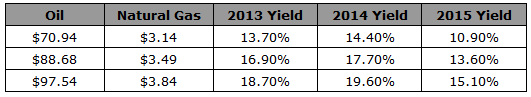

2. Is there too much commodity price risk in KMP's revenue stream?

Approximately 20% of KMP's earnings before depreciation, depletion, and amortization (EBDDA, a key earnings metric used by Kinder Morgan) has unhedged commodity price exposure. That makes KMP about 80% fee-based – higher than most of our MLPs.

Fee-based revenue is when KMP is paid for the amount of energy products it transports or processes. These fees don't rise and fall with commodity prices. Steady, predictable, fee-based revenue is one of the main reasons investors flock to MLPs.

A 20% commodity price exposure still sounds like a lot, but it's not that bad... Much of KMP's direct commodity price exposure is through "carbon dioxide flooding" to enhance oil recovery in the Permian Basin in West Texas. As we said, carbon dioxide is pumped into oil wells to get more oil out of them.

KMP estimates about 18% of its 2013 EBDDA will come from carbon dioxide oil production. KMP hedges most of its carbon dioxide oil production, but it does have exposure to some NGL prices.

For 2013, KMP expects every $1 change in oil prices will move its total EBDDA by about 0.1%. So there's really not much chance commodity prices are going to reduce KMP's cash distributions... or KMR's share distributions.

3. Does KMP consistently earn positive net cash flow from operations?

Yes. Over the past 12 months, KMP generated $3.3 billion in net cash flow from operations. It has earned net cash flow from operations for at least the last 13 quarters. "Net cash flow from operations" is how accountants say "cash flow after expenses." That's where your dividends come from.

4. Does KMP have a history of increasing annual cash distributions?

Yes. Annual distributions have increased every single year since 1997 at an average annual rate of about 13% per year. That's phenomenal dividend growth. It'll go up again this year, too. Kinder Morgan expects KMP's cash distribution to rise 7% this year, to $5.33 per unit. That's about a 6.4% yield over KMP's current share price of around $83 and about 6.7% over KMR's current share price of around $79.

So if you buy shares of KMR today, its share price remains the same as it is today, and KMP's yield is still 6.4% the next time it pays a dividend... you should receive an extra 0.01675 KMR shares for every share you currently hold.

5. Are distributions being made in excess of distributable cash flow from operations?

Not very often. KMP pays out 100% of its distributable cash flow. In just three of the past 12 quarters, distributions have slightly exceeded distributable cash flow. We've seen this with other MLPs that pay out 100% of their distributable cash flow. They typically pay out 100% or a little less most quarters, and slightly over 100% of distributable cash flow every now and then. Over the long term, the company winds up paying out no more distributable cash flow than the business generates.

6. Does KMP distribute the majority of its distributable cash flow from operations?

Yes. Again, the policy has always been to pay out 100% of distributable cash flow from operations, less small amounts held back to sustain operations.

7. Is KMP management generating an acceptable return on any cash it retains?

This is the part of the model that kept us from investing in KMR until now. Over the last 12 quarters, every $1 retained returned just $0.18. But over the past four quarters, this has improved to $1.61 for every $1 retained. The partnership is retaining less cash flow and distributing more. The less you retain, the easier it is to get a big return on it. We should always expect periods in which returns are less than we'd like, as growth projects are built up before they begin to generate cash. But the cash distributions are clearly going in the right direction.

A Great Buy Any Way You Look At It

We like to recommend MLPs trading at around 10-12 times distributable cash flow or less. We also like to see them trading at a current yield of 4% or more above the 10-year U.S. Treasury bond yield. Today, KMP trades at just over seven times distributable cash flow, so it's really cheap by that measure... one of the cheapest in our portfolio. The 10-year Treasury bond yielded 2.2% recently. KMP's projected distribution of $5.33 will produce a 2013 yield of 6.4% over its current share price.

Kinder Morgan has an excellent history of delivering on its cash distribution projections. It has met or exceeded projections in 12 of the last 13 years. This puts KMP 4.2% above the 10-year Treasury bond yield – within our valuation guidelines. This company is a great buy any way we look at it.

With KMR, your effective yield is a little bit higher than with KMP. Investors generally like to receive high-yield income in cash, not in KMR's share distributions. That makes KMR a bit less popular, so the share price often trades below that of KMP. Buying KMR today is like buying KMP for about 5% below the current market price. A slightly lower price means a slightly higher yield.

Many people avoid MLP recommendations because they invest exclusively through retirement accounts. Buying KMR is our favorite way to solve this problem. You get a stake in a large, highly diversified energy infrastructure company. You get a slightly higher yield than with KMP. And you can put it in your retirement account without incurring UBTI and without any of the tax-filing burdens you get with MLPs.

The investment is right. The price is right. Now is the time to buy KMR.

The utter convenience of KMR, the high yield of KMP, and the high quality of the Kinder Morgan organization make KMR one of the best income stocks we've ever found.

We'll track KMR a little differently than we track our other stocks and MLPs. We'll have to adjust KMR's cost basis each quarter to properly reflect the effect of KMR stock distributions. For example, if you pay $80 for KMR today and it issues shares worth $1, we'll adjust the cost basis to $79 the next quarter.

How KMP Stacks up Against Our Seven-Step MLP Selection Model

We utilize a model to help us select only the best MLPs. Without it we wouldn't recommend MLPs that can't pass this selection model.

The model boils down to seven key questions we ask about every MLP. The questions are designed to find those MLPs that do the best job of creating value – and income – for investors. Some answers are short (since they require only a quick examination of certain key metrics). Some are longer. But all are complete and tell you what you need to know to understand how KMP can provide you with a growing, high-yield, tax-advantaged income for several years.

Remember, we're recommending KMR, not KMP. But KMR's only asset is its ownership in KMP. So we're running KMP through our MLP Selection Model. You'll find that KMP stacks up well.

1. What are the prospects for future growth?

KMP is loaded with excellent growth prospects. It has completed $22 billion of acquisitions and $16 billion of expansion projects from its founding in 1997, through the first quarter of 2013.

And it has identified more than $13 billion of expansion projects over the next five years, including those we mentioned above. That doesn't include acquisitions and several ongoing expansion projects, like natural gas pipeline expansions to the Mexican border, and the build-out of more natural gas liquefaction capacity (so-called LNG, necessary for exporting natural gas around the world in ships).

KMP is a huge company and has the financial resources to take on virtually any large North American energy infrastructure project it wishes. It has billions of dollars of ready capital at any given moment.

KMP spent about $2.1 billion on acquisitions and expansions, excluding assets dropped down from its general partner. ("Dropdowns" refer to assets it bought from the general partner rather than an outside third party.) This year, KMP expects to spend about $2.8 billion. If you include acquisitions and dropdowns, KMP will spend about $10 billion on growth this year. That's more than double another MLP holding, Enterprise Products Partners (NYSE: EPD), which expects to spend $4.2 billion on growth this year.

KMP's relationship with KMR helps it grow. KMP winds up with more growth capital on hand, since it doesn't have to pay cash to KMR. KMP estimates about $625 million of the equity needed to fund its 2013 growth investment program will come from cash retained by not paying cash distributions to KMR.

2. Is there too much commodity price risk in KMP's revenue stream?

Approximately 20% of KMP's earnings before depreciation, depletion, and amortization (EBDDA, a key earnings metric used by Kinder Morgan) has unhedged commodity price exposure. That makes KMP about 80% fee-based – higher than most of our MLPs.

Fee-based revenue is when KMP is paid for the amount of energy products it transports or processes. These fees don't rise and fall with commodity prices. Steady, predictable, fee-based revenue is one of the main reasons investors flock to MLPs.

A 20% commodity price exposure still sounds like a lot, but it's not that bad... Much of KMP's direct commodity price exposure is through "carbon dioxide flooding" to enhance oil recovery in the Permian Basin in West Texas. As we said, carbon dioxide is pumped into oil wells to get more oil out of them.

KMP estimates about 18% of its 2013 EBDDA will come from carbon dioxide oil production. KMP hedges most of its carbon dioxide oil production, but it does have exposure to some NGL prices.

For 2013, KMP expects every $1 change in oil prices will move its total EBDDA by about 0.1%. So there's really not much chance commodity prices are going to reduce KMP's cash distributions... or KMR's share distributions.

3. Does KMP consistently earn positive net cash flow from operations?

Yes. Over the past 12 months, KMP generated $3.3 billion in net cash flow from operations. It has earned net cash flow from operations for at least the last 13 quarters. "Net cash flow from operations" is how accountants say "cash flow after expenses." That's where your dividends come from.

4. Does KMP have a history of increasing annual cash distributions?

Yes. Annual distributions have increased every single year since 1997 at an average annual rate of about 13% per year. That's phenomenal dividend growth. It'll go up again this year, too. Kinder Morgan expects KMP's cash distribution to rise 7% this year, to $5.33 per unit. That's about a 6.4% yield over KMP's current share price of around $83 and about 6.7% over KMR's current share price of around $79.

So if you buy shares of KMR today, its share price remains the same as it is today, and KMP's yield is still 6.4% the next time it pays a dividend... you should receive an extra 0.01675 KMR shares for every share you currently hold.

5. Are distributions being made in excess of distributable cash flow from operations?

Not very often. KMP pays out 100% of its distributable cash flow. In just three of the past 12 quarters, distributions have slightly exceeded distributable cash flow. We've seen this with other MLPs that pay out 100% of their distributable cash flow. They typically pay out 100% or a little less most quarters, and slightly over 100% of distributable cash flow every now and then. Over the long term, the company winds up paying out no more distributable cash flow than the business generates.

6. Does KMP distribute the majority of its distributable cash flow from operations?

Yes. Again, the policy has always been to pay out 100% of distributable cash flow from operations, less small amounts held back to sustain operations.

7. Is KMP management generating an acceptable return on any cash it retains?

This is the part of the model that kept us from investing in KMR until now. Over the last 12 quarters, every $1 retained returned just $0.18. But over the past four quarters, this has improved to $1.61 for every $1 retained. The partnership is retaining less cash flow and distributing more. The less you retain, the easier it is to get a big return on it. We should always expect periods in which returns are less than we'd like, as growth projects are built up before they begin to generate cash. But the cash distributions are clearly going in the right direction.

A Great Buy Any Way You Look At It

We like to recommend MLPs trading at around 10-12 times distributable cash flow or less. We also like to see them trading at a current yield of 4% or more above the 10-year U.S. Treasury bond yield. Today, KMP trades at just over seven times distributable cash flow, so it's really cheap by that measure... one of the cheapest in our portfolio. The 10-year Treasury bond yielded 2.2% recently. KMP's projected distribution of $5.33 will produce a 2013 yield of 6.4% over its current share price.

Kinder Morgan has an excellent history of delivering on its cash distribution projections. It has met or exceeded projections in 12 of the last 13 years. This puts KMP 4.2% above the 10-year Treasury bond yield – within our valuation guidelines. This company is a great buy any way we look at it.

With KMR, your effective yield is a little bit higher than with KMP. Investors generally like to receive high-yield income in cash, not in KMR's share distributions. That makes KMR a bit less popular, so the share price often trades below that of KMP. Buying KMR today is like buying KMP for about 5% below the current market price. A slightly lower price means a slightly higher yield.

Many people avoid MLP recommendations because they invest exclusively through retirement accounts. Buying KMR is our favorite way to solve this problem. You get a stake in a large, highly diversified energy infrastructure company. You get a slightly higher yield than with KMP. And you can put it in your retirement account without incurring UBTI and without any of the tax-filing burdens you get with MLPs.

The investment is right. The price is right. Now is the time to buy KMR.

RSS Feed

RSS Feed